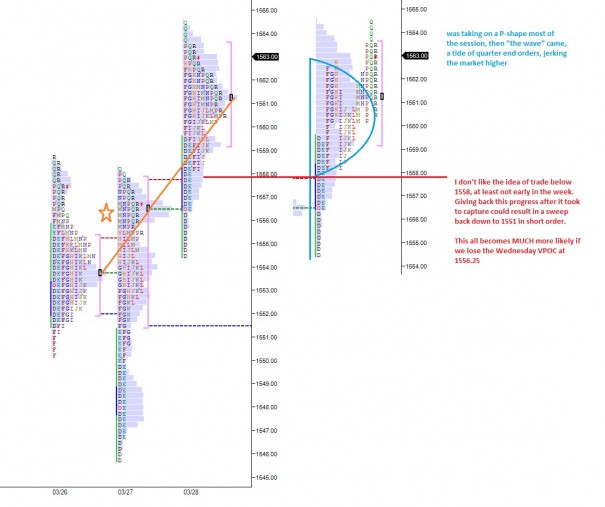

One of the key elements to yesterday’s trend that should have kept me from fading early on was the opening type. Yesterday we saw a classic opening drive: the market opened above the value area highs spanning four days and didn’t look back.

Today we’re seeing a more balanced session overnight, with the action taking place within yesterday’s upper volume distribution. I’ll be keying off the price action inside the upper boundaries of the P-shaped profile. The single prints below can get slippery, should price trade back down into them, I’m playing for a swift move through them; a crushing blow to the bulls.

But mostly, I’m looking for digestion of yesterday’s move. Should price consolidate within this upper distribution, we could see individual stocks fare very well.

Comments »