Shell games and total bull shit out of the mouth’s of European leaders has not only scared investors not to finance debt problems, but has lead the world to ask just how bad is it in Europe.

Comments »“Escape From Japan” is Becoming a New Cottage Industry for Bearshitters

Fears of a peaking Japanese economy, currency meltdown, and global banking problems have spurred real estate companies to help wealthy and worried Japanese escape Japan for greener safe heaven pastures.

Comments »All of Ireland’s Work May Be in Vain

Ireland has made great strides to repair its damaged economy and rising debt problem. Unfortunately, Greece, Spain, and Italy have crated uncertainty after all the recent moves to build confidence.

More importantly, it appears that no matter how well the country has done getting back on its feet, it may not be enough as debt will reach 120% to GDP.

The world needs a huge shot of global growth to break the debt spiral so many countries face.

Comments »Consumer Retail in China to Surpass U.S. in 2015

“The U.S. is fast being replaced by China as the world’s most important consumer market. That doesn’t mean each country has similar tastes. But broad appeal products like Coca Cola and Nike will find more consumers in China than in the U.S., and if one Chinese official is right, they might find that market better than their home one as early as 2015.”

Comments »Will the Market Help Spain ?

Spain will try to tap the markets to raise money for Bankia. According the the ECB, roughly $100 billion will be needed to stabilize the bank. So far in the past week Spain has gotten state and country bailouts to the tune of $28 billion.

Comments »$JPM Sells $25 Billion in Assets to Offset London Whale Derivatives Loss

$JPM took a profit on some assets to help smooth out the losses announced two weeks ago in a derivatives position gone wrong. The $25 billion seems like overkill compared to the losses, but perhaps they are trying to get ahead of volatile markets.

Comments »Stock Buy Backs for U.S. Companies Begin to Take a Back Seat to Cap Ex

“Stock buybacks are falling to a three-year low just as U.S. chief executive officers boost spending on plants and equipment to a record.

Companies announced $1.1 billion of repurchases a day on average during the earnings season in April and May, the lowest level since mid-2009, according to data compiled by Bloomberg and TrimTabs Investment Research Inc. Capital spending in the U.S. has risen since 2010 and reached $63.6 billion in March. Devon Energy Corp. (DVN) eliminated buybacks and boosted exploration and production spending 18 percent. United Parcel Service Inc. (UPS) cut repurchases in order to buy TNT Express NV.”

Comments »China’s Xinhua News Agency States China Has No Intention of Rolling Out Stimulus Programs

Asian markets have rallied on hopes of a stimulus program as of late. Xinhua news agency is reporting that the Chinese government has no plans for a large scale stimulus package despite. Piemier Wen Jiabao stated last week he would like to boost growth, but markets are speculating on stimulus.

“The Chinese government’s intention is very clear: it will not roll out another massive stimulus plan to seek high economic growth,” Xinhua said in the seventh paragraph of a Chinese- language article on economic policy. “The current efforts for stabilizing growth will not repeat the old way of three years ago.”

Comments »ECB Council Member Tells Reporters There are No Discussions of Further Bond Purchases

Last week the shit hit the fan with Bankia needing over $28 billion in bailouts. Sapin requested the ECB help them through bond purchases. The ECB did not commit to any such requests and today a council memeber said it is time to wait to see how previous measures have worked out.

Essentially, this was not a confidence booster statement for equities.

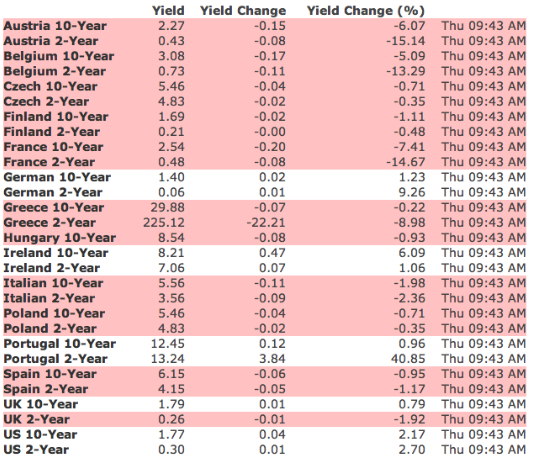

Comments »Spanish Yields Hit Nose Bleed Territory as Bankia Gets Over $28 Billion in Bailouts

Spain’s largest bank got massive bailouts last week. It started off with $11 billion, then climbed to $18b, then $23b by Friday. What many did not know was they also received a state bailout of of $4.5 billion bringing the grand total to $28.3 billion.

Law makers were sure to slowly increase the bailout during the week to lessen the blow or surprise of so much money being needed. Despite all the cash injections yields are racing back to 7%; traditionally an area that give the markets serious jitters.

Comments »Greek Banks Get a Capital Injection of $23 Billion

The Hellenic Stability Fund has turned over $23 billion to Greek banks to position them to stay in the Euro and hopefully get help from the EU shortly.

Comments »European Markets Reverse Off 1%+ Gains to Close Near the Lows

With Crime Down Why are We Spending More Taxpayer Dollars on Police ?

Spain’s Bankia Bailout Now Raised to Over $18.8 Billion

Spain’s Bankia was halted today as the bailout earlier this week went from $11.3 Billion to $18.8 billion. Not good to say the least.

Comments »More on Catalonia Spain and the Need for a Bailout

The Catalan president says “We don’t care how they do it, but we need to make payments at the end of the month. Your economy can’t recover if you can’t pay your bills,”

Comments »Think Your Market is Bad? Have a Look at the Greek Stock Market

Citadel Got Fucked on the Facebook IPO Too

Citadel’s losses were said by one of the people to be in a similar range. Both Knight and Citadel submitted claims for financial accommodation from Nasdaq by Monday’s deadline, these people said.

Comments »Will the Individual Investor Prove to Be the Contrarian Trade Again ?

Oddly enough the individual investor has pulled funds out of a cyclical bull market for 52 of the past 56 weeks. One has to wonder if this is fear or a serious need to get at funds. At any rate, last week saw the 13th consecutive week of liquidation totaling $3.5 billion.

Comments »