The stock prices reign supreme. Everything else is just rhetoric. If the American economy is upwards of 70% consumer oriented, the health of said consumer is absolutely vital to the long term prospects for the market.

Here are the returns, year to date, of some of the bigger consumer discretionary stocks — broken down by sector.

Apparel

VFC -11%, UA -6%, HBI -16%, PVH +50%, RL -11%, LULU +5.5%, GIL -4%

Apparel has been tepid in 2016 — as a fickel consumer hops from one fashion to the next. One thing is constant, however, LULU continues to execute, while PVH surprises to the upside. They own the iZod brand and that’s been crushing this year.

Apparel Stores

ROST +21%, LB -20%, GPS +10%, FL +6%, JWN +9%, URBN +53%, AEO +13%, DSW -9%, ANF -40%

LB had some issues early on, while URBN nailed the trends. Overall, it’s truly a tale of two cities. If there’s one constant it is this: you’re either killing it with good fashion or getting the price points just right, like ROST, to attract buyers. Nothing unusual about the sector so far.

Department Stores

TJX +5%, M +4%, KSS -6%, JCP +29%, DDS -9%

Department stores have been plodding along — seemingly able to navigate a lethargic consumer. There was notable strength in JCP this year, still recovering from the harrowing Ron Johnson-Bill Ackman years.

Restaurants

MCD -2%, SBUX -11%, YUM +22%, CMG -17%, QSR +18%, DRI +3%, DPZ +39%, PNRA -2%, DNKN +22%, CBRL +12%, PZZA +41%, JACK +26%

While many of the smaller chains have done poorly, the larger names continue to shovel food into the fat, fucking, faces of the American pie gobbler. There was a noteworthy drop in the poisonous CMG, while DPZ and PZZA continue to deliver artery clogging pizza pies to American at a record pace. Also, DNKN gained on SBUX and JACK took share from CMG.

Sporting Goods

DKS +59%, CAB +32%, POOL +16%, VSTA -14%, SWHC +17%

Killer year for sporting goods, following the liquidation of Sports Authority. Gun sales are robust too, which helped CAB.

Auto Dealerships

KMX -5%, CPRT +41%, AN -19%, PAG +9%, LAD -10%, GPI -16%, ABG -18%

Car sales appear to be stagnating.

Specialty Retail

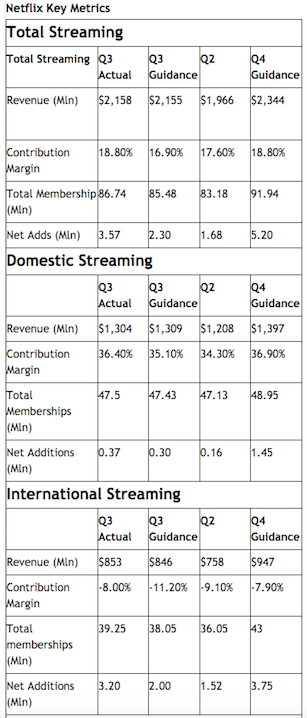

NFLX -13%, SHW +4.6%, LUX -28%, ULTA +40%, TSCO -22%, TIF -3.5%, SIG -34%, MIK +6.5%, SPLS -17%, BUFF +32%, BC -4%, BID +39%

Monster gains in ULTA. I hear they have the right mix. People love their pets, via BUFF. And the super rich appear to be collecting stuff again, via BID.

Home Furnishing

BBBY -16%, WSM -18%, RH -63%, HVT -16%, PIR -16%

Dreadful year for this sector. This is indicative of the stagnant home buyers market for the middle class. Rich people don’t buy stuff from BBBY or PIR. And, while WSM might be expensive for middle class folks, it’s not exactly high end either. This is a really hard industry to invest in now, unless we see a big uptick in home sales.

Catalog/Mail Services

AMZN +21%, EBAY +15%, QVCA -31%, W -26%

Amazon and Ebay are executing. Everyone else gets executed.

Discount Stores

WMT +13%, COST -6.7%, TGT -5%, BURL +80%

Cheap stuff. Walmart is the cheapest grocery and random shit store, while BURL sells the cheapest clothes on the planet.

Apparel Footware and Accessories

NKE -17%, COH +10%, KORS +17%, SKX -27%, WWW +35%, DECK +18%

Nike struggling, while FL stock is up? Something is off. This is a comeback year for COH, KORS and DECK.

Grocery

KR -25%, WFM -13%, CASY -3%, SFM -18%, CST +23%, WMK +25%, SVU -23%

This sector is beguiled by margin pressures. I am surprised to see KR get hit. Blame WMT.

Overall, the consumer is doing okay. There are some big winners out there and plenty of losers. Like most things in life, it all depends on your perspective. It’s performing like an economy growing at 2%. Enough said.

Comments »