Gotta quote the latest work from FatPitch. Only site I frequent for market updates. Actionable and quality information in or about the market is at an all time low. These positioning write ups tell you everything you need to know about the chemistry of the market here. It’s a ‘group-think’ position to be on the sidelines here, and this isn’t how markets unload. This is how they fucking rip.

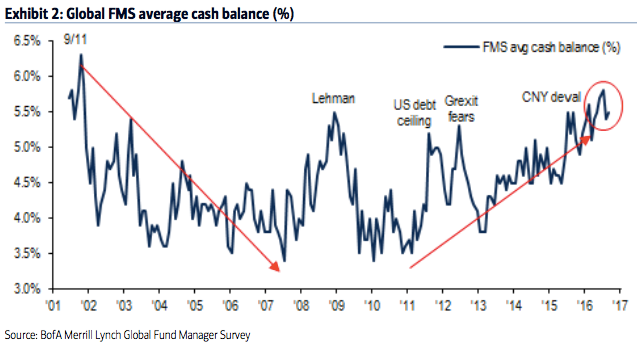

A tailwind for this rally has been the bearish positioning of investors, with fund managers’ cash in February at the highest level since 2001. Similarly, their equity allocations in February had only been lower in mid-2011 and mid-2012, periods which were notable lows for equity prices during this bull market.

Remarkably, allocations to cash in September are as high as in February and allocations to equities are now even lower. Investors have jumped into the safety of bonds, with allocations rising to a 3 1/2 year high in June and July. Overall, fund managers’ defensive positioning supports higher equity prices in the month(s) ahead.

Allocations to US equities had been near 8-year lows over the past year and half, during which the US outperformed most of the world. After rising the past two months, allocations fell again to underweight in September. Bearish sentiment remains a tailwind for US equities. European equity markets, which had been the consensus overweight and also the world’s worst performing region, are now underweighted relative to their long term mean. Investors are chasing the world’s best performing region – emerging markets – which now have their highest overweight in 3 1/2 years.

This chart tells you we are bottoming, even though we are at all time highs. Let that sink in.

This chart tells you we are bottoming, even though we are at all time highs. Let that sink in.

I respect the decision to wait it out and buy back in at the highs. If it weren’t for that, I wouldn’t have mapped this all out as well as I did last year when I said a big chase would be set off.

I bought some shit today. Hope you have as well.

If you enjoy the content at iBankCoin, please follow us on Twitter

dat short interest though…lol..Happy trades brother 🙂

Bearish!

Interesting? You bought today on this pop?? I’m hoping for some follow thru as well

I bought the open dood, ya!

All because of your bull trap comment yesterday.

Congrats! Sick timing.

Interesting to me.. IDTI, NXST, LXFT, JUNO, TXRH,SYNA, VRTU, FIZZ

I bought some shit today too, it trades under the ticker FEYE.

TOTAL PIECE OF DOG SHIT.

Stalking it too.

it’s like chernolbyl irradiated shit. don’t touch

that said, goldman will issue a 115% price target above today

Love it, I’m in the September 30th $15 Calls since yesterday end of day. Wound up real tight here. My TWLO went to shit this week but am looking at Sep 30th calls for that as well.

Bot some $VRX SEPT 5 $30 calls today

Any thoughts on an WFC long? seems to be sitting on support.

AREX and AMRN stock for volume pocket. Lots of shit under $10 here that looks tremendous.

Read something over the weekend that said the supply of equities is back to levels from the 80’s. Corporate buybacks, mergers, bankruptcies, limited IPO’s have all contributed to the situation. Melt up anyone?

Scarcity. Was talking about that a few years back. WHat happens when there isn’t much stock left for sale?

Might chase DAN here #nohomo

LABU in the midst of a great run. A volume pocket is there too.

Wish I had some of that FIT.

Couple more to consider..DG, MYL ATHN.. Low risk/high reward.. take a lookie. Stalking..

RENN up to 3 or so. Huge volume pocket

SUPN BCRX ZIOP for healthcare ideas

OA – Nice calls on the China stocks. Are you looking at any others setting up to bust higher? I followed you on YY and SOHU. What about the other laggards like LEJU / SFUN / BITA / ATHM?

$SFUN, $ATHM, $BITA, $CMCM my faves here.

Awesome thanks. I only have room for 2 so will take a look – how would you rank those 4 in terms of best setups? Thanks again.

Bought ctrp and bidu yesterday. And added to some bios. Xon biib gbt

The fundamentals on these are terrible. Discuss.

No one here is buying on fundamentals. Discussion closed.

Because some of us have a clue what’s going on.

Sold VXX puts that expire tomorrow for 2x. Going to roll some of proceeds into puts further out.

What are the odds we trade up tomorrow. Being that it’s expiration day that would be weird.

Since you got shorts from below, I think it could make sense. Not a huge move, but right in the middle of longs above and shorts below.

Sort of what I was thinking. Just would be weird to have some strength to sell into on OPEX.

Assume you own SPY for the expiry pin scenario. Stocks are based only on how good you picked. Even if market lower tomorrow, you’ll have good stocks.

Great point.

Still seeing lots of bears on the old tweetdeck also

The market stumbling and falling here and there sets up a hell of a Santa Rally, one for the books.

Tech beats small cap and China today, not bad.

Yeah, Nasdaq took the torch back in this last shuffle. Something to note of for the market challenged.

Here here!

Bot $FEYE OCT 4 $17 calls. .24 #hitthatpocketbitch

Now let’s see some follow through tomorrow.

I am very confused – someone is either lying or else we’re into the lies, damn lies, and statistics area of the market. So according to this iBankCoin post very few people are in the market and therefore others will have to chase and shorts will have to cover. On the other hand this article from just yesterday would indicate the very opposite situation: Speculative long-equities at highest since 2013, and VXX shorts at outright record highs.

Just like the rest of the internet, apparently – once can find data to backup any answer you want. If anyone has any genuine light to shed on this situation would love to hear it.

Seems you are sampling totally different audiences.

If my post is just to back up my thesis, simply fuck off and don’t read. I posted this same stat in January.

Different audiences – how so? Best I can tell the stats FatPitch cited and zerohedge’s stats seem to be talking about the same audiences but saying very different things. Just for the record, I’m not a bear or a bull, I tweeted the following on Monday:

Cool tweet bro. I didn’t ask if you were a bull or bear.

How are “spec longs” measured? I know how “Global Fund Manager” is measured. They’ve conducted these surveys for decades.

My comment was more towards why not take this up with Zero Hedge? If I am only saying this to confirm my bias, aren’t they as well? Isn’t everything they/I/everyone writing to confirm a bias?

Take your bias elsewhere? Twitter?

Jeez dude, you’re a world class dick on here. I was asking an honest question about different data because I’m fucking confused as to how they could be so different. I doubt you’d be such a jerk in person. I’ll try to take that as some consolation. Chow.

I would be, actually. If you come here to tell me about I’m writing and throwing shit on here just to backup a bias, I would act the same and say “fuck off” to your face.

Paradox, see my comment further down below.

OA, I’ve got a question about sentiment in general. Do certain market conditions, patterns indicators, and/or statistics lead you to believe when the crowd is wrong? I’m not questioning you by any means, but trying to understand whether it is ever a good idea to do what the crowd is doing? Thanks in advance, and your calls have been impeccable, congrats man.

Yes, that’s what my pain trade is, no?

This post is also used as a contrarian indicator here. They went to cash in front of all time highs. I’ve been following this stat since last year. Thought it was relevant considering cash is actually higher here.

Here’s one from last year.

http://ibankcoin.com/option_addict/2015/11/02/cash-is-king/

You prob never watch fast money but they have been saying get in cash a lot more often lately. That should make you happy

LOL. That would make me happy? I don’t care dude. It’s perfectly ok for people to go to cash, to trade or not trade, to be bullish or bearish, to like a different stock than me. I look back on the last year and I’m like…”all that work for this?” Fuck that.

I always liked to be another asshole to give an opinion about markets. Lately I realize more and more that this is all fucking pointless. Soon, I will crawl back into my hole and disappear again for many years.

Haha. Didn’t intend to stir up so much emotions. I simply stated that to contribute to your sentiment gauge.

OA I can’t blame you if you decided to disappear. You put up with a lot here.

Really Jeff? You made it through the toughest period (2014/2015) in the market and NOW you are thinking of quitting? Wow! Somebody must have really gotten to you. You are killing it. You can’t disappear now. Unless you want to go out like Peyton Manning – winning! Looking forward to your webinar on the 20th.

Thanks Jim, always appreciate the support.

OA, thanks for the response. I did not mean to stir up that big of a thread, so apologies for the comments piling up haha. That makes sense about the about being able to identify the pain trade. With that being said, I’ve got one follow up question… Is the pain trade “always at play” in markets, and if it’s not, when do you start trying to identify it and what are the conditions you look for in terms of volatility levels, breadth, speed, etc.? What I’m trying to become stronger at is when and how to identify the pain trade. Thanks in advance for all the help brother.

Pain trade is only into volatility. Volatility means both sides are engaged, when they are…bring the pain.

That helps a ton, thanks again OA for the knowledge and insight. Appreciate it all of it.

Anytime, just stop apologizing for asking questions. It’s all good. I wouldn’t do it if I didn’t want to.

Someone mentioned RENN. REN is the one to watch. Set up well to break out and has run very well so far from 8 to 24.

OA – in the end – as you know – some people care more about trying to prove seasoned and proven traders wrong than following their ideas and joining them in making money.

Had to refresh the TWTR app a couple times on my FireTV but for the most part their first attempt at live video streaming is a success. 12.67B market vs 365B valuation for FB. I small a paired trade….

*small.

Paradox, it can be hard to know what to focus on here. So here is my suggestion

OA asked you “How are “spec longs” measured?” If Zero Hedge hasn’t said how, then you might want to ask them.

In case you are not aware of this, Zero Hedge is all perma-bears. Which means that they 24/7/365 are looking for any reason they can find to be bearish.

OA knows how “Global Fund Manager” is measured and notes “They’ve conducted these surveys for decades.”

OA, you asked Paradox “Isn’t everything they/everyone writing to confirm a bias?” I would say No. You seem to look to see what patterns are there, and then form your opinion as to whether the patterns look bullish or bearish. I don’t see you picking a side first, and then going looking for something to confirm the side you already picked. If you did that, you wouldn’t be as successful as you are.

Maybe everyone has a bias. But some people have perma biases. And some people sift through information first and base their opinion on what they see, and then write about that.

OA discussed the importance of the psyche in trading. Why would a reader mess with the mind of someone they are learning from, or simply following?

I don’t think Paradox meant to mess with OA’s mind intentionally. He is just like most new traders, who want to be sure what will happen in the market, and to have indicators and gurus that are always right. He hasn’t found out yet that all you have in the market are probabilities, and that some indicators don’t work. And that you have to educate yourself about that.

My mind is a delicate and sensitive matter.

Yes, please take the best care of your mind, OA. It’s highly valuable to all of us here, as I am sure it is to you.

And most of us here know you are far too busy to spend your time discussing some other web site’s indicators with new traders. They need to find other sources of education about that.

Enough of the ass-munching …his mind isn’t THAT delicate!

It can be challenging to be and remained focused intensely on something as complex as the market, is all I am saying. One does have to protect oneself from distractions.

This is so true. Last year was so hard for me because a lot of personal issues came up as well. This is a tough sport and hard to stay focused all the time.

OA has the only drama-free no politics just trade ideas blog on the iBC site.

Let’s keep it that way.

Are you in this biz? I’ve asked before but don’t think you saw. Been curious for a year now.

I cut my teeth on road shows, did four IPO’s, three M&A’s, (China, Europe, US) lived out of a suitcase. Then got swallowed up in a takeover which closed up our location.

Afterwards taught myself how to trade watching top-of-book data on specific companies I targeted as volatile, then executed orders based my own algo. Now manage accounts for people that don’t worry about money.

Interesting, thanks. More than 20 years experience I assume? I picture you as someone that could teach me something and I think that about nobody.

What about TWLO bro?

Dude, you were the Apple guy. It was your comment last week that made me buy a fuckton of Apple calls. Thanks for your intelligence.

I apologize if I offended you in anyway I was trying to add humor to the typical questions you get.

BTW my Apple comments were regarding some one doubling down on Sep 9 weekly calls,which expired worthless for him.

I kid, I kid.

I’m on one tonight. Good night everyone.

I like to research stuff on the Internet, so I looked up this speculator measure as a predictor. I couldn’t have found this info, though, if I didn’t already know, from my past studies of the market, that the “speculator” measure is part of the Commitment of Traders Report.

Here’s an interview with Steve Briese, who has mucho experience with using the Commitment of Traders Report. He says that the speculators are correct almost 50% of the time, so they are NOT a contrarian indicator, as Zero Hedge thinks they are.

“I look at the Commitments data as a very accurate way to measure crowd psychology. From the work I have done, I have determined that in most markets, of the three, commercials are by far the best group to use as an indicator for most market conditions. The reason is they take positions for the long haul and typically defend price levels for long periods of time. I did a little research study a couple of years ago that looked at extreme readings for each of the three groups to determine whether price had moved in agreement with their position three months later or whether it had moved opposite. There are many ways to determine whether a group is right or wrong. This is just one, but it confirmed my suspicions. Commercials were right about two-thirds of the time. Small traders, who many people think are a good contra-indicator, were right 45 percent of the time. That’s way too close to 50 percent to be useful as a contra-indicator. Large speculators were very close to small traders. They were right 46 percent of the time. Based on this, in most situations I look at the Commercial position.”

http://commitmentsoftraders.org/wp-content/uploads/Static/Perm/babcock.htm

Thanks for the lively discussion here, enjoy the variety of perspectives.

Frog is right, ZH is a shit website that caters to the Ron Swanson’s of the world looking to bury gold in the back yard and live off grid in prep for the apocalypse.

On the opposite side is Cramer who is the eternal cheerleader for higher price action, that guy is a huge disservice to people investing the two cents they just scraped together.

Somewhere in between is Motley Fool. They at least are teaching people about fundamentals, but are agnostic about price action which is not as helpful.

If you like MKC, Fool would say buy bc it’s a solid company, Cramer would say BUY BUY BUY, and ZH would say to avoid bc it’s all going to shit anyway. I think that’s a little of the confirmation bias that some people seek.

You want permission to buy? You want permission to dig deep on penny stock gold miners? You can find it, that’s what Seeking Alpha is for.

I like this site because Fly’s writing is funny as shit and OA is absolutely spot on with his analysis of the short term market, and doesn’t pretend to care about forecasting a year or two out. Fly is obviously a more glacially paced trade at the moment, which is more my speed.

Thanks again, ignore everything I just said; this is a lying in bed awake stream of conciseness post.

I was reading this discussion in comment section about who positioned, how and in what.

IMNSHO, this whole way of thinking is absolutely wrong-footed, since we are dealing with a relatively closed system – the same amount of money – ‘water in a bathtub’. Necessarily, for every buying dollar is a selling dollar… and they BOTH are right, at least they think so at the time of transaction and willing to bet money for it.

THEN, one of the sides will try to influence public opinion thru TV and social media and manipulate order flow thru HFT – so now you have to be a contrarian for a contrarian opinion… wrong again? See- you will drive yourself crazy trying to figure out who is buying, who is selling, why and how much… and lose money in a process.

There is only ONE market, ONE sentiment, ONE commitment – My money, in MY account!

This is the ONLY statistic a trader should focus on.

No?

Comments are interesting today. This “I don’t get it”, “why are you right and everybody else is wrong” mentatlity, followed by heated emotions comes up on a fairly cyclical basis. I should probably be charting how often at one points because I suspect it is an indicator.

If you tend towards bearish, you find a bearish opinion. If you tend to be bullish, you look for the bullish opinion. If you follow the heard, you probably follow the talking heads and end up not knowing what to do and sit frozen in place.

I think this commentary today is an indicator we go higher, because everyone is sitting on the fence not understanding why we’re at this point and disbelieving it can continue.

The crazy here is, if the crowd is wrong and the pain trade is higher…. who the fuck is buying? I’ve never understood that. Sentiment is a bitch.

The interesting thing about OA, and why I lurk here is he seems to be the most objective, the least biased. He’s pretty clear on “I think this is what’s happening and here’s why I think that”. But you can’t just read one post and figure it out. You need to see/hear/read his rationale over time and gauge his success. Join his private conversations. The dude is a winner, you can’t deny it. Don’t just jump in and start slinging mud because you are frustrated and don’t get it. This shit is hard. If genius were easy, everybody would be one.

Kind words, thank you.

Stopped out of UWTI. Why did I go long when oil was below the 10 period ema on most timeframes? Rhetorical. That’s what I get when I bend a rule.

Still in PYPL

I think there’ll be a good oil long next week

In agreement. “They” will not let oil nosedive till the winter.

***sighhhhh where’s the follow thru???

What’s going on with GE? Getting killed. RSI is 26. It got hit with the market, but it’s continued down.

China stocks today? Also thinking UA wants up and out

I want to reload on the CMG calls, but the spread is ridic!

May not always agree with your point of view but I do enjoy your posts.

Range in TWLO has become extremely narrow. Looking for a move to the upside 54.85-55 on volume.

WFC Oct 7 43 calls @2.9

VXX Oct 7 44 puts @ 6.1

$FCX…classic Opex Week downgrade by Morgan Stanley…bottom is in.

(maybe)

@OA gun to head here $TWLO or $LN. They look real similar. Maybe just buy both? Thanks boss.

Both for sure.

Added $LULU calls here. It may get dumped big time, but betting on a reversal

SBUX quietly back testing BTEXIT lows, starting to wonder if last years August panic lows are next

HSY 96 puts for 9/23 in the green. When it spiked above 96 this morning, my puts stayed green.

Love the liquidity in UA. I have been short with 9/23 38.50 puts. Attempted to hit the bid yesterday on TDA when it spiked down to 37.81. Tried the “mark”. Bid would drop. Tried the bid, bid would drop. Figuring that shorts are getting “trapped”, I decided to go long. Made enough on the common to cover yesterday’s loss. This weeks’ close of 38.67 will determine if I stay in the trade.

Is FEYE a VIX product? Lolz. Ticks up when market ticks down, ticks down when market ticks up…

Must be Friday. $TWLO^^^^^^^

The last week has been like some girl you’ve been been wining and dining but not putting out and today finally get to 1st base

Lol. Nice analogy. I’m trying to get her pregnant. Let’s go!!!

IMAX just completing aversion ?

Guess not, hopefully finishing up discouragement since it’s almost back to my entry

$LN shaking out the weak hands. I’m going in.

Feel like there is little reward picking up Oct calls at these prices.

Not loving my buy right here. See how it closes.

Hmm, DNKN. Slight hmm TDC.

$OA…regarding the commentary from yesterday, I assume you will eventually not be able to take this someday. Have you ever considered doing a higher end service that might take some of the trivial stuff away. I don’t trade options but find your analysis to be the best I have used in 20 years. I pay allot for research and analysis that isn’t even close to what you give people for free.

The general route is guys like OA progress to get big enough that fees + profit from running a fund will dwarf any subscription service. I reckon that day will eventually come but will soak up what I can in the meantime.

I’m very close. Almost took the jump in 2014, glad I didn’t. Now is the time. I’m certain of it. All the fund managers are being fired, discarded and money leaving in droves. Generational opportunity here in money management.

Yeh man I wish you luck not that you need it. Only been reading your stuff for less than a year but you have def opened my eyes to some new stuff that I totally utilize now.

If you got time, you should write that blog about random non-trading stuff. Think you’ve alluded to it a few times and would be cool to read!

Going to do that soon. Every now and again.

Agree on the timing. Think people are realizing that most fund managers don’t add value hence all the ETF’s. And although handling institutional amounts of money, a lot have the same terrible habits and poor understanding of psychology that retail traders have.