If you were concerned about inflation yesterday, you should be shitting your pants today.

Check this out.

Natural Gas +8.2%

Copper +8.1%

Silver +7.7%

Zinc +7%

WTI +5%

Platinum +5%

Aluminum +3.8%

Gold +3.3%

ORANGE FUCKING JUICE +2.6%

Sir — are you interested in crashing the economy or not? We jimmied +400 on the Dow and +130 on the NADSAQ, with euros surging ahead by 2.2% and the US 10yr +5bps to 4.17%.

WHAT?!

The market had no fucking idea what it was doing today, surging and then collapsing and then surging again.

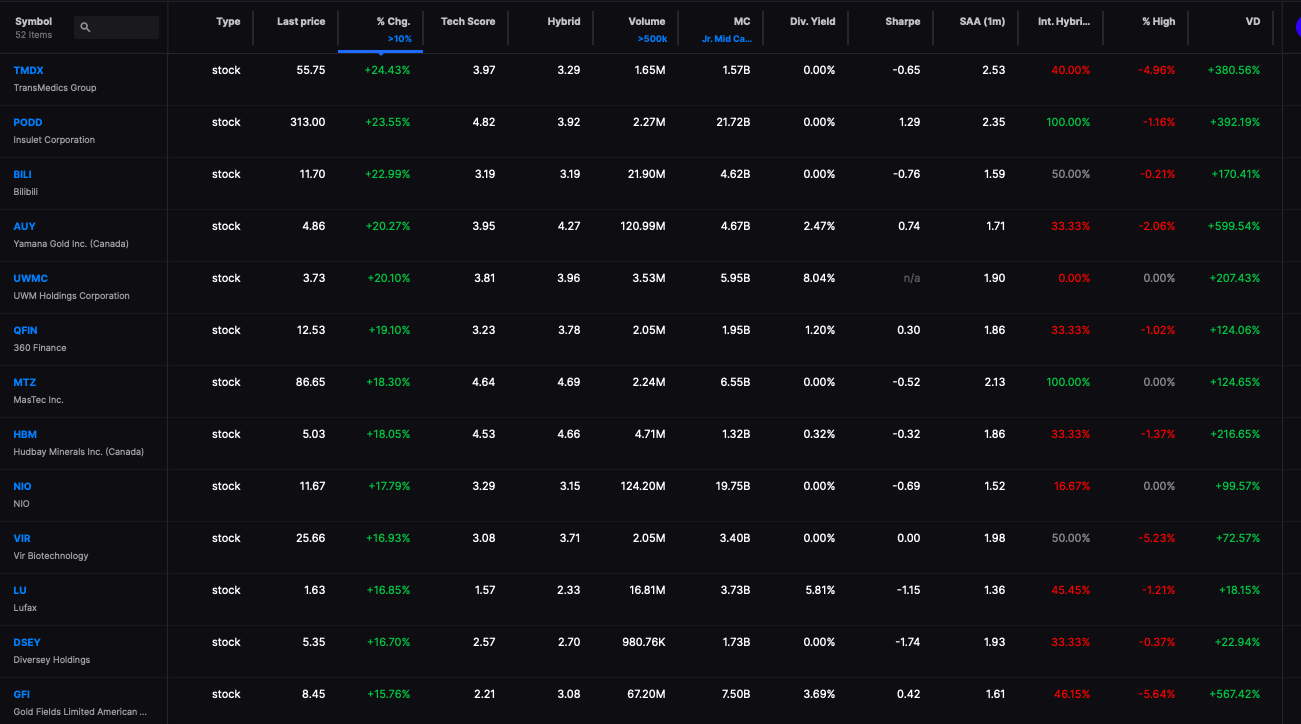

On top of that, we had a slew of stocks getting poleaxed and ripping the faces off shorts at the same time. Check this out.

52 stocks up more than 10% (data via Stocklabs)

What the fuck was that all about?

The short answer is no one knows or people are truly this stupid as to front run the RIGGED US elections. If anyone thinks the elections are real — please step forward. They’ve been rigged since the days of George Washington and rigged even more with arch comic book criminals like Hillary Clinton and Jim Cadaver Biden taking up space.

On the other hand, ’tis November — the month of meat and gravy. Markets like to rally this time of year. Very festive.

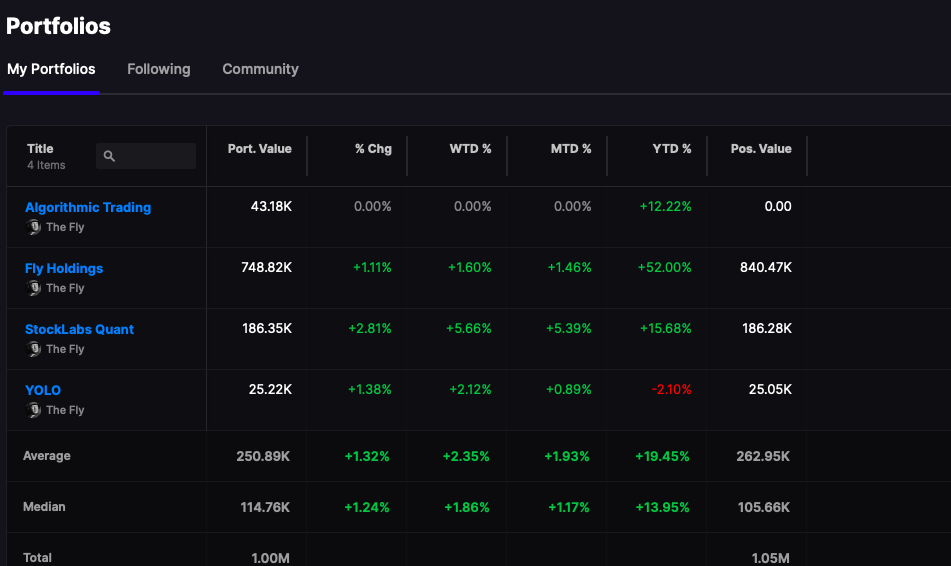

I closed +111bps for the session, trading to and fro. I am heavily hedged into Monday.

If you enjoy the content at iBankCoin, please follow us on Twitter

I was up 7% today. Quite ribald thanks to coming in long silver and natgas. Best day of the year. But the stocks I had did nothing

From a different perspective – based off earlier this year…

Natural Gas -31.1%

Copper -25.9%

Silver -23.7%

Zinc -30.8%

WTI -30.1%

Platinum -17.2%

Aluminum -41.2%

Gold -18.9%

ORANGE FUCKING JUICE +2.6% (Shit, got me there. New high, Mortimer!)

When they over-juiced it in 2021 all previous records were broken. The money and partying continue in the face of inflation.

No skin in the game for the stonkd markets, but my guess is that what passes for a market, jimmy jiggs higher by crook or by hook prior to (Mon) and during the midterm voting-machine manipulation period (Tue)

Wed, markets will not like it one bit with non-resident paper ballots still being counted,

Viva ze revelucion!

Question for @riggedgame – do you see a pattern on how government confiscated money from average joes actually working and not only transfering it to people to stop working, but to BIG PHARMA in the last couple of years via taxes? After that major profit distraction event happened, yet another one popped up and is still happening in the current MIC scam/coverup in Ukraine and wherever else we can use try to instigate our needs for more war weaponry and killing. And now we are witnessing it in BIG OIL. All in a couple years thanks to whomever is in charge now. What up with that?

Ripping commods had everything to do with China’s reopening. Chinese money was behind the buying in industrial metals and it spread from there.

Bingo juice. And that was just a “rumor” of reopening. Who even knows what they really mean anyways? I think that china thinks they’re in the driver seat now or atleast shotgun, and exploring how strategies impact the markets. Just as they have always done…but seeing major weaknesses to possobly exploit

I disagree. If China was going to re-open imminently, they would do their metals buying before, not after, that announcement. It would be complete idiocy to announce a metals-moving plan before buying the metals.

@WallStreetSilv

Remember when they said this ? ?

“we are not even thinking about thinking about raising rates until 2023.”

Don’t believe anything they say has long term meaning.