I’m going to get over my usual shtick for a minute, because I’m tired of preaching doom. My sermons are out there and I haven’t changed my tune at all.

But I really have neglected my longs, over the past 6 months. There’s no excuse for that, as I’m very happy with what I’m holding. I will not be selling these companies, even if we should go into a total meltdown. I would invariable buy more.

Right now, my only longs are two multifamily apartment REITs, and a uranium miner. I guess you could say that sums up my feeling toward what’s out there to buy right now.

I’ve spoken in the past on the great investment opportunity that multifamily units represent. But there’s more to see than just the reports. Behind the numbers and the charts and graphs, there are companies and their actual operations.

So let me show you why companies like AEC and CLP are going to continue to outperform, for the indefinite future. Here are some details from the company that CLP is assembling itself into:

Imagine yourself as a millionaire. If housing is dead as an investment, why the hell would you subject yourself to the tedious chores of homeownership, when you can live in a place like this?

Or here?

Yes, this looks like a much worse deal than buying a five bedroom home with a leaky roof and betting on a far off housing recovery.

Here are some more:

Let’s be honest with ourselves; wealthy people, once they move into places like these, are not moving back out again. These locations offer gated communities, complete with unequaled luxuries and an atmosphere built for other hard working, successful, like minded neighbors. You might see some of the 95% occupancy drop off; I’ll concede a few percent. After all there are some people who just like to own their own homes.

But after 2008, all the good homes are overpriced, and all the cheap homes are a serious liability, thanks to going on five years of vacancy/neglect. With material costs making it more expensive to build than buy, and nothing to buy worth owning, there’s just no reason to even subject oneself to homeownership.

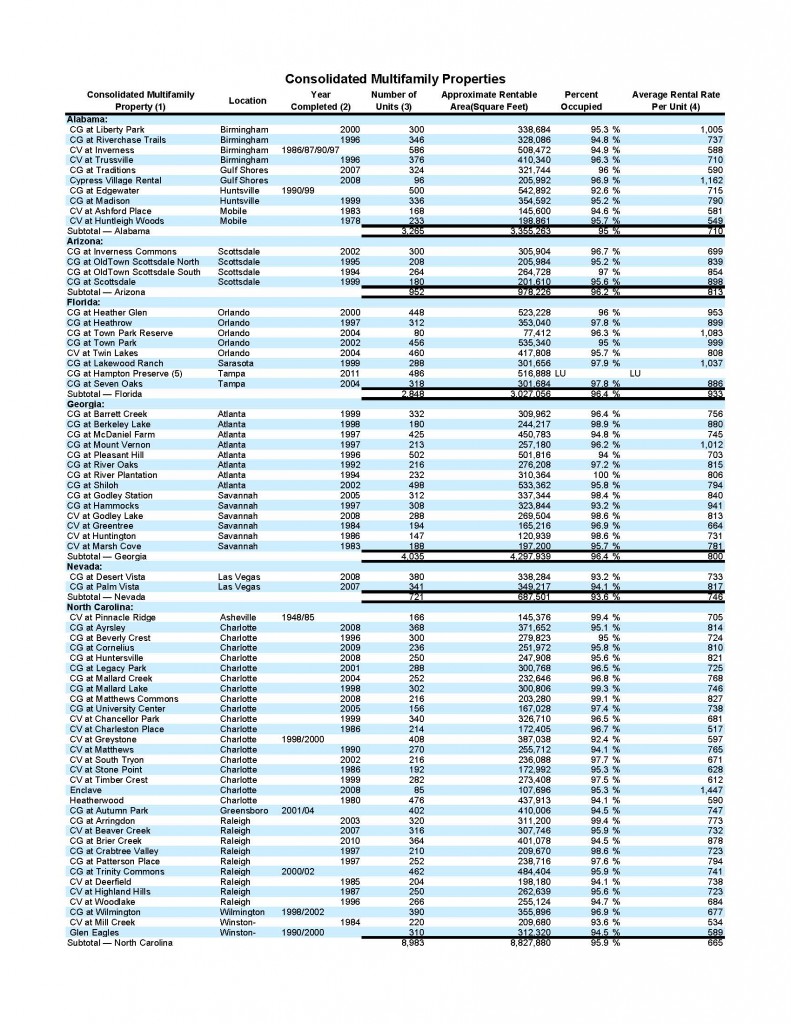

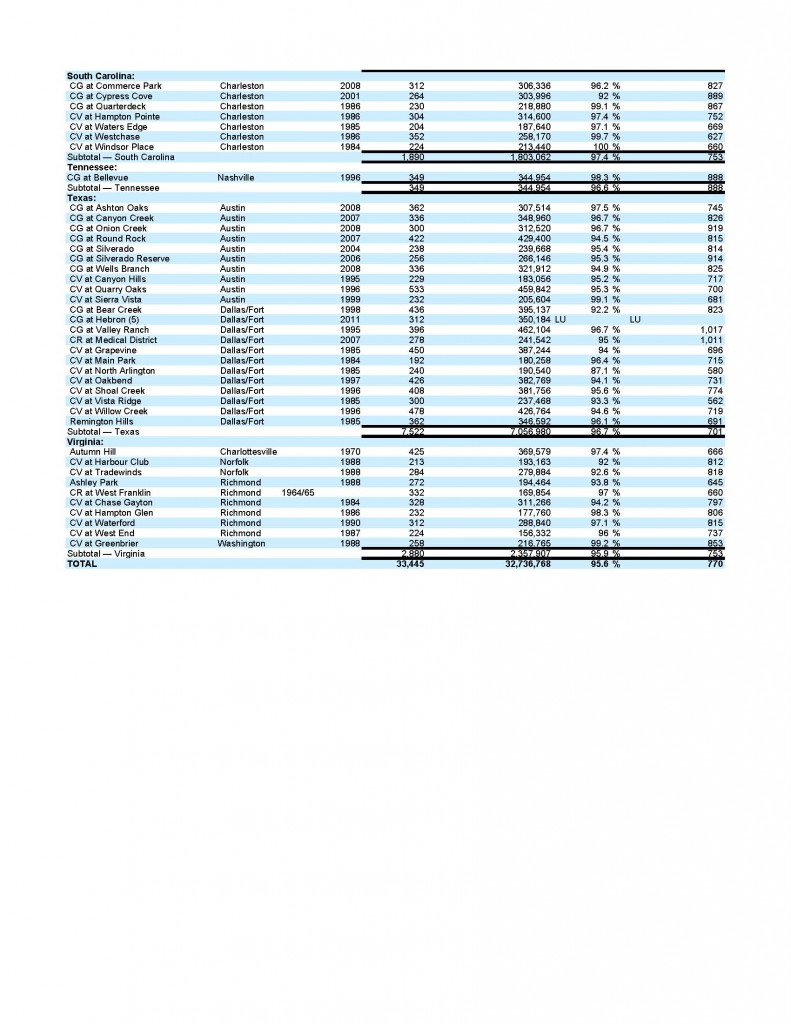

Look at CLP’s complete list of properties. This is what a well-oiled company looks like:

If you enjoy the content at iBankCoin, please follow us on Twitter

Interesting point. I’ve shied away from REITs in the past but am considering as the field narrows in value. Thanks…your work is appreciated.

The CLP spreadsheet looks pretty good. Let me throw some numbers at you. CLP has some 33,445 total units, average rents $770/month. After taxes, insurance and maintenance they probably net about $500/mo. In round numbers the units are probably worth 100K each so total value of the units is about $3.3 Billion. CLP has $1.78 Bil in debt, so a market cap of $1.5 billion would not be out of line. (close to what it is) These are quickly done, back of the envelope kind of numbers done in an old fashioned real estate operator kind of way.

My only question is, where can I rent one of those kind of units shown in the pictures above for $770/mo? ;^)

I think average unit here is misleading. What’s a unit? As you start progressing from a two bedroom studio into a six bedroom, top floor type situation, you could see rents progress from $600-800 to upwards of $1,600. If you fill the up all the lower quality spaces, it pulls your average down. But fuck averages, the higher rents pad your revenue.

Also, I cherry picked the shit out of these pictures. They are all CLP operations. But they’re best of bread. You can get more reasonable locations that aren’t as flashy.

Mobile.

Their properties are nowhere near the quality of the pictures above. In this area it actually is cheaper and safer to rent a house.

Question: who’s “they”?

Because I got these pictures off CLP’s property directory.

Looks nice but I’d like to see a picture of the pool with the fat ass renter paying $600 a month in rent. Would a millionaire want to live next door to someone making $28K per year (600*4*12)?

Lol, I’m pretty sure that you’re not living in a place like these for $600 a month. These are more then $1,000+ selections.

A $1,000 a month rent would require an income of $48K (4*1000*12). Two shlubs each making $12 an hour and living together would hit that threshold. I can’t imagine a wealthy indivudal would find this option attractive. I am assuming by wealthy we are talking at least making 200k per year. A long time ago I lived in Richmond and lived at Chase Gayton (property lisetd above). Mostly kids in their 20s and dead enders (careers without futures). Great apartment complex but the River Road crowd will not be retreating to Chase Gayton

Mr. Thaler,

I read this fine post yesterday and agree that these reits can be good investments. And probably will be for some time.

HOWEVER, having recently spent several months in a place that looks very much like the photo at the top of your post while relocating and house hunting on the East Coast, let me “hip you” to a few residential realities:

Your neighbors, though credit- and crime-checked by the management, will be an odd bunch. And they will be very close. Some rode the coattails of their parents credit scores in order to qualify for the lease (about $2,300-$4,200/month where we were staying). Others began renting just before losing their homes and shattering their credit. Others are in the midst of losing homes and families in divorce and are trying to rent places that allow them to see their kids on weekends.

What I’m saying is that there are many circumstances that bring people to these nicer apartments beyond making a smart financial choice for housing. As a “community,” it’s a kind of sad place.

Daddies with means like to put their college-aged daughters in places like these to keep them safe. Two sets of such daughters seemed to be working in some sort of medical marijuana and amateur prostitution internship program at the complex where we were.

The beautiful pool areas? Unless designated as adults only, they will be occupied solely by screaming tikes and chatty mommies.

The “adult” pools will be a white trash Coachella of loudly played poor musical choices, semi-drunk dudes of all ages and tramp stamps from 10am Saturday to 11pm Sunday night.

Management assured us that our complex was full of lawyers, engineers, techies and other professionals before we moved in, and it is a popular temp housing solution used by many of the tech and healthcare companies in the area. Looking at the demographics, it would look like a great place to live. But the difference between living in a place like this and in the neighborhood where we bought is night and day. Despite the occasional pain and expense of ownership, we are much happier where we bought and know that our neighbors have “skin in the game.”

These are factors to keep in mind when recommending or considering these rental properties as “home.”

(laughter) thanks for bursting my bubble. Hopefully your observation was a fluke, because if rental rates drop with a housing bottom, I’m going to be pissed.

But really as long as CLP keeps them full, I’m happy.

I’ll dig up our old lease and see who owned those apartments. They also owned two other complexes north of Boston of similar quality.

They really did keep the place perfectly maintained and landscaped.

An interesting note about their pricing: Rates changed weekly based on seasonality, length of lease and some algo they had that factored in the most recent demand numbers for the state. (I don’t know where they got that last variable.)

Demand for rentals is at an all time high in the Boston metro area, from what I read. And since we always planned to be short term renters, I’m sure we were paying more than most of our neighbors per sq. ft. Their proprietary pricing formula always enables them to charge top dollar the market will bear.

I guess my point was just that as you make more money you’re less willing to put up with bullshit of any kind, especially at home. And apartments kind of mask the downside of the biggest threat comfortable living: Your neighbors.

Hahaha, well said.

Spain Needs No Bailout? EU Officials Doth Protest Too Much

http://finance.yahoo.com/blogs/daily-ticker/spain-needs-no-bailout-eu-officials-doth-protest-173946576.html

Yeah I saw that. It’s posted in the news section too.

It’s crazy to think these countries with their debt issues can just waltz through while eating printing deficits.

neither of those REITS has outperformed SPY ytd

That is a fact