Gapping up

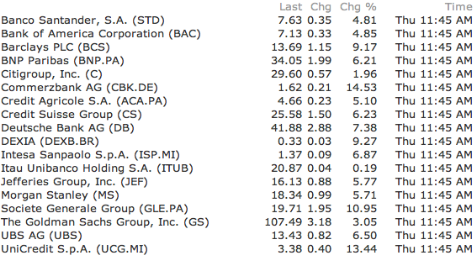

MFN +23.3%, NBG +6.1%, CS +2.5%, RIMM +5.3%, ING +1.7%, RBS +1.7%, DB +3.5%, AXL +2.2%, UBS +2.2%, BAC +1.8%, BP +1.5%, UXG +3.6%, CHK +3.1%,

SVM +1.9%, KGC +1.9%, SLW +1.6%, RIO +1.2%, AG +1.1%, SLV +0.9%, GLD +0.4%, BBL +0.4%, GDX +0.3%, PVA +2.9%, SWN +2.5%, BP +1.7%, FST +1.7%,

COG +1.6%,

Gapping down

CBRX -58.2%, IGOI -27.1%, CCL -3%, HAL -1%, GAME -19.5%, COP -0.9% , PG -0.5%, FSC -4.2%

Comments »