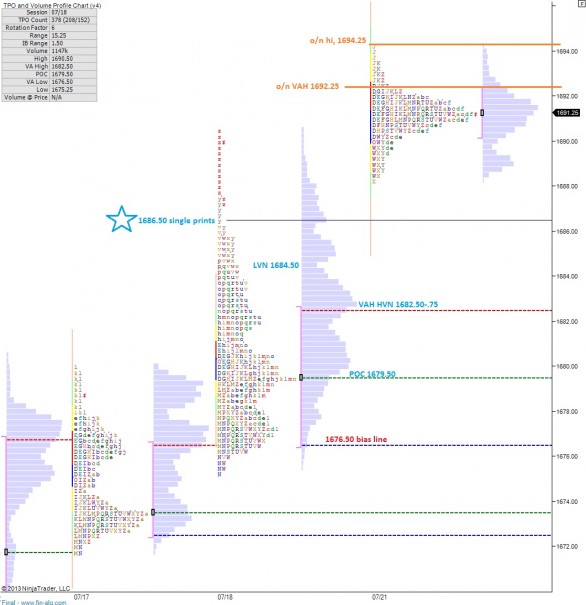

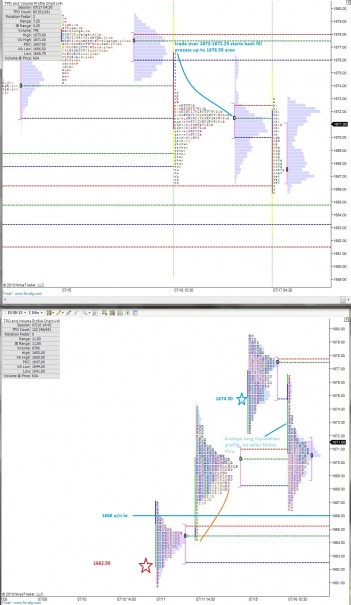

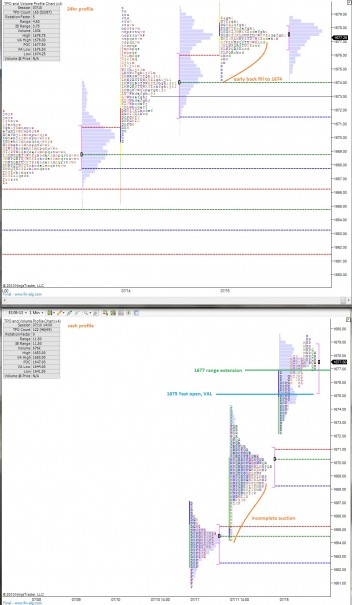

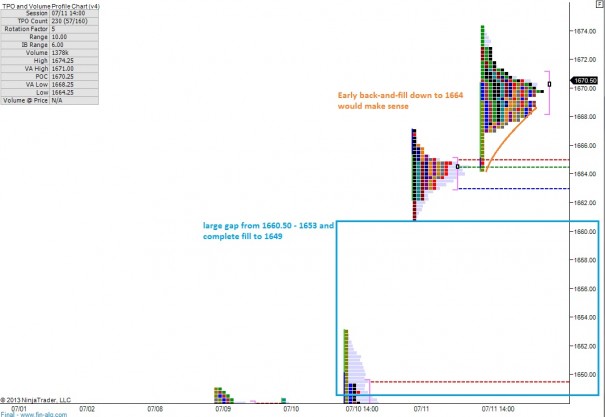

We’re experiencing a big of strength again in the overnight market, pressing us up against the all-time highs we experienced during yesterday’s globex session. The important matter becomes how we handle these high water marks early on in the session. Yesterday they were aggressively faded and we spent the remaining session stuck on support until an early afternoon rally which was faded.

If we can see price holding above 1693 during the first hour of trade, that alone would be an impressive achievement and could suggest the pain trade is on, pressing price higher when everyone is becoming more conservative.

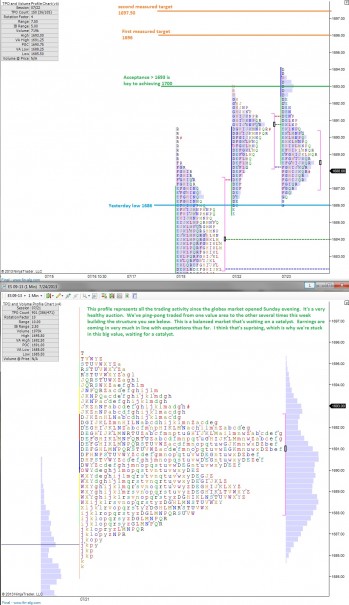

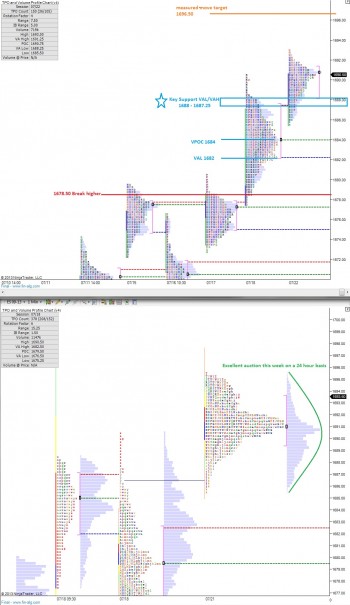

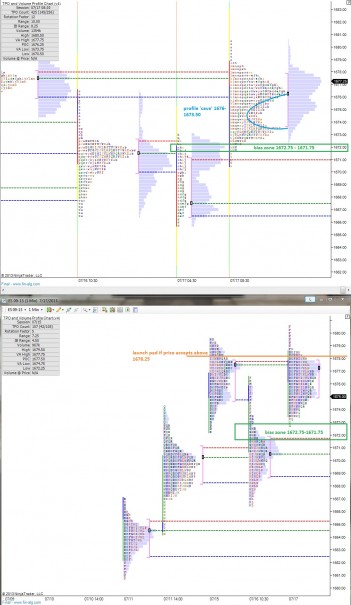

I’ve highlighted some measured targets to monitor in the event we trade higher, and also a key support level and some notes about the large auction occurring this week in the following profile charts:

Comments »