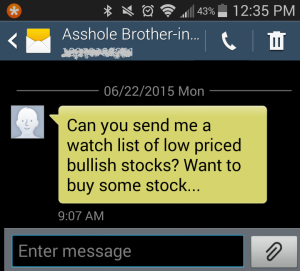

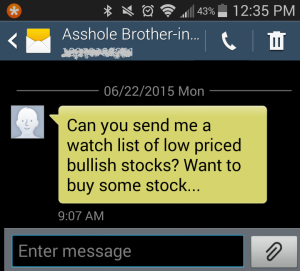

As you all know, I’m big on behavioral finance. I feel in many aspects that it provides an incredible edge, when applied to investment decisions. I also like to look for signs close to home to participate in trade ideas. Things like a co-worker publishing a book on how to invest in Gold back in the summer of 2011, or my brother-in-law asking for a list of bullish stocks to buy in the summer of 2015…

Don’t miss the date that he fired off that text, especially in relation to the $RUT (he likes to play cheap small cap stocks).

Don’t miss the date that he fired off that text, especially in relation to the $RUT (he likes to play cheap small cap stocks).

I started blogging about sentiment in Gold back in 2013 when I started blogging here, and my reasons behind a bearish bias on Gold. Aside from the book publishing I referenced, I had pee-wee football coaches asking me about investing, and watched my in-laws partake in the rush to buy Gold at some fairly awful prices. This is how sentiment works. I also mentioned that I wouldn’t really get interested in this idea, until the public started to lose interest. Or capitulate.

I started blogging about sentiment in Gold back in 2013 when I started blogging here, and my reasons behind a bearish bias on Gold. Aside from the book publishing I referenced, I had pee-wee football coaches asking me about investing, and watched my in-laws partake in the rush to buy Gold at some fairly awful prices. This is how sentiment works. I also mentioned that I wouldn’t really get interested in this idea, until the public started to lose interest. Or capitulate.

On Christmas eve, my family and I went up to the in-laws for dinner and a family gift exchange. The kids all get some fun toys and such, and the in-laws normally hand out a nice gift for the couples. This year upon opening our couple gifts, I was surprised to see the following gift inside:

There are 6 couples that received the same gift. My response to this was “wow, great timing!” I received a puzzled look in response, but now having sat back and watched this recent rally unfold, I think this trade, at least in my perception has come full circle.

There are 6 couples that received the same gift. My response to this was “wow, great timing!” I received a puzzled look in response, but now having sat back and watched this recent rally unfold, I think this trade, at least in my perception has come full circle.

Sentiment, FTW.

Sentiment, FTW.

OA

Comments »