Portugal received money last year and is currently distributing another tranche to the markets while implementing austerity. The austerity measures caused the government to give gloomy guidance.

Comments »The Prime Minister of Spain Called on Merkel to Act Decisively on New Debt Resolutions

“Spanish Prime Minister Mariano Rajoy ratcheted up pressure on German Chancellor Angela Merkel to back new ideas for a resolution of the debt crisis as he urged European leaders to bolster efforts to protect banks.

With markets bracing for further deterioration in Spain’s finance sector and a possible Greek departure from the 17-member euro area, Rajoy on June 2 added his voice to calls for a more robust “banking union” in Europe, lending his support for a centralized system to re-capitalize lenders. On the same day, Merkel toughened her opposition to euro-area debt sharing, telling members of her party in Berlin that “under no circumstances” would she agree to German-backed euro bonds.”

Comments »Citigroup Study: Banks Buying “Sovereign Debt” Causing Financial Crisis

“According to Citigroup, US and European regulations force banks to purchase government debt; which will only lead to the debt crisis worsening.

Citigroup conducted a study that showed regulators mandate banks to buy government debt against internal capital requirements. Yet other rules facilitate the stability of the government bonds market.

In this scenario, the government issues more debt that ultimately will result in the economic destruction of governments. While they are unable to produce bond payments, this leaves banks with the unfortunate reality of billions of dollars of “toxic debt” Hans Larenzen, Citigroup strategist claims.”

Comments »BoE Considering a 50 Billion Sterling Stimulus Program

The bank of England stated that they are considering a stimulus package; in other words it is a matter of when not if.

Comments »Merkel Still Rejects EU Debt Issuance

While the ESM fund is to come on line again in July; for the moment Merkel is rejecting any kind of joint debt issuance by the EU nations.

Under ‘no circumstances’ Germany will not support Euor backed bonds.

Comments »Documentary : Vox Populi – Methods of Manipulation

When i was a young pleb i would watch episodes of M*A*S*H* waiting for my mom to get home from work. Any way, the cast became a pseudo group of surrogate parents and i would take lots of lessons to heart. The show was well written and witty.

I remember a saying from the show: “in order to understand what it means to be sane, one must be a little insane. You have to cross the line of sanity to know where it is.”

That is how i view this weeks documentary. There is good historical information to learn for those who are not up to speed with the gentlemanly knowledge that flies around these here interwebs. But some of you will say a tin foil hat will be needed to listen to these outrageous claims. I think that description is a way for people to deal with the world.

Put something in a box, label it, and you’ll always know how to deal with it. Bad philosophy imo. Once you do that, you leave it alone and never really examine it. Therefore if it changes you do not recognize it.

So call me what ever you like, but i enjoy exploring the outrageous and then going on a fact finding mission to discover how outrageous those claims are or not.

Cheers on your weekend !

[youtube://http://www.youtube.com/watch?v=HqrdHLzvIV4 450 300]Megan ‘Verb’ Kargher are proud to present Vox Populi, Methods of Manipulation. It has become increasingly evident that large portions of the planet are descending with alarming speed into Orwellian police states. What is the New World Order and what are their plans for mankind? How can we stop the corruption now? Join me as I travel in search of what is really going on in the world in which we live. Featuring interviews with David Icke, Max Igan, Freeman, Jordan Maxwell, Dr. George Rhodes, Ben Stewart and Charlie Veitch.

[youtube://http://www.youtube.com/watch?v=Zz5jIxzneMA 450 300] Comments »Has Central Bank Strategy Now Become a Time Bomb ?

We walk a line of many unknowns in today’s world; we can only hope central banks know what they are doing.

Comments »A Case Study of Greece and Portugal: Austerity Does Not Work, Full Stop.

Austerity does not work in desperate economic times. You must trim back during a boom.

[youtube://http://www.youtube.com/watch?v=14ZIGJTF7vk&feature=fvst 450 300] Comments »Brazil Cuts Interest Rates to Record Low and Stands at the Ready to Do More on Global Weakness

Rockefellers and Rothschilds Unite

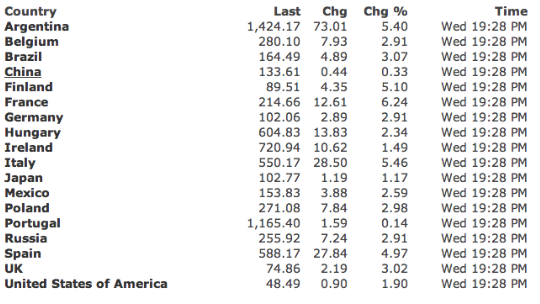

Global CDS Spreads Widen Considerably

DEFLATION SCARE: Turmoil Has Led to Dollar Scarcity

“The pool of high-rated assets has been shrinking, not just in the euro zone but elsewhere as well,” Ian Stannard, Morgan Stanley’s head of Europe currency strategy, said in a May 22 telephone interview. “With the core of Europe shrinking, and the available assets for reserve purposes shrinking, it makes the euro zone less attractive.”

Comments »Former Spanish PM: ‘WE’RE IN A SITUATION OF TOTAL EMERGENCY’

It really is all about Spain.

“We’re in a situation of total emergency, the worst crisis we have ever lived through” said ex-premier Felipe Gonzalez, the country’s elder statesman.

The warning came as the yields on Spanish 10-year bonds spiked to 6.7pc, pushing the “risk premium” over German Bunds to a post-euro high of 540 basis points. The IBEX index of stocks in Madrid fell 2.6pc, the lowest since the dotcom bust in 2003.

The buzz is that Greece is an afterthought and that the Euro either lives or dies based on the immediate response to Spain.

The EU Gives Spain Some Time and Monetary Crumbs

Being touted as lifelines the EU will give Spain more time to work out its deficit problems and direct aid from its euro zone rescue fund.

This is more of the same attitude we have seen in the past. Giving time to work out an over blown deficit when your already in the whole is a non event. Will Spain impose austerity ? Can they impose enough to make a difference ? More likely this is a move to make Germany not look like the bad guy.

Finally the direct support from the EU rescue funds is what we have seen all along and have we a success in the PIIGS ?

Comments »Consumers Move Back to Credit

A hopeful trend of debit card use over credit has now reversed according to the latest 8k filing by Visa-$V.

Comments »EU Summit Produces Too Little Too Late

Details emerging out of an EU summit have disappointed equity markets as the EU would rather apply direct aid and use bond creation as an anti dote. The world wants a fire wall and a colossal amount of fire power through bond issuance to stem the problems.

Worries of a $LEH style failure are now on the table as the world does not trust the EU to respond quickly enough to put out fires and contain possible contagion.

Comments »ACK, ACK: Markets Tumble on 15 Hour Old News, Regarding Tepid Chinese Stimulus

This is bullshit. Someone is trying to fuck with people here. I’d ignore the “crisis” reaction in Asian trade tonight. The Heng Seng went “ex-dividend”, which is exaggerating the move lower.

Comments »“The Chinese government’s intention is very clear: it will not roll out another massive stimulus plan to seek high economic growth,” Xinhua said in the seventh paragraph of a Chinese- language article on economic policy. “The current efforts for stabilizing growth will not repeat the old way of three years ago.”

Premier Wen Jiabao’s call last week to focus more on boosting economic growth has spurred speculation the nation will step up measures to boost expansion that’s set to slow for a sixth straight quarter. Economists at Credit Suisse Group AG and Standard Chartered Plc said yesterday that stimulus is likely to be smaller than the 4 trillion yuan ($630 billion at today’s exchange rate) package announced in 2008.

Credit Suisse economists said spending on investment will probably range from 1 trillion yuan to 2 trillion yuan. Standard Chartered said China is starting a “mini-me” version of the prior stimulus.

On Derivatives: Should We Worry or Just Ignore The Cries of Wolf ?

I say regulation and full transparency is needed. Those institutions that play in the market above and beyond the basic hedge should have a separate business division tht can potentially win big or lose big without hurting the institution or the tax payers.

Comments »Spain Will Issue New Bonds to Bolster Bankia

“MADRID (Reuters) – Spain, battling a debt crisis that is shaking itsgovernment, banks and companies, will soon issue new bonds to fund ailing lenders and indebted regions despite borrowing costs nearing the 7 percent level that drove other states to seek a bailout.

The move will dent the country’s strong liquidity position and further worsen public finances under scrutiny from investors and European officials who fear the euro zone’s fourth economy may go the same way as Greece, Portugal and Ireland.”

Comments »WSJ: Half of US Households Receive Government Aid

The number would be higher if Sole props and LLCs were able to get some assistance. Not good America.

Comments »