They stay at neutral.

Comments »Derivatives Trader: ‘The Trouble is, Regulators are Idiots’

An excellent collection of thoughts by a trader about trading, City short-termism, high pay, the excitement of recent years and why he now wants a way out. This monologue is part of a series in which people across the financial sector speak about their working lives.

Read the article here.

Comments »Was the $JPM News Leaked? 13,800 May $41 Puts Traded Ahead of the News

Someone bet big time against JPM today, with over 13,000 put contracts traded in the May 41’s (WEEKLIES), 10,000 contracts more than any call contract. Suspicious to say the least. If the news was leaked, this would help shed light as to why the market sold off hard during the final hour of trade and was weak all day, despite robust trading in Europe.

UPDATE: That trade just returned 10x overnight.

Comments »JPM Took Significant Losses in its Synthetic Credit Portfolio

London Whale: Since March 31, 2012, CIO has had significant mark-to-marketlosses in its synthetic credit portfolio, and this portfolio has proven to be riskier, more volatile and less effective as an economic hedge than the Firm previously believed.

More from the filing: The Firm is currently repositioning CIO’s synthetic creditportfolio, which it is doing in conjunction with its assessment of the Firm’s overall credit exposure. As this repositioning is beingeffected in a manner designed to maximize economic value,CIO may hold certain of its current synthetic credit positions for the longer term.

More from the filing: The Firm is currently repositioning CIO’s synthetic creditportfolio, which it is doing in conjunction with its assessment of the Firm’s overall credit exposure. As this repositioning is beingeffected in a manner designed to maximize economic value,CIO may hold certain of its current synthetic credit positions for the longer term.

Those comments are likely what we are looking at for this conference call. Jamie Dimon scoffed at all the media stories about the bank’s Chief Investment Office, which the media dubbed the London Whale, during the quarterly results, calling it a “complete tempest in a teapot.” Looks like that might have been overstated.

Source: WSJ

Comments »FLASH: $JPM TO HOLD CONFERENCE CALL AT 5:00 REGARDING POSSIBLE CREDIT RATING DOWNGRADE

JPMorgan Chase- 10-Q comment on impact from potential Moody’s downgrade

On February 15, 2012, Moody’s announced that it had placed 17 banks and securities firms with global capital markets operations on review for possible downgrade, including JPMorgan Chase. As part of this announcement, the long-term ratings of the Firm and its major operating entities were placed on review for possible downgrade, while all of the Firm’s short-term ratings were affirmed. If the Firm’s senior long-term debt ratings were downgraded by one notch or two notches, the Firm believes its cost of funds would increase; however, the Firm’s ability to fund itself would not be materially adversely impacted. JPMorgan Chase’s unsecured debt does not contain requirements that would call for an acceleration of payments, maturities or changes in the structure of the existing debt, provide any limitations on future borrowings or require additional collateral, based on unfavorable changes in the Firm’s credit ratings, financial ratios, earnings, or stock price.

Mortgage Rates Make Another Record Low

NEW YORK (CNNMoney) — Mortgage interest rates hit new lows this week as both the 30-year and the 15-year fixed-rates fell, according to a weekly survey by Freddie Mac. It was the second consecutive week that rates broke records.

The 30-year, the most popular mortgage product, fell by 0.01 percentage points to 3.83%. Last year at this time, it stood at 4.63%. The new lows can save borrowers $46 a month for every $100,000 borrowed. Over a 30-year term that comes to more than $16,000.

The 15-year fixed dropped by 0.02 percentage points to 3.03%, lowering borrowing costs to $692 a month for every $100,000 borrowed, a $38 savings compared with a year earlier. Borrowers would pay out only $24,565 in interest over the life of the loan.

Rates are tracking the downward trend in Treasury yields, according to Frank Nothaft, Freddie’s chief economist, which have fallen in response to election results in Europe and a weaker than expected U.S. employment report.

Read more here:

Comments »Japan Dumps Gold Faster Than it Can Be Absorbed

Merkel is Absolutely Opposed to Debt Growth

“Chancellor Angela Merkel rejected calls from her center-left opponents in Germany and Europe for economic stimulus policies that rely on new debt, warning parliament on Thursday that “growth on credit” would just tip Europe deeper into crisis.”

Comments »The China Wealth Fund Has Stopped Buying European Debt for Obvious Reasons

Turmoil rules the world causing China’s wealth fund to stop purchasing debt for the moment.

Comments »Bad News for England: BOE Halts Stimulus as Inflation Threat Outweighs Slump

As if things were not tough enough in England. Now all they have left is austerity. Not a wise move in a deflationary slow growth environment.

Comments »FLASH: EFSF to Pay out 5.2bn Euro Tranche Aid to Greece

FLASH: SPANISH AND ITALIAN SOVEREIGN YIELDS SOAR

The Central Bank of Poland Raises Rates Unexpectedly to Fight Inflation

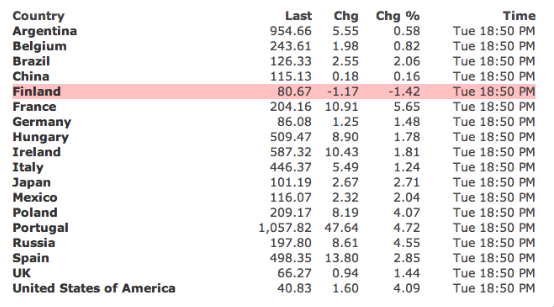

Sovereign CDS Spreads Rise Across the Board

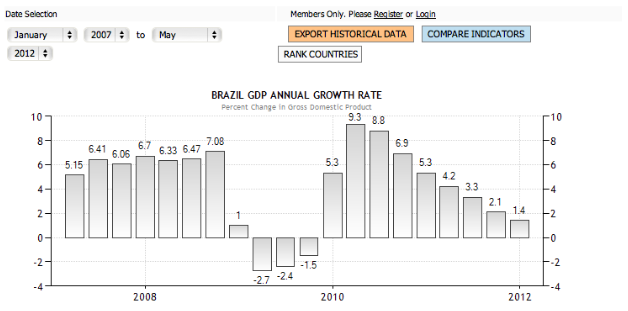

The B in BRIC Sucks Dick: Brazilian Borrowing Costs Slightly Better than Pakistan.

Brazilian borrowing costs are slightly better than that of Pakistan, 3rd worst of all developed nations.

Oh, and their GDP sucks too.

Comments »FLASH: The Chairman of GMCR Just Got Margin Called the Fuck Out of His Company

These changes are the result of the actions taken by the Board to address stock sales by Mr. Stiller’s and Mr. Davis’ brokerage firm, which sales were inconsistent with the Company’s internal trading policies. Specifically, Mr. Stiller and Mr. Davis had margin call-related stock sales totaling 5.548 million shares, reflected in Form 4 filings filed with the Securities and Exchange Commission today. These forced sales were related to margin loans, which were secured by pledges of Mr. Stiller’s and Mr. Davis’ GMCR stock and triggered by recent GMCR stock price activity.

Comments »

Moody’s: Half of Brazilian Companies Remain Exposed To Liquidity Risks

Sao Paulo, May 07, 2012 — While corporate liquidity in Brazil has improved modestly over the last year, practices continue to lag global standard and companies remain more reliant on banking relationships rather than the international capital markets when compared to Mexico and the U.S., says a new special comment by Moody’s Investors Service.

“Market improvement over the past year allowed a number of companies to tap the capital markets and extend debt maturities,” said Filippe Goossens, a Moody’s Senior Vice President and an author of the report.

Moody’s concluded that 59% of the 39-rated companies—excluding homebuilders— have adequate or good liquidity, compared to the 81% observed in Mexico. Moody’s defines the degree of liquidity risk by considering each company’s cash needs to fund debt maturities from December 31, 2011 until December 31, 2013 against available cash sources.

Brazilian companies remain exposed to varied liquidity risks including potential credit market disruptions, the ongoing sovereign crisis in Europe, a potential hard landing in China, the fragile global economy and foreign exchange volatility, says Moody’s.

Companies in Brazil often rely heavily on bank financing and government-owned financial institutions, although few companies have committed bank lines of credit. Moody’s notes that this is a common practice in Latin America as companies prefer to maintain high cash balances to cover upcoming maturities and retain flexibility. Foreign exchange volatility also remains a key issue for companies with high levels of foreign currency denominated debt.

Read here:

Comments »Gold Dips to $1600 As China Imports Surge 587%

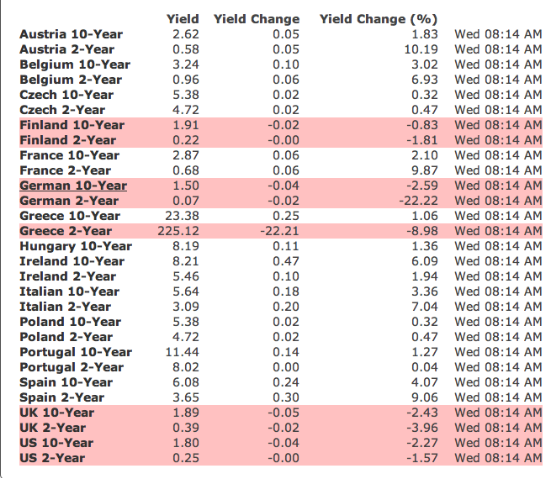

FLASH: EUROPEAN SOVEREIGN BOND YIELDS DECLINE, DESPITE RISK-OFF MODE

It’s worth noting, the bearish sentiment has not resulted in higher borrowing costs in Europe this morning.

Comments »