Markets are listing lower today — but again straight up from the early morning collapse. At the vanguard of today’s strength are oil and gas stocks — partly due to a busting loose of Brent (now nearing $90bbl) and natural gas. Over in Europe, Dutch TTF spot is +28%, as winter looms.

Morning pin action suggests chicanery, largess.

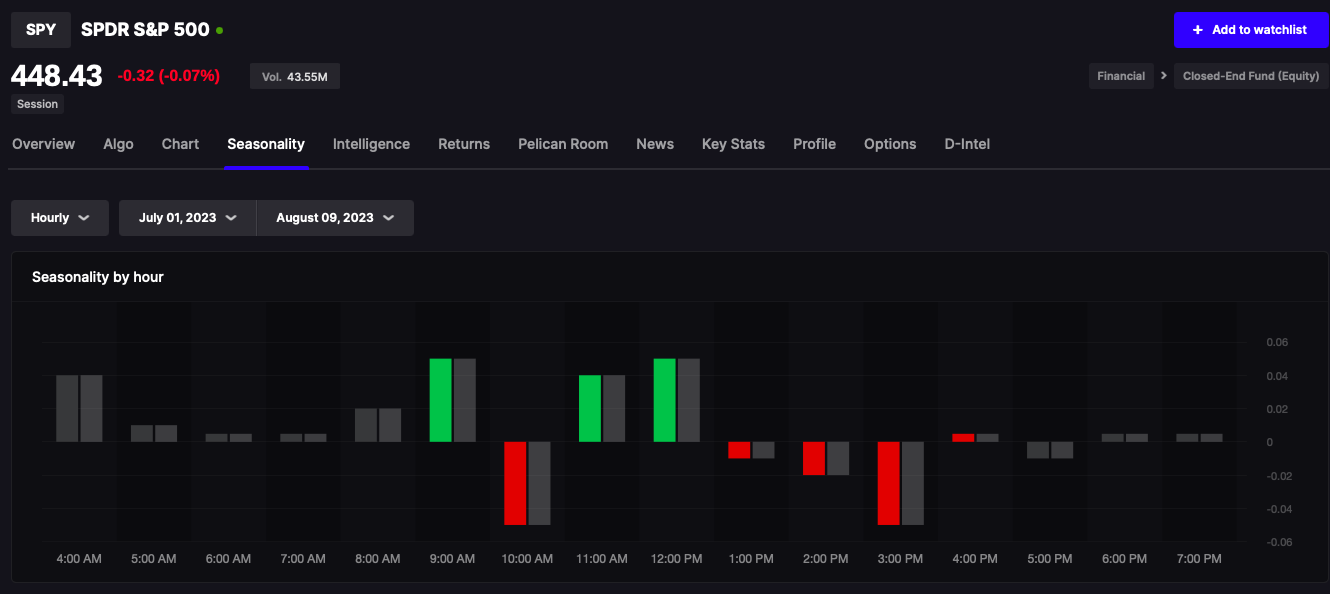

If you dig into some hourly data — you will find that since July 1 the trend has been to buy morning dips and fade them into the afternoon. This is not the sort of action that is conducive to a stress free life.

My issue with buying and holding now is due to the murderholes being produced post earnings and/or news. Today alone more than 120 stocks are down by more than 5% in an index that is barely lower. In other words, if you’re not pigeon holed in the biggest stocks and have attempted to try your luck elsewhere — you’re being flayed alive.

The prime movers are oil and gas. This was a trade made popular in the early stages of the war — where we saw risk off but also on in the commodity sectors most afflicted by the regional conflict in Ukraine.

With Autumn fast approaching, I believe in this trade more and more. The overvalued skew of the tech sectors crossed against the seemingly undervalued oils presents a very good trade, in my opinion. Much of this is predicated upon supplies and of course demand out of China. Nothing is as it seems and there is very little that I can predict with great accuracy. My strengths lies with being changeable — although I will admit to having a bias here long commodities/short stocks. I feel and always have felt if the global economy was strong we’d see it reflected in the price of oil. I do not believe there is any risk premium in the price of WTI today, since it has been rigged lower by incessant US SPR released.

But those days are fast ending and the risk of global war looms larger than ever — which of course produces an environ where oil can be bid up to heights never seen before. Because of this, any time we see oil breaking out – I am a buyer.

If you enjoy the content at iBankCoin, please follow us on Twitter