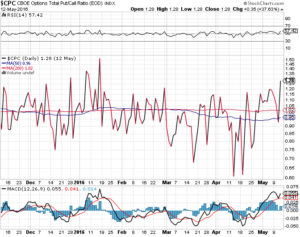

This is the highest read for the Put/Call ratio since January’s landslide. They’re buying puts here into relatively quiet action, anticipating something on the horizon. Normally, they buy puts while the landslide is happening.

I bought some NQ here into the close and some $X calls for June. HAGW.

OA

If you enjoy the content at iBankCoin, please follow us on Twitter

OA. You looking for just a short term bounce on NQ or do you think it has legs?

I own calls for distance, futures for the close

Sorry OA, but NQ are calls or futures?

NQ = e-mini futures contract

QQQ – the ETF I bought calls against

Good luck. Going to be an interesting Sunday for sure

What’s Sunday?

I believe futures open on Sunday?

No shit dude, why is it different than every other Sunday? More crashing?

I think the idea is that it will be interesting to see if Europe and Japan follow our lead down or not?

I took 600 points out of NKD this week. Has a pretty strong current

Good job. Going to be an interesting Sunday for sure.

But we’re not even going down. NQ has been at these prices 3 weeks now.

I know. NQ just can’t get back to its April high for some reason.

Not even the April high. NQ can’t get into April levels. Only one day in April [the 29th] held the same or lower prices.

After this week’s action, I have concluded they have been propping futures so they can sell stocks / load up on puts. Still have not seen the extreme close in put:call ratio to confirm bottom and interestingly many stocks / indicies closed below significant moving averages this week so my belief is that we have considerably more pain ahead – especially with $NYSI and other breadth indicators coming off of extremes.

$204 has been a line in the sand for SPY. Gotta think that will be defended.

Every day feels like a game of chicken against the market, doesn’t it?

Potential chaos crash

Did you see this?

https://pbs.twimg.com/media/CiTAsCaWsAARG-3.jpg

@kidstock … referring to your “short CIT” comment from last post – they are involved in your space, no? I thought they were pretty heavy equipment lenders, at least many years ago.

CIT was big many years ago but now they vendor service clients like Avaya, etc…

From what I understand CIT writes shitty paper with very loose underwriting criteria (ie. not requiring personal guarantees for closely held companies). I used to work for the company they purchased (Direct Capital) and being a competitor of mine, I review their UCC filings weekly. The businesses they have been lending to for the last two years are not your ideal Commercial borrower (short time in business, cash businesses, mom & pop types with no business credit history). These mostly short-term loans (6-9 mos avg) charge rates in excess of 30% with payments taken out DAILY.

These loans are unsecured (unlike the loans I originate) and once a customer has a track record established, these lenders will extend even more credit to customer. This becomes a problem when a competitor (such as ONDK) steps in and layers another unsecured loan on top of existing loans and ultimately customer takes on more debt than their cash flow can bear.

@kidstockibc I have saving accounts with CIT. Would you transfer the money out to other banks then? How about Amex?

I do not believe that Direct Capital acquisition will lead CIT to its demise, a sizable haircut no doubt but its way too early to determine how deep the losses will run in the coming quarters if liquidity continues to dry up and the pace of business activity continues to be choppy / sub-par.

That being said, the OneWest merger might ultimately have more impact on the potential demise of CIT — there is plenty of compelling data online that suggest the two should never have been allowed to merge.

@kidstockibc Thanks for your comments!

“They’re buying puts here into relatively quiet action, anticipating something on the horizon. ”

In terms of the headline, Brexit vote and Greece bonds coming due are probably enough to get the Put buying up. It could actually lead to a July bump if GB stays and if Greece once again pushes their problems into the future.

OA- do you use put call ratio as a contrarian indicator?

wouldnt be surprised if some kind of debt relief for greece on horizon in exchange for housing migrants. migrants are there anyway, rest of europe doesnt really want them and would rather pay greece to look after them.

good call

we are not going to crash but it still feels like there is more downside before upside.

All major indices are below 50ma now

There goes BABA

The “Mall is Dead” thesis might be gaining traction. Look at shares of GGP, MAC & SPG — those are major reversals on the weekly charts (with volume). Expect continuation lower in the coming weeks.

Restaurant stocks are trading like shit — this is consistent with the sharp fall off in lunch traffic that our bar / tavern experienced once gas prices breached $2/gal. I just unloaded JDST so only trades I have on are CAKE June & July puts and shares of CBIS.

Only high conviction setups I can see are shorts in the restaurant group and CIT.

Good thing the bass are biting….

OA, do you see this as a strong indicator of a pain trade set up, wherein participants are positioned in a manner that could catch them off guard? Or, do you see this as a more ominous sign?

As you mentioned in the comments above, you’ve got QQQ calls so maybe I’m answering my own question. Even so, I’d still appreciate your input big time. Thanks in advance, and hope you have a great weekend as well.

P.S. That Warrior-Thunder series is gonna be real fun to watch. I think Thunder give them all they have, but Warriors win in Game 7.

Yeah, operating under the theory that markets only crash when mom and dad are invested.

7 games? Nice!

Is the brother in law invested? That’s the important question here… GS in 6. KD and RW carry three games but they only win 2 of em.

Lol, no way. Heard he had shares of NETE. Not sure why.

And that would mean the chaos and erratic action, for the super majority of the time, is when mom & dad are invested? Thanks again for the insight.

Sentiment seems to be a relatively untapped and unexplored area of markets when comparing it to fundamental and technical analysis. Almost seems to be where the two intersect.

Markets trend until everyone feels confident and secure that it will trend forever. That’s when it has trended long enough to suck as much retail into the market to transfer their money away from them.

OA, how do you feel about buying $VSLR at this level? TIA!

I bought a couple shares a bit higher. Not sure if I want to drop or add.

I sold out late last week… so odds are now would be a good time to buy… 🙂

Interesting, thanks.

It’s dropped another 10% this week so consider urself lucky

Expect a gap and continuation lower off a weaker than expected Empire State Manufacturing survey tomorrow morning. My conclusion after reviewing the action from last week is the rally built on the back of rising Crude prices was the last thrust before our markets plunge to test and ultimately breach the February lows.

A sudden shift from earnings to data dependence will mark the end of this bull market as we now are at the point in the Presidential cycle where the “truth” returns to indicators such as unemployment, housing starts, CPI, etc. so expect more downside disappointments when Housing Starts and Industrial Production figures are reported on Tuesday, Philly Fed and Leading Indicators Thursday and finally Existing Home Sales on Friday. The media will quickly forget the bullshit Retail Sales report from Friday.

What if we gap up?

I would have to see evidence of price rejection to change my view. My first instinct would to be to fade said gap but suspect the direction next week will be determined prior to the Opening Bell.

I guess I didn’t answer the question – in case of gap up, catalyst for for gap and confirmation across asset classes and across the pond would be considerered.

I have been suggesting the Short into Brexit thesis for awhile and finally started executing trades in that direction but lacked conviction last week on short-term Put positions (notably NFLX weekly 87s) and the UVXY ($13.48) trade which I kept too tight of a leash on. Failed trades affirm or help refute my current market stance. In both cases my entry was correct but I failed to give trade sufficient time to play out.

Take a look at VXX chart. Is that the kind of wedge you would buy or sell?

If Nikkei trades below 16K, will that change your outlook Jeff?

A monthly close under 15500

More from OEW Weekend:

“After the Major B uptrend topped in mid-April at SPX 2111 the market has been working its way lower. The first decline was five overlapping waves to SPX 2039. We have labeled this with Intermediate waves i/a, while we await some further market activity to clarify which label it is. The rally that followed to SPX 2085 we labeled Int. ii/b. After that high occurred on Tuesday we have been tracking an Int. iii/c decline.

“Thus far we have noted three small waves: 2053-2071-2043. We could label these waves as Minor, but think they are of a smaller degree since we are expecting a significant decline during this downtrend. On Friday the SPX ended with a positive divergence on the hourly chart. If the market gaps down on Monday it will likely get cleared. If not, the market could rally 15+ points off the SPX 2043 low to clear the oversold condition. After that it should resume the downtrend. “

Gap up just means setting up for gap down next day or so

Why’s that?

Just been the trend of last few weeks. Hope it doesn’t happen

OEW Weekend Recap:

“For the past several weeks we had been noting that the Tech sectors, NDX/NAZ, had been displaying a clearer view of the growing weakness in the general market. We hold this belief because the Cyclical sectors, SPX/DOW, have been greatly aided by the upward surge in the commodity sector.”

“The NDX topped with the rest of the major indices in late 2015. Then it declined 18% over the next two months into a mid-February low. After that it rallied for two months into a mid-April high, retracing 80% of the decline. Since that high it has rolled over and entered a new downtrend, which has already declined 6%. The NDX does not have any commodity stocks.”

“During the mid-February to mid-April uptrend, in the four major indices, the Transportation index was in the midst of its largest rally since it topped in late-2014. During its uptrend the TRAN rallied 27%, led by the surge in energy and commodities, and this clearly overflowed into the Cyclical sectors. It recently has confirmed a downtrend as well.”

“After the SPX bull market topped in late-2015 its first downtrend lasted until mid-February as well. Its decline, however, was only 15%. During its two month uptrend it nearly retraced the entire initial downtrend, falling only five points short. With surging energy and commodity stocks making up 10% of the index, this may have added the extra strength. While it has yet to confirm a downtrend, the DOW has already done so.”

“Clearly commodities are having an impact on the Cyclical sectors. This suggests, however, when the Tech sectors start making new lows commodities will probably selloff, as the SPX/DOW have a lot of catching up to do on the way down. Medium term support is at the 2043 and 2019 pivots, with resistance at the 2070 and 2085 pivots.”

What’s not to like:

1) Record Bond Issuance will sap what’s left of remaining liquidity

2) AAPL’s massive QQQ weighting

3) Crude buyers are desperate oil companies locking in $45+ prices

4) Complacency

5) AMZN double top – look for prices to break below last week’s buy point of $696

6) Biotechnology’s inability to bounce (Watch REGN after making cover of Barron’s this weekend)

7) FinTech unwind – CIT is next shoe to drop after LC and ONDK

8) Weekly $TRIN close of 2.17

9) Transports leading DJIA lower and confirming economic weakness

10) Dip buying is alive and well

I am a Controller at commercial real estate RETAIL development company, my boss, keep in mind he has never talked about the markert, walks in Friday and says, “we need to start shorting retail stocks.”

Stay long.

That could be a good contrarian indicator (I had posted te same given all the high-publicity negativity on retail), but if your company is heavily dependant on retail stores for business, then it would have made sense to be short retail a long time ago simply as a hedge agaisnt fallign business. You company’s business model is basically leveraged in favor of retail gains.

I’m sure needed a reminder about his company’s business model.

Yeah, your right, that was probably obvious

Let’s see how ES acts now that its on the other side of 2040…

Jumped in JDST pre-market at $1.66. Any updated thoughts?

Sorry but not in position to give advice — I can only tell you that I sold JDST on Friday. I’m not a gold bug / commodity guy – my opinion is shit. Only advice: There are much easier ways to play the market than triple inverse ETFs.

My sense tells me that the market will be much lower by Sep/Oct.

You said that in March too.

bot the open in this weeks SCTY 21 calls and then the dip on NFLX for this weeks 89 calls.

Opening put:call ratio screams “Fade Me!” but money can be made in both directions. I like CAKE DIS and SBUX on the short side. FIT TSLA and SQ on the long side.