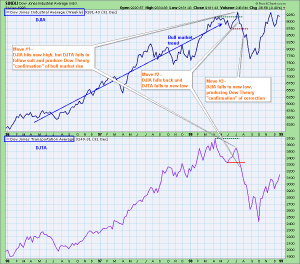

I’ve been running this 1998 analogue since 2012 in every asset class, so please forgive me for talking it up beyond recent chart correlation.

I’ve talked at length about the environment now, from a breadth and negative divergence perspective is no different than it was in 1998.

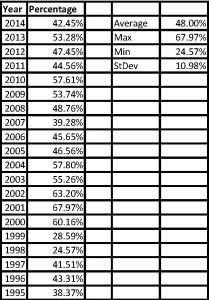

I’ve shown you just how bad 1998 was from a performance perspective. ONLY 25% of stocks out performed the market. Roughly the same number of stocks are in bear markets already (down 20% or more on the year) as there were in 1998.

Again, breadth was just as bad then as it is now.

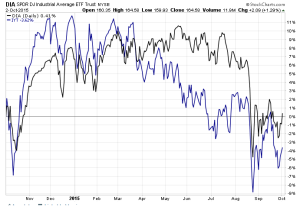

Let’s discuss two other items. The number of stocks below their 200-day moving average, and the Dow Theory sell signal.

The percentage of NYSE stocks trading above the 200-day moving average has historically ranged from a high of 80-90% (at the peak) to a low of 10-20% (at a market bottom). This percentage fell below 20% at market bottoms in 1998, 1990, 1987, 1981 and 1974.

We breached 20% (17%) on 8/25 this year. This is why the market is divergent.

Of the 5 years that breached 20%, 1981 was the only year where the market traded lower into year end. In all other years, the market moved higher into year end and beyond.

As for the Dow Theory Sell Signal:

The three major Dow Theorists had been under a BUY signal for many years up until the SELL signal on August 4th, 1998, after which interpretations diverged.

1998 newspaper clippings for Dow’s Theory in 1998.

OA

If you enjoy the content at iBankCoin, please follow us on Twitter

All these bears coming out at end of Friday saying how last week’s rally is a perfect set up to short the market. Feels like pain trade is definitely up.

They have to say that. They all shorted the fucking lows.

Disagree. Too much bullish sentiment over Friday’s short cover move. Want to see more skepticism after that kind of move. We will test the lows at the least.

No way. I watch people react in real time. No way you can call that bullish sentiment. I got more questions about the move than I read statements. I respectfully disagree.

Yeah, definitely not bullish sentiment in my house. All of that nice fat big biotech long common I bought for LT in m IRA? I sold every fucking share into the close Friday. I felt gutless doing it, but there is something off about the tape and I can’t put my finger on it. Probably will miss a pop this week but I am not sanguine enough to even stay long and large into the weekend much less LT. No regrets; I think I was way early. 100% cash. 100%.

FWIW, I think part of my reaction was my original buys were underwater immediately, so I went very large at lower prices to recover. My positions became over-large for me, and the rebound gave me my justification/excuse to sell and I just kept selling until I was dry. I believe I will be buying the same names at lower prices (and smaller sizes) later. Especially looking forward to your take on the events of the the next few weeks.

OA – when you say “This is why the market is divergent,” what is it divergent from? Other markets from the past (from your table)?

In a high correlation environment, everything moves together. We monitored critical elements of the market in relation to the market itself(SPY/DIA/QQQ/IWM).

right, like you were saying last week, divergences in bio or USD/JPY, etc that clue us into moves the market itself hasn’t fully made yet…?

If there is strength in weakness, then the market isn’t really weak.

Your plan and write ups for the week have been spectacular. Curious of your opinion on AAPL. I view it as a decent market tell and trying to follow your divergences plan, AAPL isnt it looking as strong as Id want.

I don’t think it’s as important really. I think it reflects what everyone is thinking…uncertainty.

I bought calls on Friday though, so I do see it higher along with the market. I chose it because premiums are still reasonable.

Long $NQ_F here at 4252.5

Looking forward to seeing how the week plays out. Best of luck to you good sir.

looking how this develope , if fed is under the support of this really it may hold .. if not headlines like this http://www.marketwatch.com/story/those-who-sold-in-may-are-looking-to-return-to-stock-market-2015-10-02?dist=tbeforebell are sure signs of pending flush

Why does a headline signal flush?

good day Jess hope you good and you family and everything. financial mass media is more then half the time scam and contrarian . you know it . the same way GS & co rise targets when he have to sells ( the big majority of time it happens this way, and not the other )

mark hulbert is a marketwatch jolly. marketwatch is on peak of financial mass media in 2015 , financial mass media is always been quite bad and contrarian ..

You running out of ammo, bro? Here to argue a Marketwatch headline?

ammo? for what ? ammo for commenting on a blog .. come on bro .. no jeff.

i bought friday price action .. as well as i sell enthusiasm .. i think you teach me this too ..

have a good day see you tomrw at open ..sincerely a ‘bro of you ..hoping the best 🙂

ps.. bro.. side note .. it puzzle me though that you use polls to understand the pain trade , while you argue my n. of ammo when i use titles to poll how they want to drive sentiment ..

I don’t read those articles, just you.

“here to argue a Marketwatch headline” ..yes. sorry. and it’s you that called me an asshole before ? no prb ..

I did? Sorry bro. I must have been mistaken.

no boss .. i don’t read mark hulbert.. or marketwatch.. i check headlines .. mw barrons and on .. for aforementioned reasons.. chill bro , and have a good day the best you can

Hi OA, first off, thank you very much for sharing your knowledge. Your calls over the past couple weeks are so impressively point on and I’ve learned a ton.

Could you please quickly explain what you meant in a previous post about using $TICK to find extremes? As it applies to divergence, are you looking for down market yet an extremely high $TICK in the positive?

Thank you very much for the knowledge and response. (Posted this in a prior blog post).

High TICK means strong buying

MGK – Mega Cap 300 Growth leads the way YTD ….