Everyone knew Amazon was crushing retail, dating back at least a decade. But for some reason, very few went through with the easiest pair trade of all time — long AMZN, short shopping mall operators. What a simple, yet brilliant, trade. Is it not?

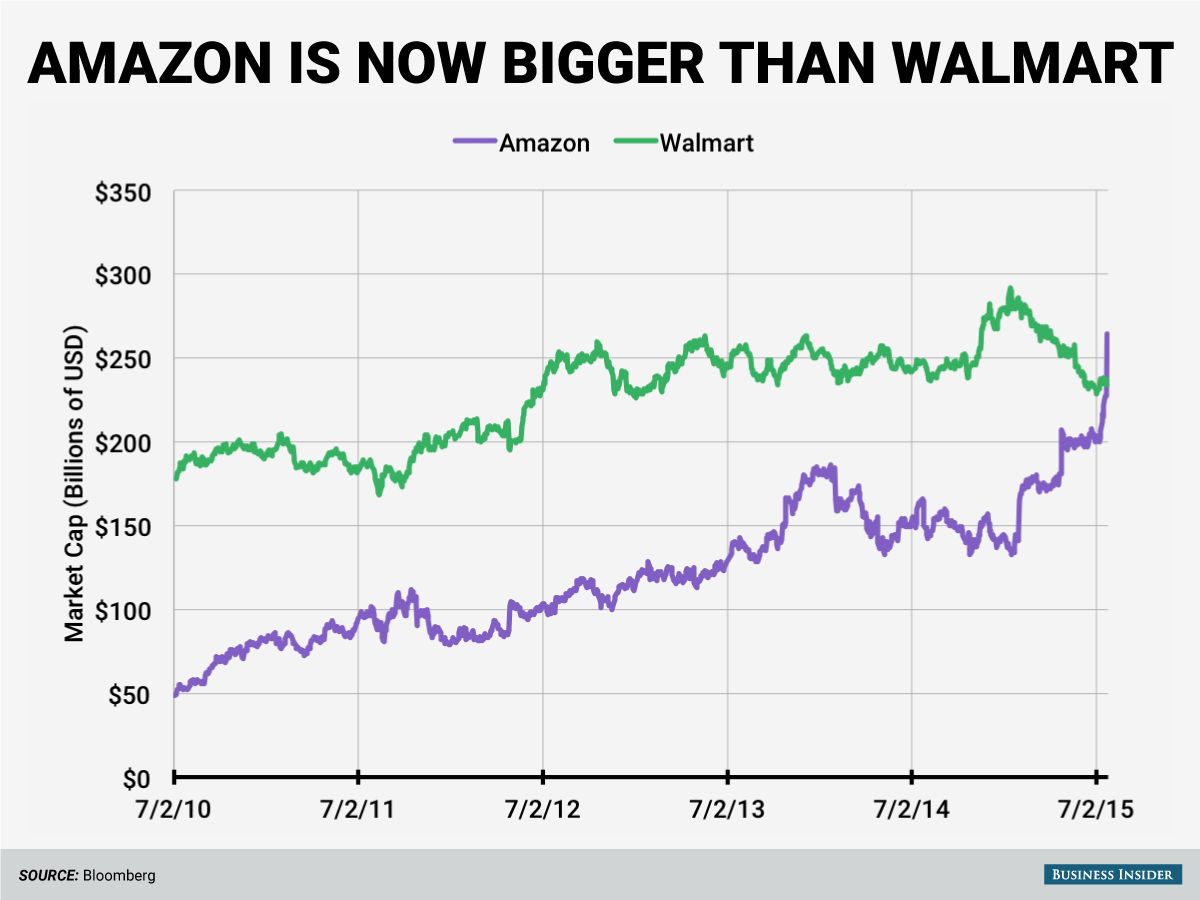

Here’s an old market cap chart of when Amazon topped Walmart. Now it’s worth two Walmarts

Here’s another old chart that captures the spirit of Amazon’s sales explosion. The current annual run rate is in excess of $140b.

So how does Amazon’s $143b in annual revenues stack up against other retailers?

According to Exodus, there are 31 companies in the Apparel Stores industry, the names you’re all familiar with when shopping at the old dead mall, whose sales equal $107b combined, with net income of $13.6b. Their composite market caps are $81.69b, the inversion of the price/sales ratio is indicative of an industry in duress.

Amazon’s $143b in annual sales and net income of just $9b is rewarded with a market capitalization of $469b.

Think about that for a moment. The entire shopping mall, sporting +1.1% quarterly revenue growth, does more net income than Amazon, on 40% less in revenues, and yet Amazon is valued at 5x what the entire mall is being sold for on the market today.

The Department Stores are an even worse comparison. TJX, M, KSS, SHLD, DDS, JCP, SRSC, SHOS and BONT combined do revenues of $129b, netting $10.17b in income, yet the composite market caps are just $68b on -4.5% quarterly revenue growth.

I get Amazon is the future and they’re growing at 22% per annum. But is it worth more than all the department stores and apparel stores combined 3x over?

And now for the most egregious juxtaposition: Amazon vs the Discount/Variety Store industry.

The Discount Variety stores include WMT, TGT, COST, DG, DLTR, BURL, PSMT, BIG, FRED and TUES. An impressive set of retailers, no doubt. Together, they sport sales of $729b with net income of $51b, enjoying median quarterly revenues growth of nearly 5%.

Their market caps combined equal $389b. If you threw in another COST, you might get to match Amazon’s market cap.

Does any of this shit make sense to you?

If you enjoy the content at iBankCoin, please follow us on Twitter

Ten years from now, AMZN will be a $2 trillion market cap company and Jeff Bezos will be emperor of the moon.

….AMZN isn’t just retail. It’s AWS and unicorn bets.

Most of Amazons value isn’t on the retail side

is that you Dasan? where have you been?

If I did not know that Amazon is worth every penny and that there’s lots of value in Bezos’ business, I would be thinking it surely has something to do with central banks conjuring money ex nihilo and buying equity with confetti. /s

Amazon Web Services is a $100 billion business itself.

How many of these retailers run an AWS cloud service? Oh that’s right, none.

They’re all custies of it tho lol

The Deep State is worth a lot of money.

If we stay on the path of financial repression via the Fed, and financial engineering (a la stock buybacks at ridiculous multiples of book value) we will have several trillion dollar market cap companies in a relatively short period of time.

Like others said, AWS is where the money is. Besos is perfectly fine bankrupting all these retailers just for shits.

I’m in IT and AWS is not only a superior product, but the cost of entry is infinitely lower…

As long as you aren’t in a video-related business AWS is the obvious choice. Bezos is way ahead of VMware/Dell and the likes…

Jahfari- I’m curious, why not video? Is AWS not the best choice for video content?

Only on paper. All these companies have an internet presence. Amazon isnt even a brand. It makes nothing besides alexa which really isnt a product its a convinience. Amazon will keep going up in price because they refuse to split. Amazon is just a website and a warehouse. No customer service. They arent even the lowest in price. Would like to see a breakdown of their category sales.

I’m not defending amazons cap, but you my friend are fucking retarded

http://memes.com/img/282018

2nd’d

The figures are amazing. Amazone is really a king of shopping online industry

rolling sky

there use to be this thing called anti-trust. Amazon is a product of no regulation, sales tax loophole, and ZIRP financing.

All they’ve done is undercut the entire industry to build market share at the expense of no margin…..going to the extreme end of the rate/volume curve, and finance the operation at 0%.

Anti-trust laws are only for those that do not support or are not part of the deep state. Beezoos and his WashPoo is on the deep state’s “Russia did it” bandwagon.

Slaughter day always comes to the pig. Amazon will have its day.