Spanish banks will have to do a better job in cleaning up their balance sheets. Bad loans jumped by 90% from a yoy basis.

Comments »A Million SPX Put Contracts Traded Today…a Contrarian Timing Signal

Bill Luby’s analysis finds that the extreme volume of SPX put contracts traded today has typically coincided with bottom in stocks.

Read his analysis here.

Comments »Rare $3 Gold Coin to Fetch $2-4 Million in Auction

Gold prices are shooting up the roof, but its also the time for the coin collectors to reap their investment. And for the investors, its never too late to extend their investment portfolio. We had earlier told you about the 1792 Silver Center Cent, from the first group of coins ever struck in the U.S. Mint, that fetched $1.15 Million. And, now another rare coin in American history 1870 ‘S’ could become one of the most expensive coins ever. Supposedly one of the rarest coins, only two of this kind were made, and the other one has already been sold years ago.

Comments »Half Of Americans Are Spending More Than They Earn, But Don’t Realize It

Will the Fiscal Cliff Crush the Economy ?

“Investors and analysts everywhere are warning of the fiscal cliff that is approaching at the end of 2012 that could significantly hit the American economy.

Unless Congress acts, more than $600 billion in tax and spending provisions will change at the end of the year. And this will impose fiscal restraint at a time when the U.S. economy is growing very gradually.”

Comments »Eihorn Enters a Type 5 Position in AMZN & Martin Marietta

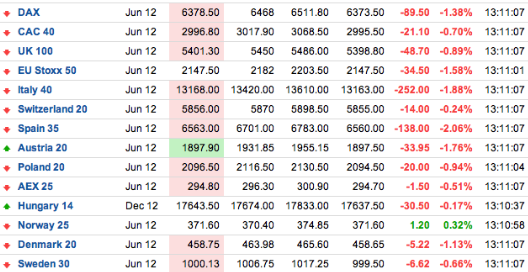

Spanish Yields Blow Out As Rumors Swirl of Bank Runs

The finance ministers of Spain have tried in vain to quell rumors of Spanish bank runs. As a result European markets are down and Spanish yields are blowing out.

Comments »Re-Entry Signals Following 10 Month Moving Average Exit

Ritholtz and Faber are going to be backtesting some interesting re-entry signals. Based on Faber’s and Ritholtz’s track records, their results will likely prove to be of significant value to the system trader who wants to follow a long-term quasi buy-n-hold strategy with a market timing entry and exit. Read exactly what they will be testing here.

Comments »Notable ETF Inflows Over the Past Week

MBA: Q1 Delinquency Rates Hit Lows Not Seen Since 2008

Traders Inside $JPM Take the Other Side of the Trade; Classic Capitalizing on Debacle

General Electric Will Receive a Special Dividend From its Financial Unit

The payout of $4.5 billion is the first since a suspension of payments in 2009.

Comments »BoE Forecasts Lower Growth and Higher Inflation While Preparing for a Debt Crisis

“Bank of England Governor Mervyn King said officials have prepared for dangers posed byEurope’s debt crisis, after the bank lowered growth forecasts and raised predictions for inflationthis year.

“Contingency plans have been discussed and have been for a considerable time,” King said at a press conference to present the bank’s quarterly Inflation Report today in London. “We are navigating through turbulent waters with the risk of a storm heading our way from the continent.”

Comments »On the Matter of Student Debt

Sometimes i think to macro, but then again it only helps me see opportunity into the micro or short term. Student loan debt is not to be ignored when factoring in future growth and the overall health of the economy going forward.

While the average student debt obligation is small in monetary terms, collectively it is a large sum. Some kids are looking at decades before paying off loans.

Comments »Whitney Tilson Has Nearly 30% of His Fund in Fucking Call Options!

For all the totally inexplicable facetime T2’s Whitney Tilson gets on prime time financial comedy air, one would imagine that the man runs billions and billions. Instead, as per the just released 13F, Tilson’s fund has a grand total of $345MM in long AUM as of March 31. So far so good, however that does not explain why the manager has a Sharpe ratio of roughly 0.00 in the past 3 years. Well, now we know: of the $345 MM total, a ridiculous $104 Million is in call options! In other words, not only is Tilson nothing but a bullish bet that copycats various other select hedge fund portfolios, it is a mega-levered one at that, with what appears ridiculously high theta! It get’s worse: as it turns out, another $24MM or so is… in Warrants. Yup: all levered products without actually owning the underlying, leading to massive monthly swings in actual P&L. In other words, real assets held by Tilson amount to $217 Million. And one wonders why the fund can be up 20% one month and down 30% the next… or how Tilson can spend hours a day on TV.

UPDATE: It’s been pointed out to me that Tilson most likely doesn’t have 30% of his fund in calls. The source might have gotten confused about how options are reported to the SEC. 10,000 apologies to Lord Tilson.

UPDATE II: ZH is insisting he is correct. I don’t give a shit at this point. Take it for what it’s worth. Tilson is a God damned idiot.

Comments »HELP! Greek Elections to Be Held: Euro Slides, Sovereign Bond Yields Spike

It was just announced that elections will be held in Greece, sending the euro under $1.28 to the dollar. Spanish yields spike to above 6.3% and Italian yields are now north of 5.8%.

European markets have reversed and are decidedly lower.

Comments »Hedge Funds: ‘There Will Be Blood at $JPM’

Hedge funds on the opposite side of $JPMs debacle derivatives trade are holding out to scoop up all available profits possible.

Comments »Facebook Price Range Rises to $34-$38 Bones

Direct Investments in China Fell for a Sixth Consecutive Month; Exacerbating Slowdown

“Foreign direct investment in China fell for a sixth month in April, the longest stretch of declines since the global financial crisis, amid renewed turmoil in financial markets.

Inbound investment dropped 0.7 percent from a year earlier to $8.4 billion, the Ministry of Commerce said today in Beijing. That compares with a 6.1 percent drop in March.”

Comments »