Seeing the futures open flat tonight made me smirk a little bit. Let the market open at fair prices tomorrow with no pain scenario and let trader’s determine value the right way.

Last week we did a lot of heavy lifting. If you haven’t yet, read my recap of last week, I think you ought to at least skim though it. Two traps were set in the last two weeks that have participants in a precarious position here heading into the upcoming week.

Last week I talked about watching for divergences in the tape for the week, as they would indicate strength into weakness. Now days, when things are strong into weakness, it means that the weakness itself is suspect.

As for this upcoming week I have three things on my radar.

First, I won’t be as focused on the index action as I will the groups that will lead/lag this week. In other words, each day we will discuss themes under the surface. Which groups were the strongest and which were the weakest, and whether value or growth outperforms. This will determine the appetite for risk. So if the market doesn’t see any volatile price swings, I want to know what specifically is being bought, and what is being sold.

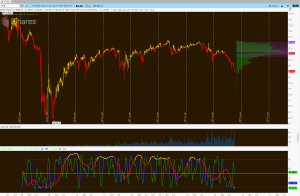

Second, another measure of risk has been the decline in credit vis a vis the $HYG. As a technician, I pay very close attention to volume, as prices have memory, and as this instrument has declined, I haven’t found myself worried yet. Here’s why.

Since bottoming in 2009, $HYG has traded in a range.

The dips in $HYG occurred under market duress. In fact I am using the low end of $HYG to determine acceptable market correction, versus “oh-shit.” The dips in $HYG translated into a 17% total correction in 2010, and a 20% correction in 2011. Right now, we’ve managed to correct roughly 13% from high to low. This instrument managed to reverse in an incredible location Friday. Any further weakness this week and I will be concerned about the lows/no lows argument.

Finally, the USD/JPY. This week we will need to see this range break. If higher, the lows are in. If lower…we watch carefully.

It’s interesting, but in the last week or so I have encountered a few bearish viewpoints and engaged said viewpoints for validation/clarification. I’m amazed at how many opinions out there are not genuine opinions, but most derive from the opinion, analysis, or charts of someone else.

I’m not spewing the opinion of anyone else here but my own. Why would I write with the conviction that I do? Simply because I trust my own analysis, work, and understanding of what I write enough to justify my own risk taking.

As many will tell you, there is a lot riding on this month. The monthly charts are in a vulnerable location. If we don’t have a strong monthly close here, the argument for downside will get louder. Because there is so much on the line, do your own damn homework. I have an opinion that comes from eighteen years of my own work and analysis. I don’t read the opinion of others. Never have. I don’t find that they’ve encountered any idea or question in this sport that hasn’t already come up in my mind, on my own. That said, don’t take my opinion or the opinion of anyone else and let it determine what you do with your own money. Do your own research, understand what’s really going on out there, and use your own conclusions to justify your own risk taking. With each post I write, despite being dead on accurate lately, I pose a compelling argument; one that hasn’t been completely ruled out yet. Try to understand it on your own, get to the bottom of it, go down the rabbit hole with me until you feel confident enough in the process as to when you should/shouldn’t take risk.

See you in the morning,

OA

If you enjoy the content at iBankCoin, please follow us on Twitter

Exceptional post sir

The only thing I haven’t figured out yet is what sector / index leads the way out…so what the hell, buy VTI in large quantities…

INTL small cap waking up…VWO

The more you lay your thinking out as you do so well here and in AHWOA, the more I become able to understand what’s going on and think for myself. Thanks so much. You are a great teacher!

Awesome stuff!

Bloomberg guy also citing ’98 and ’90 – seems to be reading OA posts 🙂

To quote:

“The S&P 500 saw similar routs and subsequent rebounds in 1998 and 1990. In both the years, the selloff started in late July and slowed in late August through early September, before the gauge touched an early-October low and started rallying from there.”

http://www.bloomberg.com/news/articles/2015-10-02/s-p-500-may-bottom-in-days-then-rally-seasonality-charts-show-analysis

yeah, that guy follows OA.

bravo

Grabbed some UCO weekly 25 calls

Out of TCK, 1 acct 5.1%, the larger acct 10.4%.

Fly jinxed bios. I’m getting short

Good luck

Thanks. Playing out nicely. All thanks to fly. Lol

What did you trade?

Labd. Up 9% already. Make take profits and chill.

You actually introduced me to the 3x bios. Didn’t know they existed. Thanks

… the dude might be on to something.. at least for the day. FLY has a long history of jinxing.

I’ve been following this site for last 2 years only. So I dunno about his track record prior to that. But since I started, his calls have shit the bed. I suffered with many of them in the beginning as well. But I’ve learned my lesson.

OA, anything out there to cause the FEYE drop? Not acting right but would you start a position down here if you didn’t have one already? Thank you.

Yep, I bought these levels last week.

It got downgraded by piper this morning

Got some Nov1 calls this morning. Playing birthday weekend karma.

Bought weekly AAPL 111 calls – looks like you got a second bite at the apple if you didn’t get in on Friday….

Besides OA’s call and the possibility of market upside, what about the company itself would make you want to get long ? Just a trade ? Curious.

Just a trade – it held the support it had from volume at 109 and it has an easy path to get to 112.50, so good risk/reward on this one. If it exceed 112.5, could rally pretty good – lagging this morning made it a good candidate for me.

The key was to hold the 109 support this morning – On Friday, the support was 107.75 That, and watching the Yen…

Oh.. oH IBB going down .. expecting it to HIT 330 before going down ..

LABU filled the gap up nicely and going back up.

Most comments I read about this were about short positions being taken. Perfect catalyst for more upside.

Im figuring there is some pain involved in holding these. Ive been burned bad by 3x ETFs. And turnaround Tuesday is a thing. I still have an order in to buy more if we break the lows. Would pref not to see that but perhaps Thanksgiving is a bit of a long hold. Or maybe Im just a pussy.

This $LABU?

3x ETFs in general. If thats what you meant by the question.

Agreed, they make things so much harder than they need to be. Get back into this $LABU though.

You are talking about the 9/28 gap, correct?

That gap down was minor. I was talking about today morning’s gap up. But with these 3x ETFs technicals arent perfect at all. Are they ever tho ?