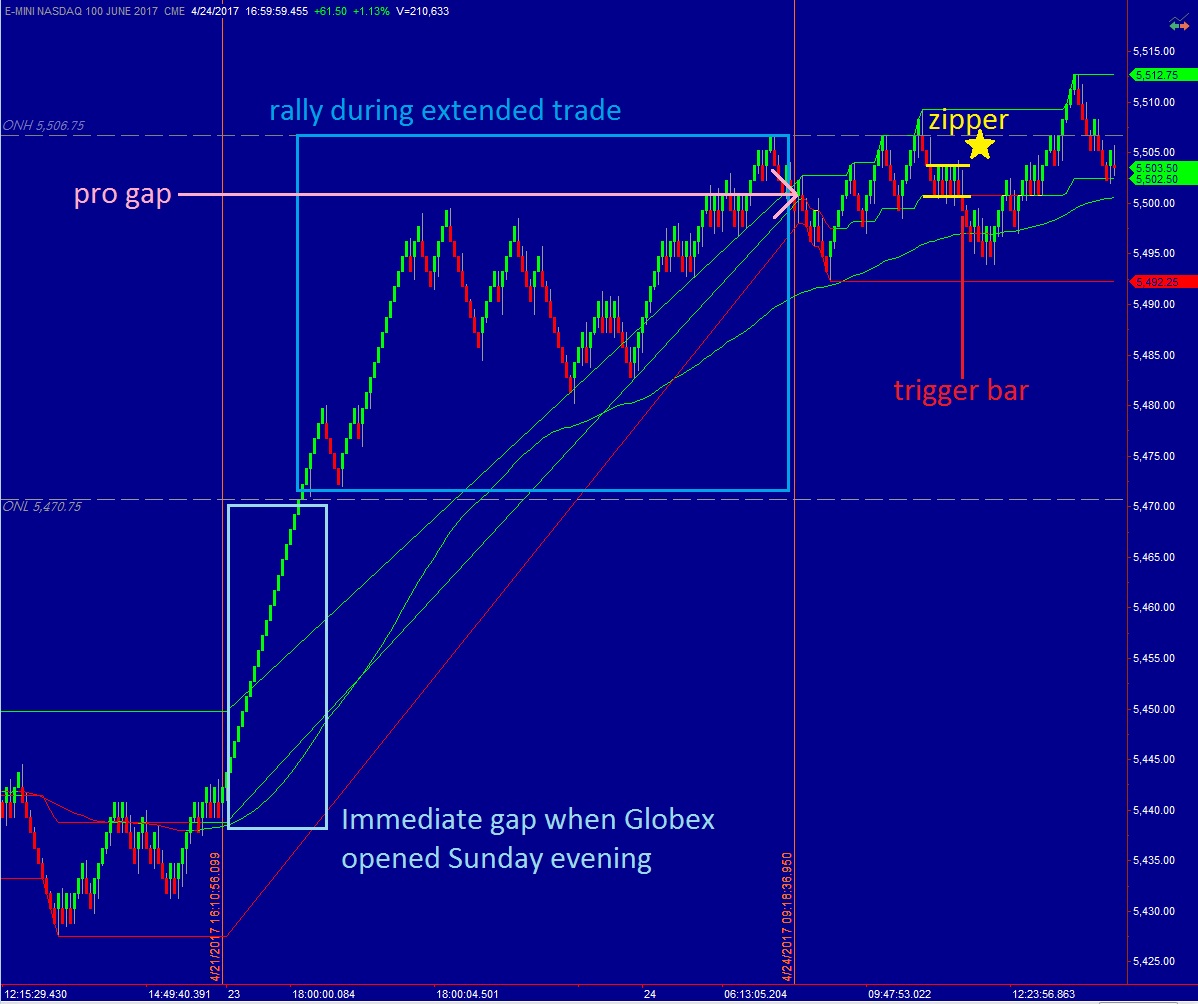

Pro gap is loosely defined, per my own statistics, as a gap greater than 40-60 points on the NASDAQ, roughly. Greater than 60 points and we truly are dealing with something unique. Let’s discuss the forces behind a pro gap and the implications they carry into the trading day.

A gap usually occurs when information deemed material by investors and traders is discovered outside of open market hours (9:30am-4:15pm, New York Time). When the market resumes trading, many participants (including institutional, the higher or ‘other’ time frame) are put in a position that may require them to adjust their exposure.

In Monday’s instance, the large move higher may have pressured short sellers to cover their positions, creating a natural demand force inside the market. The move was deemed macro driven, tied to the first round of French Elections.

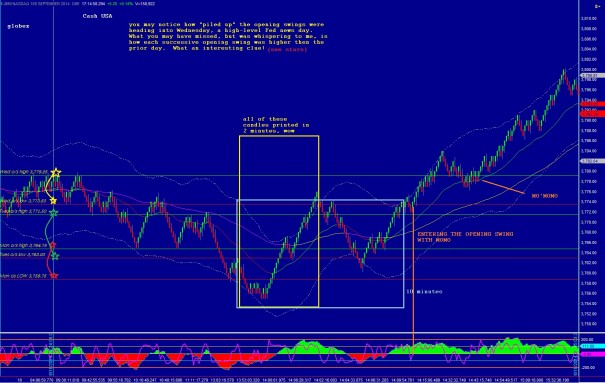

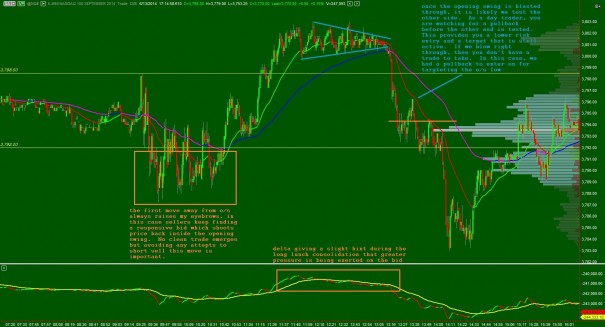

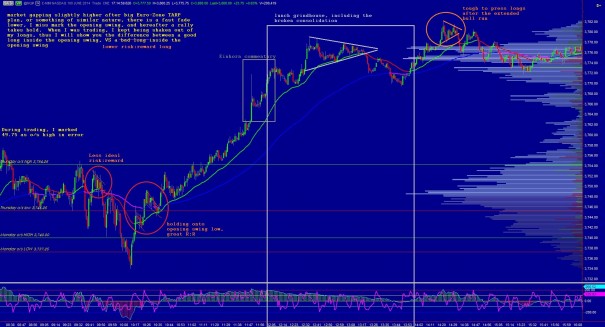

And buyers were the first ones to attempt a move after the opening swing, but by late morning, NQM17 (the front month futures contract) had fallen back around the opening prices. This is when the day became interesting. The first trade of the week set up, a zipper, affectionately named by the image it resembles on my renko trigger chart. See below:

The trade was scratched at cost. I managed to cover one unit at the exponential moving average then due to the day’s context scratch the remaining units instead of re-adding to the shorts and pressing for the range extension down.

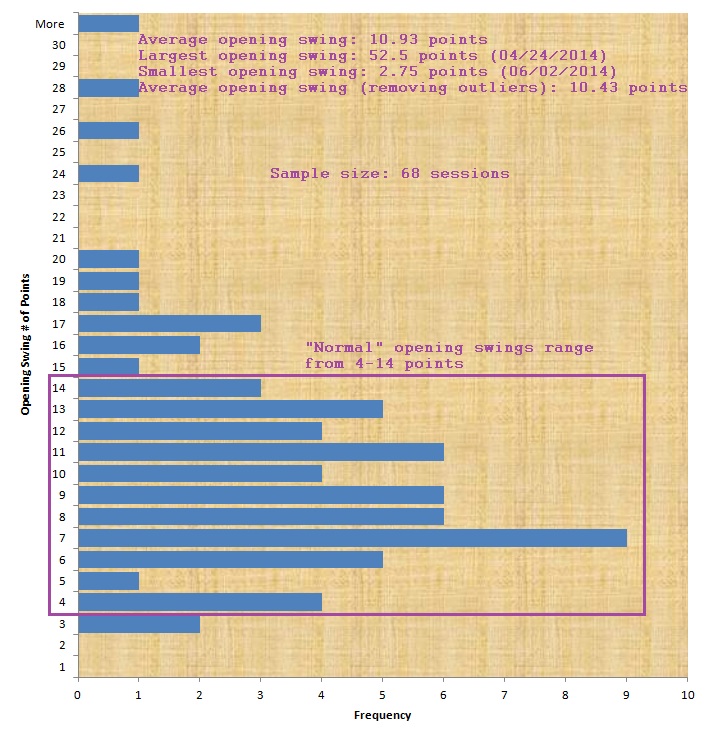

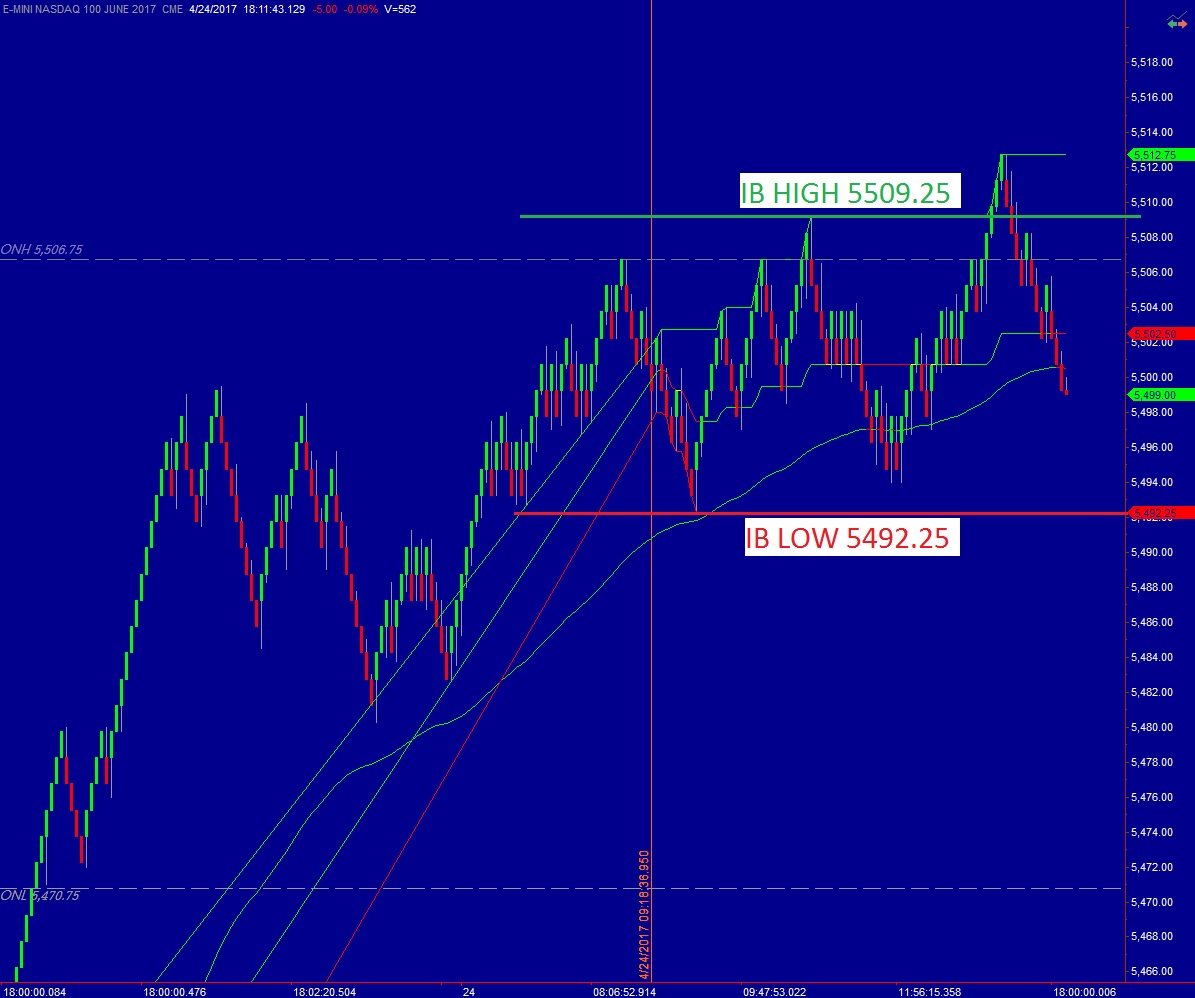

Range extension is a move beyond the first hour’s range. Understanding range extension is only important because it unlocks a high probability edge for day trading. You can run a study yourself (and you should for added conviction) where you calculate what percentage of the time the first hour’s range is exceeded. It happens 94.3% of the time.

94.3% probability, does that sound like an edge to you?

The trick of it is guessing which side of the range is going to break. On a big gap day like today’s, the range extension could carry big order flow with it, and implications that could last days, even weeks into the future. Historically, the high of the 1st hour’s range (aka initial balance) is taken out 66% of the time, while the low is breached 52% of the time. The high breaks more often mainly due to the long term trajectory of the NASDAQ, which is up.

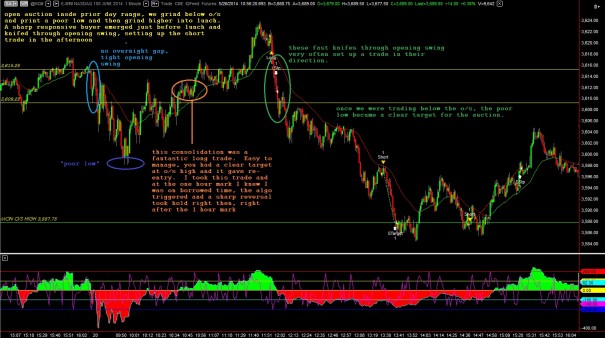

Below you will see Monday’s initial balance, which is clearly marked—observe:

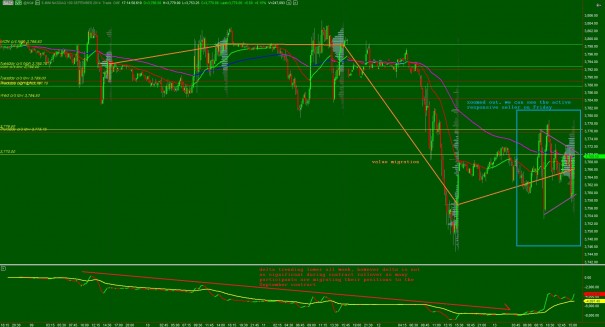

When sellers failed to take out IB low it became evident that the primary expectation from this morning’s trading report was still in play. For added context, we had a clear pivot zone, the old zipper that triggered the late-morning short trade.

The final layer of context is a statistic that needs to be dug up (it is archived in the laboratory somewhere, SMH) which states that if a gap outside of the prior day’s range is not filled by 1pm, the market is likely to continue in the direction of the gap.

Mix all these little contextual quirks, expectations, trade set-ups, and high probability events and you have an excellent foundation for justifying taking longs—afternoon day trades.

Overall, the day had a wait-and-see feel to it, with buyers hardly initiating fresh risk beyond opening balance. This suggests the institutions are waiting for more information before they become aggressive in either direction.

In short, it seems, for now, the market remains out of balance which means it is interesting. Interesting, because of the potential opportunity it holds.

Comments »