Nasdaq futures are trading higher on the globex session. The buyers stepped in around 3am after defending the value area low of Monday’s cash session. Range overall on the globex session is on the high end of normal [1st sig] as is volume. Oil is trading up into the open and we saw a positive earnings reaction from KB home this morning.

At 10am we have JOLTS, a low impact event. 2pm Monthly budget statement, and 5pm we have Fed speak from Kocherlakota. Tomorrow premarket we have WFC & JPM earnings and also Advance Retail sales, Fed’s Plosser, and MBA Mortgage applications.

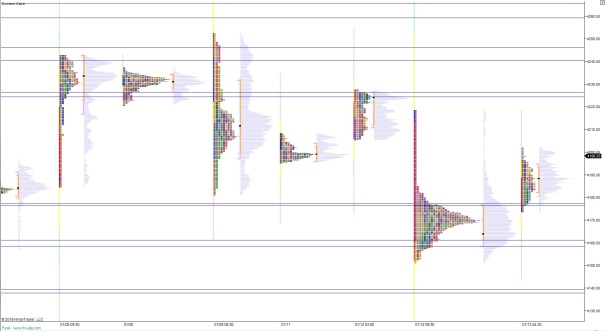

The main feature of yesterday’s action that had me constructive was the b-shape of the market profile. This suggested a short term phenomenon known as a long liquidation. An early entrant pressured the market lower which forced longs into liquidating. Once that business was complete the market balanced and showed decent signs of excess(tails). You cannot see the tails as clearly, but the b-shape is quite evident on an old school MP:

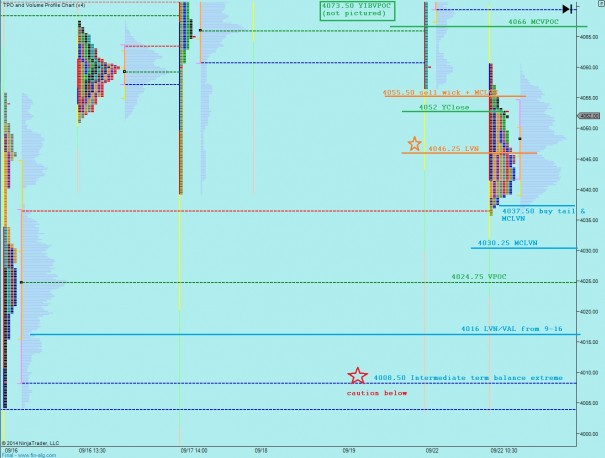

Primary hypo is a 2-way open auction with big chop where sellers push into overnight inventory and test down to 4180 area. If no buyers than test down to 4176 area before we work higher to test Monday session high 4218.50

Hypo 2 is for buyers to thrust early and run us up the zipper and test Monday’s HOD 4218.50. Just above around 4224.25 I will look for signs of responsive sellers.

Hypo 3 responsive sellers reject the overnight move and sustain trade back inside the b-shape, below 4176. Then we test through to 4160 area and continue probing lower.

These levels are highlighted on the following volume profile chart:

Comments »