With stocks down more than 30% this year and all of the crowd favorites in the toilet for -70%, it should impress you to learn, mind you, Le Fly has once again done it. Let me be emphatic: if you are reading this blog and have money to invest, there is a 99% chance that I am better than you in almost every facet of trading/investing. This is a simple fact, same as the shape of the Earth and color of water. I am not besides myself with arrogance. Quite the opposite, actually. There are few things that I am highly skilled at doing. If you asked me to fix something around the house, I’d likely mess it up 2 or 3 times before figuring it out. But if you showed me a portfolio, I could fix it right away.

Unlike most of you, I am a professional. I was trained since young and taught in the proper method of money management, retired from that racket in 2017 to become a full time shit talker on the internets, managing Stocklabs filled with a trading room of top hatted degenerates.

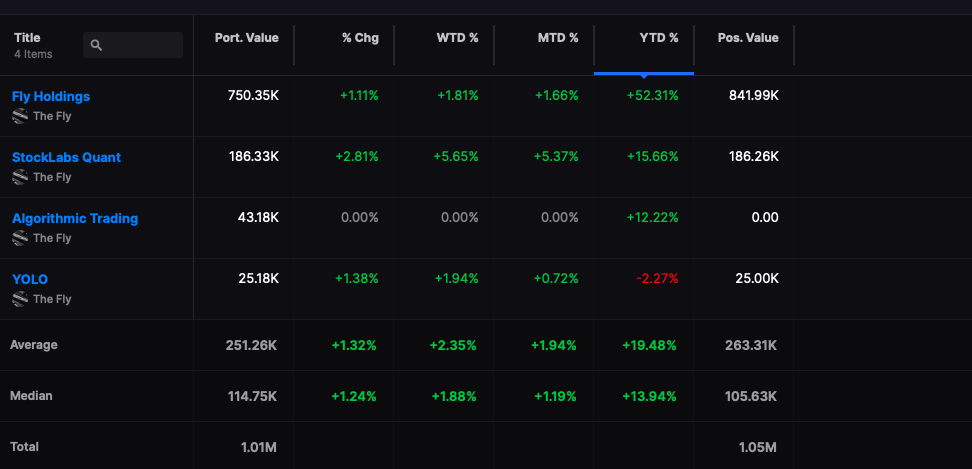

This is NOT a sales pitch, but a life raft for those of you with shot through boats sinking rapidly into the deep. I have 4 portfolios inside Stocklabs and I will describe the methods for each.

1. Algorithm account: I buying TQQQ when our system flags oversold. I buy in three increments of 33%. I have done only a handful of trades this year — all trades are 5 day holds — strictly enforced.

2. Stocklabs Quant: This is a portfolio of 20 stocks (5% weighted positions) that is rebalanced the first of each month using the Stocklabs fundamentals and technical metrics. I do not force diversification, which is how this portfolio is up so much this year, as the technicals and fundamentals shifted the portfolio OUT OF TECH in late 2021 and into oils.

3. Fly Holdings: This is my trading account. I employ many different tactics to achieve results. In early 2022, I was heavily short and long oils which made me the bulk of my returns. Nowadays, I day trade 3x ETFs for quick rips and buy strong stocks for overnight holds. In the past, I would buy volume breakouts using Stocklabs delta tools. In short, trading is as much of an art as it is a science.

4. YOLO: This is a new portfolio that is actually up more than 60%, but I only added it into SL recently for tracking. With this portfolio I buy 1 stock or ETF with the whole account based off my conviction. Simple.

All trades are broadcasted and trackable though the portfolio feature, alerts sent out, etc. Enter into House Fly and your only complaint will be you’re not up enough during the worst market since 2008 (extra JMORON).

If you enjoy the content at iBankCoin, please follow us on Twitter

Hats off, nicely done and very impressive. Fun to watch! Got 8 inches last night, things Pelosi said. Winter is upon us just in time for daughters bday party.

I am a transgender person of color …but I identify as a porcupine. How much is my discount?