Sam Poser, the guy who nailed DECK, is very bullish on CROX ahead of numbers, with a $30 target on CROX.

Comments »Monthly Archives: April 2012

Red Tape Wait for Veterans Doubles Under Obama

“The Department of Veterans Affairs is so behind in processing claims and benefits that the waiting list for decisions has doubled since President Barack Obama took office.

Chesapeake Energy, $CHK, Files to Spin Off Subsidiary

“Chesapeake Energy Corp. (NYSE: CHK) will spin-off its wholly-owned oilfield services business into a new company to be called Chesapeake Oilfield Services Inc., which will trade on the NYSE under the stock symbol ‘COS’. The filing indicates that the company hopes to raise $862.5 million from the offering, but the filing does not indicate how many shares will be sold. Underwriters for the offering are Goldman Sachs Group Inc. (NYSE: GS) and Bank of America Corp.’s (NYSE: BAC) Merrill Lynch.

Chesapeake Energy will control the oilfield services business following the spin-off through its ownership of all the new company’s shares of Class B common stock:

Chesapeake will continue to control our business and will be able to control all matters requiring the approval of our shareholders, including the election of directors and the approval of significant corporate transactions.

The S-1 filing shows that services business revenues have doubled from about $650 million in 2009 to $1.3 billion into 2011, and a net loss of about $40.4 million in 2009 is now a net profit of about $19.8 million. That’s a pretty nice turnaround at a time when natural gas prices are at near-record lows.

The filing is available here.”

Comments »

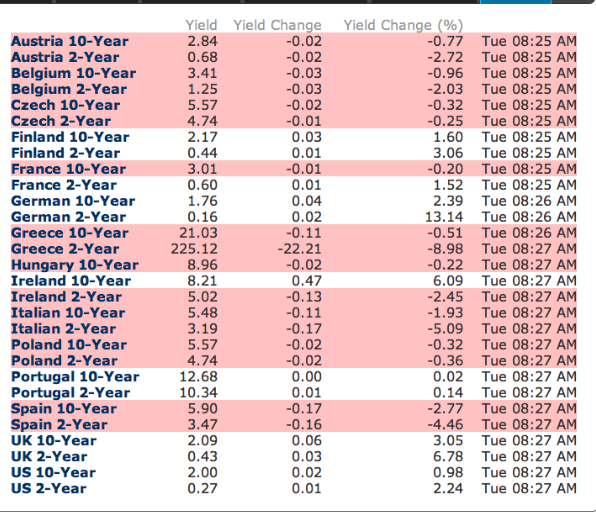

Full Summary of European Sovereign Bond Yields

IMF boosts global growth forecast, with caveat

NEW YORK (CNNMoney) — The outlook for the global economy has improved, but there are still major risks that policymakers need to address, the International Monetary Fund said Tuesday.

The IMF now expects global economic output to increase 3.5% in 2012, according to the latest edition of its World Economic Outlook. In January, the IMF projected a slightly weaker growth rate of 3.3%.

The fund raised its forecast for U.S. economic growth this year to 2.1% from 1.8% in January. But the outlook for Europe remains bleak, with the euro area economy expected to shrink 0.3% this year, according to the IMF.

The debt crisis in Europe and a potential spike in oil prices are the two main risks facing the global economy, the IMF warned.

“The most immediate concern is still that further escalation of the euro area crisis will trigger a much more generalized flight from risk,” the report states.

While officials in Europe have taken steps to contain the crisis, the IMF said more needs to be done to address longer-term economic problems in the eurozone….”

Comments »Spain Won’t Need a Bailout, Eurogroup’s Juncker Says

Fleckenstein: Don’t Judge Economy by Stock Market

“Contrarian investor and fund manager Bill Fleckenstein says looking at the stock market as an indicator that the U.S. economy is doing better than expected is a mistake.

“Were it not for the money-printing going on, I would be looking very seriously at getting short, betting stocks will go down,” Fleckenstein writes for MSN.com.

Obviously, says Fleckenstein, the April 6 employment report was a giant disappointment. But many observers have been all too willing to let the stock market “write the news.”

“By that I mean, as stocks have gone higher, people have changed their opinion about our economic situation, thinking, ‘Gee, the market must be telling us that the economy is better than we thought,’” he says.

“I do think the market is quite vulnerable, for a number of reasons, but obviously there is a rather large, oblivious contingent out there.”

The first half of April has punched holes in the idea that the economy is becoming healthy, either here or abroad, notes Fleckenstein. It also raises the specter of more easy money from the Fed.

The influence of unseasonably warm weather in improving the underlying economy will cease shortly, Fleckenstein says.

“Thus, all the economy bulls, who had concluded that another round of quantitative easing from the Federal Reserve—including the much talked about QE3—is D.O.A. now will be back to contemplating just that,” says Fleckenstein.

“It is really hard to see how the U.S. economy can be all that strong, given the sorry state of Europe and the fact that China is slowing.”

The Associated Press reports that China’s declining economic growth fell to its lowest level in nearly three years in the first quarter.

Meanwhile, foreign direct investment in China dropped for a fifth straight month in March on a slowing economy, limited prospects for gains in the yuan and renewed concerns that Europe’s debt crisis will worsen, Bloomberg reported.”

Comments »Nokia Gets Shunned by European Wireless Carriers

Industrial Production: Prior 0.0%, Market Expects 0.2%, Actual 0.0%

Utilization was 78.6….market ignore data

Comments »Gapping Up and Down This Morning

Gapping up

GMXR +6.3%, NBG +5%, MDAS +4%, BCS +4%, ING +3.6%, DB +3.4%, CS +3%, E +2.7%,

UBS +2.6%, TSL +1.6%, HBC +1.4%, SAP +1.1%, RDS.A +1%, MLNX +1.4%, QCOM +0.4%,

SAP +1.5%, TNK +2.2%, VLO +1.5%, USB +1.2%, MMR +1.1%, CMA +5.3%, ICUI +2%,

FCX +1.8%, NBG +5%, ING +5%, BAC +2.4%, C +1.5%, HBC +1.4%,

Gapping down

ZOOM -14.3%, STWD -4.4%, AMTG -3.3%, EXR -2.4%, TIBX -1.3%, CHOP -4.4% , GS -0.5%, DNN -8.5% ,

KITD -6.2%, AMTG -3.3%, WNC -3.2% , EXR -2.4%, CLS -1.2%,

Comments »Upgrades and Downgrades This Morning

Achillion Pharmaceuticals Inc. (NASDAQ: ACHN) Started as Outperform with $11 target at Credit Suisse.

Apple Inc. (NASDAQ: AAPL) Started as Strong Buy with $800 target at Raymond James (late Monday call).

Boston Scientific Corp. (NYSE: BSX) Reiterated Outperform with $7 target at Credit Suisse.

Celestica Inc. (NYSE: CLS) Cut to Hold at Deutsche Bank.

Citigroup Inc. (NYSE: C) Reiterated Outperform with $48 target at Credit Suisse.

Citi Trends, Inc. (NASDAQ: CTRN) named Bear of the Day at Zacks.

First Solar, Inc. (NASDAQ: FSLR) Cut to Hold at Goldman Sachs.

Hain Celestial Group (NASDAQ: HAIN) named Bull of the Day at Zacks.

Idenix Pharmaceuticals Inc. (NASDAQ: IDIX) Started as Neutral at Credit Suisse.

Infosys Ltd. (NASDAQ: INFY) Cut to Neutral at Goldman Sachs.

Newcastle Investment Corporation (NYSE: NCT) Started as Outperform at Keefe Bruyette & Woods.

SAP AG (NYSE: SAP) Raised to Buy at SocGen; Cut to Neutral at HSBC.

Teekay Tankers Ltd. (NYSE: TNK) Raised to Neutral with new $5.20 target at BofA/ML.

Tiffany & Co. (NYSE: TIF) Started as Neutral at Macquarie.

Valero Energy Corporation (NYSE: VLO) Reiterated Outperform with $37 target at Credit Suisse.

Vertex Pharmaceuticals Inc. (NASDAQ: VRTX) Started as Outperform with $43 target at Credit Suisse.

Comments »TD Ameritrade, $AMTD, Net Drops 20%

“TD Ameritrade Holding Corp.’s AMTD -0.43% fiscal second-quarter earnings slumped 20% as a decline in fees for handling trades weighed on the online brokerage’s revenue.

Chief Financial Officer Bill Gerber called the operating environment during the quarter “difficult,” noting the e-broker managed to improve its revenue from the previous quarter despite near-zero interest rates and low intraday volatility.

Average daily client trades at Ameritrade totaled roughly 388,000 in the latest period, down from a year earlier, although up from the December quarter.

Rising optimism on the state of the global economy helped draw retail investors back to the market in recent months, boosting trading volume at the major e-brokers.

Ameritrade, which has in recent quarters made strides in gathering new assets, reported Tuesday that it added $10.8 billion in net new assets in the latest period, compared with $11.5 billion a year earlier and $10.2 billion in the previous quarter.

For the quarter ended March 31, the company reported a profit of $136.7 million, or 25 cents a share, compared with a year-earlier profit of $171.7 million, or 30 cents a share.

Net revenue fell 6.3% to $673.1 million. Commissions and transactions fees slumped 14% to $292.1 million.

Analysts surveyed by Thomson Reuters expected earnings of 25 cents a share on revenue of $672 million.”

Comments »Housing Starts: Prior 698k, Market Expects 700k, Actual 654k

U.S. Equity Preview: $LNG, $CNX, $DTSI, $EXR, $GS, $KITD, $LNCR, $STWD, & $USB

“Cheniere Energy Inc. (LNG) surged 12 percent to $19.02. The liquefied natural-gas company won federal approval to build the largest U.S. natural-gas export terminal as drillers who extract the fuel from shale formations struggle to find domestic buyers to absorb a glut.

Consol Energy Inc. (CNX) : The fuel producer based in Canonsburg, Pennsylvania suspended coal production forecasts for the second quarter and 2012 until the idled longwalls at the Blacksville and Buchanan mines have been restarted.

DTS Inc. (DTSI) : The maker of decoders used in surround- sound systems agreed to acquireSRS Labs Inc. (SRSL) in a cash-and-stock transaction valued at $9.50 per share, or $148 million.

Extra Space Storage Inc. (EXR) dropped 2.3 percent to $28.23. The operator of self-storage facilities will sell 7 million shares in a public offering. Proceeds will be used to fund acquisitions and repay debt and for general corporate purposes.

Goldman Sachs Group Inc. (GS) declined 2 percent to $115.35. The fifth-biggest U.S. bank by assets reported a 23 percent decline in first-quarter profit.

Kit Digital Inc. (KITD) fell 6.2 percent to $6.70. The provider of software for online video said nonexecutive Chairman Kaleil Isaza Tuzman resigned.

Lincare Holdings Inc. (LNCR) : The Clearwater, Florida- based oxygen supplier reported first-quarter earnings of 54 cents a share, beating the average analyst estimate by 1 cent.

Starwood Property Trust Inc. (STWD) decreased 3 percent to $20.30. The real estate investment company will sell 20 million shares in a public offering. Proceeds from the sale will be used to originate and purchase commercial mortgage loans and other assets, and for other general corporate purposes.

U.S. Bancorp (USB) rose 1.8 percent to $31.72. The nation’s fifth-largest lender by deposits reported a 28 percent increase in first-quarter profit that beat analysts’ estimates as revenue rose and credit losses fell.”

Comments »In Play and On the Wires

U.S. Exports Continue to Climb (chart porn)

The American export boom continues.

Calculated Risk crunches the numbers from the latest Port of Los Angeles data, and finds that outbound volume (exports to Asia, red line) have surpassed pre-recession levels, hitting an all-time record high.

First Solar. $FSLR, Pink Slips 2k

No Biggie: Spain May Need a Total of $174 Billion to Be Bailed Out

Investors Expect that $IBM Will Raise Guidance After Competitors Accenture, $ACN, and Oracle, $ORCL, Had Good Reports

Goldman Sachs, $GS, Beats the Street and Raises Dividend

“Goldman Sachs (GS) shares fell about 2.2% in pre-market trading after the bank beat EPS expectations on strong investment banking and trading results. Goldman also boosted its quarterly dividend to 46 cents per share from 35 cents.

Goldman posted $3.92 of EPS, 40 cents ahead of expectations. Revenue of $9.95 billion was also ahead of expectations for $9.34 billion. Banking revenues rose 35% above fourth quarter results, and fixed income trading revenues were more than double fourth quarter results….”

Comments »