It certainly looks like a dark cloud hovers over all dictators.

Comments »FLASH: World Indices Start 2012 With a Pop

Asian markets are up 1-2% tonight, following a very strong European session.

Comments »2011’s Worst Performing ETF’s

No. Ticker YTD Return

2 TMV -68.51

3 INDL -67.21

4 SBND -65.58

5 KWT -64.77

6 LBJ -63.90

7 TAN -63.11

8 EDC -62.93

9 YINN -62.51

10 ZSL -60.44

11 URA -60.33

12 DRV -57.85

13 DZK -53.18

14 FAS -52.87

15 GAZ -52.80

16 EGPT -51.76

17 TVIX -51.50

18 TBT -51.30

19 NUGT -50.74

20 ERY -50.38

21 PBW -50.29

22 SOXL -47.33

23 BRIL -46.81

24 BDD -46.60

25 AGQ -46.36

26 UNG -45.91

27 XIV -45.02

28 TZA -44.76

29 IFN -44.34

30 SRTY -44.29

31 ICLN -44.09

32 GEX -43.89

33 VNM -43.51

34 IIF -43.47

35 EET -41.73

36 QCLN -41.60

37 TRF -40.50

38 EPI -40.49

39 DLBS -40.38

40 TYO -40.12

41 INP -39.96

42 PBD -39.65

43 GRR -38.87

44 DTYS -38.49

45 PXN -38.32

46 XPP -37.84

47 SQQQ -37.49

48 SDP -37.00

49 LIT -36.81

50 TNA -36.53

2011’s Best Performing ETF’s

No. Ticker YTD Return

1 LBND 119.94

2 TMF 107.63

3 INDZ 76.64

4 UBT 72.43

5 ZROZ 60.45

6 EDV 55.60

7 DTYL 44.56

8 TYD 43.37

9 DLBL 42.87

10 UPW 35.37

11 TLT 34.05

12 NUC 28.71

13 MUE 28.07

14 FLAT 27.10

15 PDT 26.85

16 BZQ 25.17

17 HPI 25.12

18 BAF 25.10

19 HTD 24.86

20 BLE 24.73

21 BTA 24.63

22 BKN 24.55

23 BBF 24.07

24 LEO 23.86

25 BIE 23.42

26 BBK 23.14

27 BFZ 23.12

28 DSM 22.98

29 AFB 22.55

30 HPF 22.44

31 NIO 22.00

32 MUC 21.92

33 TLH 21.81

34 MFL 21.73

35 EVY 21.72

36 MYI 21.56

37 BBH 21.55

38 BLV 21.41

39 IHE 21.39

40 NPI 21.17

41 MUH 21.13

42 VGM 21.13

43 PMO 21.03

44 NPP 20.71

45 FCO 20.70

46 XAA 20.55

47 VKQ 20.47

48 EIM 20.41

49 PJP 20.40

50 NEV 20.37

2011’s Top 100 Losers

Min mkt cap: $500 mill

No. Ticker YTD Return Market Cap

1 IRE -83.90 600,870,000

2 ITT -80.98 1,840,000,000

3 DNDN -78.47 1,200,000,000

4 NBG -76.19 2,340,000,000

5 RIMM -75.18 9,670,000,000

6 MTOR -74.17 594,350,000

7 FSLR -74.13 4,110,000,000

8 TSL -71.18 556,480,000

9 MTL -70.99 4,570,000,000

10 HGSI -69.36 1,490,000,000

11 XUE -68.94 518,170,000

12 RLD -68.36 560,290,000

13 GFA -67.72 1,360,000,000

14 CREE -66.49 2,790,000,000

15 MWW -66.46 887,440,000

16 WFR -65.90 961,040,000

17 ANR -65.75 4,580,000,000

18 ITMN -65.44 1,210,000,000

19 AIXG -65.11 1,230,000,000

20 GSS -64.71 535,350,000

21 FST -64.42 1,740,000,000

22 DNN -64.04 507,750,000

23 MTG -63.98 621,620,000

24 DRYS -63.84 873,960,000

25 VQ -63.36 525,370,000

26 RMBS -62.65 873,090,000

27 EXH -62.53 719,630,000

28 YGE -62.15 716,620,000

29 LYG -62.04 25,970,000,000

30 CECO -61.75 523,390,000

31 GGAL -60.92 876,430,000

32 ODP -60.65 622,640,000

33 CTCM -60.47 1,450,000,000

34 NFLX -60.46 3,530,000,000

35 ROVI -60.33 3,020,000,000

36 VE -60.14 6,410,000,000

37 CODE -59.61 503,950,000

38 CPF -58.79 532,720,000

39 BAC -58.62 51,490,000,000

40 OVTI -58.56 683,130,000

41 UXG -58.55 553,420,000

42 NAK -58.43 660,080,000

43 ATE -58.36 1,950,000,000

44 LOGI -58.17 1,400,000,000

45 BMA -58.15 1,130,000,000

46 TQNT -58.00 761,320,000

47 CRIC -57.81 667,740,000

48 AUO -57.75 3,990,000,000

49 ACI -57.70 3,090,000,000

50 SLT -57.48 27,430,000,000

51 GLE.PA -57.22 12,380,000,000

52 GOL -56.50 2,140,000,000

53 PCX -56.43 913,290,000

54 TEX -56.35 1,790,000,000

55 NKTR -56.26 562,980,000

56 DRIV -56.25 579,810,000

57 SHLD -56.14 6,140,000,000

58 TX -55.57 3,280,000,000

59 CRWN -55.34 517,930,000

60 PWRD -55.26 506,850,000

61 X -54.88 3,920,000,000

62 CCJ -54.72 6,900,000,000

63 WMS -54.66 1,130,000,000

64 PHH -54.47 864,300,000

65 DLB -54.44 3,390,000,000

66 YOKU -54.30 2,200,000,000

67 MDAS -54.14 564,340,000

68 KWK -54.07 1,390,000,000

69 BPOP -53.98 1,470,000,000

70 HL -53.74 1,740,000,000

71 BFR -53.71 935,960,000

72 GHL -53.70 1,100,000,000

73 CYD -53.57 522,110,000

74 NMR -53.45 11,900,000,000

75 AWC -53.39 3,230,000,000

76 CYH -53.30 1,640,000,000

77 PTNR -53.19 1,480,000,000

78 TC -53.13 1,240,000,000

79 ASIA -53.05 614,370,000

80 SFL -52.70 788,880,000

81 ACH -52.53 6,220,000,000

82 AEM -52.36 6,960,000,000

83 NIHD -52.33 3,890,000,000

84 SSRI -52.27 1,180,000,000

85 WLT -52.26 4,500,000,000

86 ACA.PA -52.14 10,080,000,000

87 NAT -52.08 562,370,000

88 VECO -51.91 973,350,000

89 ILMN -51.82 3,390,000,000

90 ICA -51.76 802,260,000

91 HDY -51.61 585,100,000

92 MCP -51.60 2,590,000,000

93 AIG -51.57 40,130,000,000

94 GTY -51.40 507,920,000

95 NKA -51.37 658,370,000

96 PZE -51.25 1,310,000,000

97 SWC -51.15 1,240,000,000

98 TGA -51.10 578,360,000

99 CSC -50.81 3,610,000,000

100 NUVA -50.64 580,860,00

2011’s Top 100 Winners

Min mkt cap: $500 mill

No. Ticker YTD Return Market Cap

1 VRUS 477.96 9,770,000,000

2 SIMO 381.88 600,910,000

3 INHX 324.62 1,070,000,000

4 MDVN 207.12 1,610,000,000

5 GLNG 206.02 3,430,000,000

6 QCOR 186.63 2,730,000,000

7 LQDT 163.63 975,720,000

8 PCYC 146.88 1,030,000,000

9 ARIA 141.08 1,550,000,000

10 SCSS 140.42 1,010,000,000

11 ELN 137.17 6,350,000,000

12 RGR 124.87 579,140,000

13 SPPI 114.70 810,680,000

14 DPZ 114.61 1,930,000,000

15 HS 105.62 3,660,000,000

16 COG 103.47 8,680,000,000

17 JAZZ 97.15 1,630,000,000

18 EP 93.74 19,310,000,000

19 ABMD 93.44 714,620,000

20 RRR 91.48 1,270,000,000

21 ULTA 90.79 4,200,000,000

22 MG 89.24 642,090,000

23 PSMT 86.11 2,000,000,000

24 CBST 85.75 2,270,000,000

25 BGS 83.81 1,020,000,000

26 AKRX 83.69 980,990,000

27 OXM 81.75 605,600,000

28 WPRT 81.05 1,410,000,000

29 ISRG 80.73 16,990,000,000

30 RNOW 80.65 1,420,000,000

31 SUG 78.50 5,160,000,000

32 HANS 77.05 8,020,000,000

33 RENN 76.53 1,480,000,000

34 EVEP 75.77 2,310,000,000

35 WCG 75.25 2,440,000,000

36 GNRC 74.95 1,680,000,000

37 ASPS 74.92 1,110,000,000

38 REGN 71.28 5,480,000,000

39 ZOLL 70.88 997,230,000

40 TNH 70.49 3,000,000,000

41 SONO 70.38 575,500,000

42 BTH 69.37 516,760,000

43 VHC 69.16 983,190,000

44 MA 67.49 48,350,000,000

45 GCO 66.90 1,380,000,000

46 MAKO 66.89 1,250,000,000

47 NEU 65.63 2,640,000,000

48 BIIB 65.32 26,820,000,000

49 LOOP 65.08 740,680,000

50 VRX 64.83 14,090,000,000

51 RDEN 63.36 1,050,000,000

52 N 62.92 2,830,000,000

53 NUS 62.77 2,920,000,000

54 BKI 62.76 1,180,000,000

55 HUM 62.65 14,560,000,000

56 ELGX 62.52 659,410,000

57 OKE 62.11 8,570,000,000

58 HPY 61.15 881,630,000

59 DK 60.88 635,280,000

60 HGIC 60.54 1,600,000,000

61 VPHM 59.93 1,680,000,000

62 GTLS 59.80 1,800,000,000

63 PKD 59.74 803,270,000

64 CMG 59.70 9,790,000,000

65 PRIM 59.58 721,460,000

66 APL 59.07 1,810,000,000

67 LNG 58.33 790,240,000

68 NETL 57.88 3,430,000,000

69 TRLG 57.86 866,490,000

70 LAD 57.74 600,710,000

71 HITK 57.47 529,600,000

72 CNC 57.46 1,860,000,000

73 DISH 57.23 10,710,000,000

74 TRGP 56.60 1,490,000,000

75 DFG 56.56 1,440,000,000

76 NR 56.49 826,620,000

77 EDMC 56.08 2,870,000,000

78 FEIC 55.85 1,520,000,000

79 FICO 55.67 1,280,000,000

80 BWLD 55.62 1,170,000,000

81 CFX 55.40 1,280,000,000

82 CATM 55.37 1,110,000,000

83 PRGO 55.21 9,050,000,000

84 ABCO 55.13 1,150,000,000

85 HLF 54.87 6,500,000,000

86 RLI 53.81 1,440,000,000

87 AIRM 53.15 941,280,000

88 VFC 52.87 15,240,000,000

89 ROST 52.59 10,360,000,000

90 OKS 52.50 10,470,000,000

91 TIN 52.38 3,490,000,000

92 SIX 52.22 2,160,000,000

93 PEET 52.16 755,710,000

94 OCN 52.10 1,360,000,000

95 REV 51.63 806,230,000

96 CLH 51.59 3,160,000,000

97 CVLT 50.91 2,070,000,000

98 CPHD 50.64 2,070,000,000

99 HOS 50.14 915,210,000

100 DLTR 49.93 9,490,000,000

North Korea Got Busted Altering a Stupid Funeral Photograph

This is beyond stupid. However, it is important to N. Korea for reasons unbeknownst to me.

Comments »Worst Performers Over Past Month

min mkt cap: $1 bill

No. Ticker 1-month Return Market Cap

1 SHLD -41.67 6,140,000,000

2 ITMN -31.91 1,210,000,000

3 FSLR -27.44 4,110,000,000

4 EXPE -27.28 7,480,000,000

5 NG -25.21 2,670,000,000

6 DECK -23.83 4,050,000,000

7 MCP -23.61 2,590,000,000

8 INHX -22.19 1,070,000,000

9 GTE -21.90 1,730,000,000

10 GFA -21.02 1,360,000,000

11 EGO -20.76 10,030,000,000

12 GIL -18.96 1,990,000,000

13 RIMM -17.79 9,670,000,000

14 BBY -17.70 10,090,000,000

15 AUQ -17.53 2,750,000,000

16 VIP -17.14 19,130,000,000

17 IAG -17.12 7,670,000,000

18 NBG -16.87 2,340,000,000

19 PAY -16.19 4,600,000,000

20 MTL -16.12 4,570,000,000

21 LPS -15.79 1,600,000,000

22 SVM -15.28 1,320,000,000

23 EXK -15.27 1,030,000,000

24 SINA -15.16 4,380,000,000

25 KGC -14.92 15,890,000,000

FLASH: Crack Spreads Jump 5%

To $15.30

Comments »Florida Sucks: Marine Shot Three Times After Meeting Prospective Buyer Via Craigslist

Year to Date Returns of Canadian Stocks Listed in US, 2011

No. Ticker YTD Return Country

1 CXZ -85.32 CN

2 CSIQ -78.61 CN

3 MGH -76.56 CN

4 ANO -76.09 CN

5 RIMM -75.26 CN

6 URG -70.90 CN

7 GBG -69.15 CN

8 EGI -67.34 CN

9 PLG -66.81 CN

10 CRME -66.67 CN

11 GSS -65.14 CN

12 KFS -64.41 CN

13 IVAN -64.34 CN

14 DNN -64.04 CN

15 PAL -63.40 CN

16 THM -60.48 CN

17 NAK -60.32 CN

18 KGN -59.27 CN

19 XRA -58.78 CN

20 DRWI -57.94 CN

21 CDY -57.39 CN

22 BQI -57.38 CN

23 PLM -56.90 CN

24 CCJ -56.42 CN

25 AAU -55.60 CN

26 SSRI -54.36 CN

27 BRD -54.29 CN

28 SWIR -54.02 CN

29 TC -54.01 CN

30 AEM -53.18 CN

31 TGB -52.19 CN

32 TGA -51.10 CN

33 PAAS -48.88 CN

34 MVG -48.79 CN

35 PZG -47.87 CN

36 SA -46.68 CN

37 MITL -45.65 CN

38 NOA -45.35 CN

39 ONCY -44.78 CN

40 TLM -44.68 CN

41 TCK -43.27 CN

42 NG -42.96 CN

43 AAV -41.18 CN

44 RBY -39.75 CN

45 KGC -39.72 CN

46 CGR -38.81 CN

47 MFC -38.03 CN

48 STKL -37.72 CN

49 SLF -37.44 CN

50 UPL -37.26 CN

51 MGA -35.44 CN

52 YMI -35.19 CN

53 ECA -35.08 CN

54 AZK -34.84 CN

55 GIL -33.33 CN

56 LMLP -32.95 CN

57 NXY -32.64 CN

58 IMAX -31.42 CN

59 COT -30.19 CN

60 EQU -29.64 CN

61 KBX -29.50 CN

62 NSU -27.64 CN

63 SLW -27.53 CN

64 EGO -27.50 CN

65 SOQ -26.59 CN

66 AGU -26.30 CN

67 MEOH -26.07 CN

68 SU -25.75 CN

69 BLDP -25.33 CN

70 IVN -23.69 CN

71 AXU -23.44 CN

72 CLS -23.40 CN

73 AZC -21.52 CN

74 MDCA -20.98 CN

75 POT -19.35 CN

76 TESO -19.08 CN

77 BIN -18.70 CN

78 CNQ -17.79 CN

79 BAM -17.59 CN

80 EXFO -15.58 CN

81 CAE -15.40 CN

82 ABX -15.39 CN

83 PWE -15.03 CN

84 ERF -13.37 CN

85 JAG -12.90 CN

86 HWD -12.56 CN

87 PGH -12.21 CN

88 AEZS -11.63 CN

89 IAG -11.61 CN

90 BAA -10.95 CN

91 BNS -10.85 CN

92 TAP -10.56 CN

93 RNO -9.94 CN

94 MFN -9.42 CN

95 TPLM -9.38 CN

96 BPO -8.20 CN

97 SJR -5.28 CN

98 GG -4.76 CN

99 RBA -2.74 CN

100 BMO -1.18 CN

101 RY -1.11 CN

102 QLTI -0.68 CN

103 CVE -0.15 CN

104 NGD 0.10 CN

105 CP 1.49 CN

106 TAC 1.49 CN

107 TD 1.56 CN

108 DSGX 2.84 CN

109 P D S 6.60 CN

110 UFS 7.15 CN

111 IMO 7.20 CN

112 GTU 8.00 CN

113 GIB 8.05 CN

114 OTEX 9.03 CN

115 RCI 13.94 CN

116 NYMX 14.49 CN

117 AUY 14.50 CN

118 TRP 15.97 CN

119 CNI 17.39 CN

120 MIM 20.55 CN

121 BCE 20.77 CN

122 BTE 22.29 CN

123 LGF 23.35 CN

124 VGZ 25.10 CN

125 EXK 25.61 CN

126 TU 26.87 CN

127 PVX 29.22 CN

128 SXCI 31.82 CN

129 ENB 35.54 CN

130 LULU 39.26 CN

131 DEJ 57.81 CN

132 CRYP 66.67 CN

133 WPRT 79.48 CN

134 RIC 100.00 CN

135 MDW 155.95 CN

Year to Date Returns of Chinese Stocks Listed in US, 2011

No. Ticker YTD Return Country

1 HEAT -94.09 CI

2 RCON -93.75 CI

3 NEWN -91.84 CI

4 CIS -89.21 CI

5 FEED -86.76 CI

6 CSUN -86.36 CI

7 CHGS -85.23 CI

8 SCEI -85.02 CI

9 SHZ -84.40 CI

10 DQ -83.91 CI

11 CSKI -83.86 CI

12 SIHI -82.77 CI

13 SOL -82.38 CI

14 JASO -81.36 CI

15 BSPM -79.79 CI

16 COGO -79.66 CI

17 CTDC -78.35 CI

18 OINK -77.92 CI

19 CPHI -77.79 CI

20 XING -77.65 CI

21 GU -77.48 CI

22 SEED -76.34 CI

23 TPI -76.11 CI

24 ADY -75.85 CI

25 JRJC -75.65 CI

26 CAAS -75.04 CI

27 DHRM -74.75 CI

28 CMED -74.64 CI

29 STP -74.41 CI

30 AOB -73.79 CI

31 VIT -73.54 CI

32 VISN -72.84 CI

33 EJ -71.76 CI

34 TSL -70.96 CI

35 BORN -70.58 CI

36 HSFT -69.64 CI

37 WH -65.67 CI

38 FFHL -64.49 CI

39 CHLN -64.23 CI

40 GSI -63.41 CI

41 CBAK -62.18 CI

42 YGE -62.15 CI

43 CISG -61.36 CI

44 SPU -60.65 CI

45 VIMC -60.05 CI

46 DEER -59.05 CI

47 TSTC -58.19 CI

48 TRIT -58.09 CI

49 NPD -57.70 CI

50 CNTF -57.62 CI

51 YONG -56.31 CI

52 LDK -54.65 CI

53 HOLI -53.69 CI

54 ACH -53.32 CI

55 PWRD -53.28 CI

56 ASIA -52.93 CI

57 SUTR -50.46 CI

58 AMCN -49.49 CI

59 SVA -47.35 CI

60 EDS -46.00 CI

61 YTEC -44.75 CI

62 CO -44.53 CI

63 GRO -43.75 CI

64 KONG -43.58 CI

65 CTRP -43.36 CI

66 LFC -39.56 CI

67 GAME -39.19 CI

68 AMAP -38.30 CI

69 HTHT -37.33 CI

70 HMIN -36.79 CI

71 CBPO -35.81 CI

72 LONG -34.14 CI

73 SHI -33.08 CI

74 SSRX -32.87 CI

75 YZC -31.03 CI

76 SCR -30.67 CI

77 CEA -30.49 CI

78 XIN -29.88 CI

79 KNDI -26.76 CI

80 JST -21.44 CI

81 KH -21.18 CI

82 GRRF -21.07 CI

83 CYOU -20.80 CI

84 SOHU -20.76 CI

85 CHRM -18.05 CI

86 ZNH -17.44 CI

87 LTON -16.98 CI

88 NINE -15.07 CI

89 ACTS -14.42 CI

90 JOBS -13.16 CI

91 EDU -9.73 CI

92 FMCN -9.21 CI

93 GSH -8.73 CI

94 NED -8.02 CI

95 GA -6.76 CI

96 NCTY -4.45 CI

97 CXDC -3.13 CI

98 PTR -2.80 CI

99 MR -2.03 CI

100 SNDA 1.14 CI

101 ATV 1.66 CI

102 HNP 3.06 CI

103 CHA 9.71 CI

104 SNP 14.53 CI

105 SPRD 15.00 CI

106 SSW 15.40 CI

107 BIDU 21.50 CI

108 NTES 23.10 CI

109 ATAI 119.18 CI

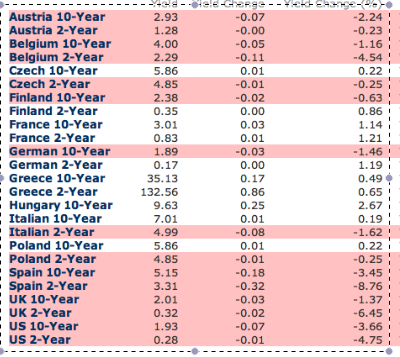

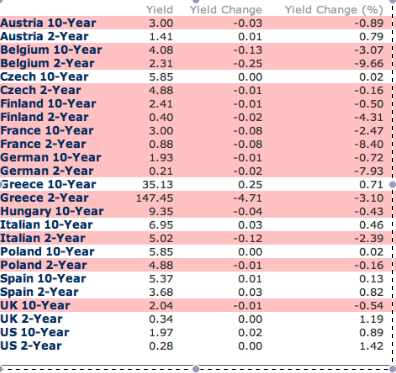

European Sovereign Yields Mostly Unchanged, Despite Equity Weakness

Chinese Blogger Gets 10 Years in Prison for “Subversion”

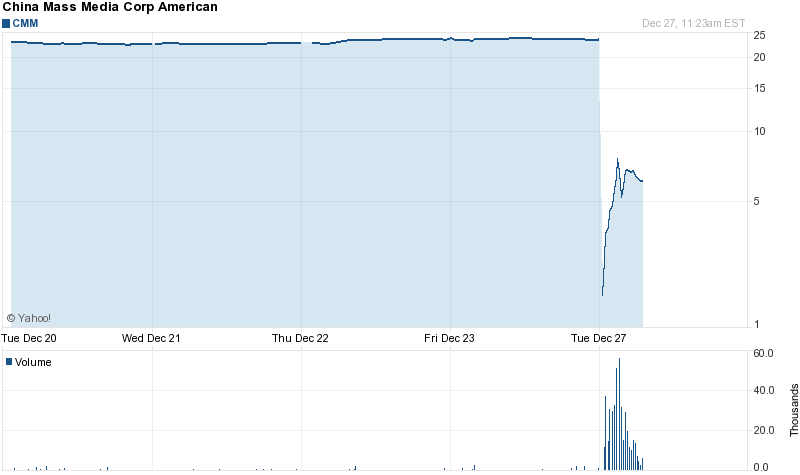

China Mass Media Corp (CMM) is Fully Idiotic

The company paid almost $23 in a special dividend to shareholders today. But then people started to sell and panic out, not knowing about the divvy. Then the insane momo buyers emerged, taking the stock up several hundred percent in minutes. The result is this chart.

Comments »Today’s Biggest Winners

No. Ticker % Change

1 NOA 27.82

2 PNCL 20.48

3 CNAM 18.52

4 SOMX 18.00

5 FFN 16.67

6 DEJ 16.56

7 CTC 16.13

8 MOTR 14.61

9 RMBS 13.80

10 HPOL 13.42

11 ENMD 12.90

12 RCON 12.62

13 SPRT 12.50

14 GGR 11.36

15 GRNB 11.20

16 TRID 11.11

17 SYUT 10.80

18 DDMG 10.50

19 WHRT 10.05

20 NEXS 9.78

21 ACFN 9.65

22 ASTI 9.62

23 EK 9.52

24 FSIN 9.21

25 VLNC 8.82

26 VHC 8.79

27 IVAN 8.60

28 CRED 8.58

29 SATC 8.42

30 DCTH 7.82

31 THQI 7.76

32 THM 7.67

33 TAT 7.41

34 MGN 7.40

35 LEI 7.37

36 JNY 7.25

37 ACRX 7.14

38 RDA 7.08

39 GBE 7.08

40 FTEK 7.05

41 TNCC 6.85

42 OTIV 6.72

43 ZGNX 6.67

44 YZC 6.39

45 SEH 6.37

46 VOXX 6.25

47 TPI 6.14

48 SGI 5.97

49 OPTT 5.96

50 VVUS 5.88

50 Large Cap Stocks Near 52 Week Highs

No. Ticker % From 52 Week High Market Cap

1 XOM 4.42 382,450,000,000

2 RDS-B 3.96 222,140,000,000

3 GSK 0.35 220,220,000,000

4 WMT 0.74 201,910,000,000

5 GOOG 2.02 198,790,000,000

6 CVX 3.28 193,950,000,000

7 PG 2.26 176,300,000,000

8 JNJ 4.16 176,000,000,000

9 PFE 0.41 153,970,000,000

10 KO 3.59 151,790,000,000

11 PM 0.57 131,470,000,000

12 MRK 0.24 108,750,000,000

13 VZ 0.51 106,930,000,000

14 MCD 0.88 97,720,000,000

15 UN 3.87 94,420,000,000

16 UL 4.25 93,290,000,000

17 ABT 0.02 82,640,000,000

18 V 0.96 79,470,000,000

19 KFT 0.63 64,490,000,000

20 HD 0.29 60,580,000,000

21 MO 2.93 58,910,000,000

22 BMY 0.57 53,380,000,000

23 DEO 1.29 51,530,000,000

24 UNP 3.37 49,720,000,000

25 AMGN 0.11 49,210,000,000

26 CVS 0.94 49,050,000,000

27 MA 3.62 48,350,000,000

28 NKE 3.50 44,160,000,000

29 CL 2.58 43,660,000,000

30 LLY 0.19 41,920,000,000

31 EPD 3.43 40,410,000,000

32 SO 0.41 37,790,000,000

33 SPG 1.62 36,140,000,000

34 SBUX 0.99 32,490,000,000

35 TRP 4.46 29,810,000,000

36 BCE 0.26 29,710,000,000

37 EXC 4.64 29,210,000,000

38 D 0.21 28,960,000,000

39 KMB 0.42 28,100,000,000

40 CELG 1.70 27,180,000,000

41 DUK 0.25 26,930,000,000

42 KMP 0.83 26,240,000,000

43 YUM 1.30 25,920,000,000

44 GIS 1.01 25,670,000,000

45 LMT 1.94 25,380,000,000

46 AGN 2.90 24,820,000,000

47 RAI 2.11 24,310,000,000

48 TJX 0.58 23,960,000,000

49 ADP 2.32 23,830,000,000

50 NEE 0.32 23,480,000,000