I got an email over the weekend that triggered some deep meditation on my end. It was to the effect of “where do we go from here?”

Those are my favorite emails, considering that each day we are here our actions are geared towards where we think we are heading. However, I took time to think deeply in regards to the last several months. Not only about the tremendous success we’ve had, but also the excitement, the traffic explosion, the community development, and then the changes to all of that in the last three months.

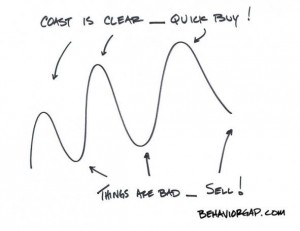

It reminded me of two very similar points in time over the last 5 years. Two specific points in time where the crowd had shifted from full blown over-confidence mode, from points where the money made was easy, to a prolonged period of difficult market conditions. These difficult market stretches did their worst on the retail investor, and are the only two “behavior gap” reference points over the last 5 years that have stood out to me like they do today. In other words, the average investor “generally abandons investments at inopportune times.” That’s a polite way of saying that investors panic when the market goes down and they sell out, often near the lows. Example:

These two other points in time were the late summer of 2010….

These two other points in time were the late summer of 2010….

And pretty much all of 2011…

I’ve gone back and studied these charts so much that I can freehand them blindfolded. What makes them significant, aside from how they follow our sentiment philosophies, was the mood and behavior of traders during these time frames. See, we can measure this by our interactions, traffic, comments, memberships, cancellations, etc. Those of you watching have seen this happen slowly over the last few months. The attitudes in the chat, the number of comments, the traffic stats, etc were all exploding as we headed into January. Now days, its a ghost town.

As I pondered this over the weekend, I was calmed by the fact that in the last two instances as mentioned above, I went into some of my best trading performance stretches of my career. After the market shakes you down, conditions start to get easier. As I went back to look over my notes from these tough periods in time, I noticed that every time, the ticker symbols I traded on the way out were a little more conservative, the vehicles I used to trade them were more conservative, and I stuck with that theme until new leaders emerged.

I’ve got a new group of stocks we’ll be focusing on for the next week or so. I’d to see folks transition away from the things that aren’t working, and start focusing on new ideas and fresh perspectives.

Today’s After Hours with Option Addict will start immediately at market close today. At this time we’ll start talking up these new ideas.

OA

Comments »