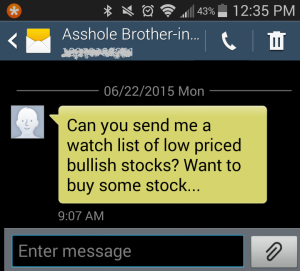

As you all know, I’m big on behavioral finance. I feel in many aspects that it provides an incredible edge, when applied to investment decisions. I also like to look for signs close to home to participate in trade ideas. Things like a co-worker publishing a book on how to invest in Gold back in the summer of 2011, or my brother-in-law asking for a list of bullish stocks to buy in the summer of 2015…

Don’t miss the date that he fired off that text, especially in relation to the $RUT (he likes to play cheap small cap stocks).

Don’t miss the date that he fired off that text, especially in relation to the $RUT (he likes to play cheap small cap stocks).

I started blogging about sentiment in Gold back in 2013 when I started blogging here, and my reasons behind a bearish bias on Gold. Aside from the book publishing I referenced, I had pee-wee football coaches asking me about investing, and watched my in-laws partake in the rush to buy Gold at some fairly awful prices. This is how sentiment works. I also mentioned that I wouldn’t really get interested in this idea, until the public started to lose interest. Or capitulate.

I started blogging about sentiment in Gold back in 2013 when I started blogging here, and my reasons behind a bearish bias on Gold. Aside from the book publishing I referenced, I had pee-wee football coaches asking me about investing, and watched my in-laws partake in the rush to buy Gold at some fairly awful prices. This is how sentiment works. I also mentioned that I wouldn’t really get interested in this idea, until the public started to lose interest. Or capitulate.

On Christmas eve, my family and I went up to the in-laws for dinner and a family gift exchange. The kids all get some fun toys and such, and the in-laws normally hand out a nice gift for the couples. This year upon opening our couple gifts, I was surprised to see the following gift inside:

There are 6 couples that received the same gift. My response to this was “wow, great timing!” I received a puzzled look in response, but now having sat back and watched this recent rally unfold, I think this trade, at least in my perception has come full circle.

There are 6 couples that received the same gift. My response to this was “wow, great timing!” I received a puzzled look in response, but now having sat back and watched this recent rally unfold, I think this trade, at least in my perception has come full circle.

OA

If you enjoy the content at iBankCoin, please follow us on Twitter

I think the market forgot to take its anti-psychotic for the year….

OA,

So do you sill think a est of 960 or so is on the table? GOLD

Nah. This rally is strong enough to where I’d want to buy dips. I am actually short GC as of pre-market, but would buy a move lower.

Think about the significance of this story in sentiment terms.

looks like you and your relatives got some coin at the lows. nice.

My guess is the relatives bought at the highs and gave it away at them at the lows. So, guess we are looking at the possibility of a medium-term + move.

Sold profitable puts in WMT fwiw.

is asshole brother in law selling out of his mutual funds in his 401k yet? #bullishindicator

Yep. Cash.

whatt???? seriously? that’s a game changer piece of info.

That happened so long ago though, so not really. Most actives went cash on 401k months ago, no?

valid point

My late 80 yr old mother wanted me to buy her gold…the price?? 1900/ounce…I KNEW it was the top and no I didn’t buy her any

I worked with a woman who was selling stocks and buying bonds at the exact stock bottom in 2002

as in the movie ‘little big man’…the perfect ‘reverse barometer’ as custer said to dustin hoffman

Bury them in a box labeled ‘Hedge fund startup money’ and return in 20 years.

Night of Googlebets last earning my Dad whose owned it for awhile texted me in ecstasy. I immediately texted back “SELL” kind of as a joke to which he replied “not a chance”

Does your phone actually have “Asshole Brother in Law” as the address book entry? If so, I salute you.

Yes, it does. He is an asshole.

That’s awesome.

Agree on the value of evaluating sentiment but it takes second-place to tomorrow’s Yellen-speak. Hard to imagine she won’t throw a bone to the market but will the pump just provide an exit for traders on underwater positions from last week? My guess is yes.

lol. That has nothing to do with this story.

What are your thoughts on NASDAQ here?

$NDAQ?

With OVX over 70, I am positioned for SCO 207ish. A 9.5% to 10% intra day move is also possible which takes SCO to 215 ish today.

That would not be a new low in oil, nor would I expect to get there ahead of API, EIA inventories & the Werther’s original candy sucking Fed chairperson

man, so relentless on the selling.

Sold some SCO at209.50. And bot UWTI at 1.42.

I will be doing these types of oil trades as oil approaches 25 & 22.

I have no timeline for that.

There was no reason for oil to trade higher after 2/1, so that really didn’t sans the stupid spike last Wednesday that was a short gift.

Expecting another spike as we approach March 1st. Wanna have some exposure from long side.

Yes QQQ. Do yo think it will turn around soon or the FANG stocks will drag it down a lot further first?

I’m in SPX futures from yesterday. I figured that was the easier play here. Long from 1825.5, stop is now at breakeven.