Trying my hand at a little risk again. I started a small position in CNQR.

Comments »ATTENTION BONEHEADS: The Market is Rallying

I am seeing huge risk appetite present itself here, alongside the prospect of short squeezes. We might have ourselves a nice week of trading, if this sticks.

Just to keep you informed of what might bounce here, if only for the sake of dead cat:

IMPV

YELP

FEYE

SPLK

WDAY

POWR

FUEL

NMBL

HIMX

MKTO

CSOD

N

NOW

GOGO

JAZZ

CIEN

Naturally, the futures guys were DEAD WRONG as to the immediate direction of the market. There is some meat on the bones of this rally. Let’s see how it closes.

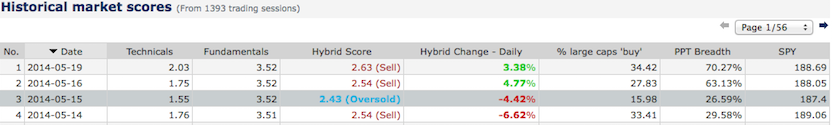

FYI: The PPT flagged OVERSOLD on Thursday, which is the reason why I bought QQQ. I didn’t alert people here of the signal because I am no longer sharing it on the free site.

LONG AMERICA

I just read an amazing story that said Jordon Belfort, scum bag from Wolf on Wall Street, made over $100 million over the past year and will be able to pay back all of the people he ripped off. That truly is amazing and can only happen in America. This sort of stuff could never happen in 3rd world countries, like Canada, where people suck down glasses of mapled syrup for breakfast. You bastards should kiss the ground you walk on and give thanks that you were born into this great empire, and not some off-shot slum in Mexico.

I’d like to give you good folks some hard opinions here about the market. However, I’m like a vagabond now, in search of destination and purpose. Sure, I own a bunch of stocks. I even own QQQ, betting on the NASDAQ like an OTB gent. But it’s all a crapshot from here on out. Nevertheless, I do believe, at some point, there will be an asymmetrical trade to be had in the tech sector. Maybe the CRM numbers will stoke the flames?

All I know is this: earnings are behind us. Without negative headlines to scare the wits out of the canaille, there is a distinct possibility that we can rally super hard (extra viagra) from here until the end of June. It might fascinate people to the point of becoming stupid again, buying old wares, seahag stocks like FEYE and SPLK again. For me, it will be incredibly trying to get me back into those sort of demon stocks again. Having said that, I do understand the only way I stand a chance at saving my 2014 is to partake in debauchery aka “an epic trading moment,” the type of opportunity that you tell the grandkids by the fireside, as you gently roast an enemy in the flames.

But this is all fantasy, as I am stuck in the mud of mediocrity, or worse. The way I see it, the longer I can weather the proverbial storm, gather my senses and stabilize my assets, the better chance I have. It’s a very basic thing to understand, quite frankly, as I am simply better than most. I see things more clearly, and possess the talents that were bestowed unto me via genetic traits, to outperform you.

Time is on my side. All I need now is a few goddamn good ideas.

Comments »The Futures Guys Are Utterly Useless

I’m looking at the S&P futures right now and can’t help but to laugh at the never-ending fail that is the futures markets. I know some of you trade the futures markets, for reasons unbeknownst to me. It is the least intelligent of all the exchanges, a place where neanderthals trade ideas with one another while feasting over elephant dung.

We’ve been getting massive spikes and drops in the markets, yet almost every single night the futures are flat. Man up, sack up, you apes. Either come to play the game, or don’t play at all.

It’s pathetic, really.

On that note, future are exactly flat, indicating the NASDAQ to open up by 0.05% tomorrow.

Jesus Christ.

Comments »HEED THESE DIRE WARNINGS

Everyone loses, eventually. This is the sort of market that befuddles both bulls and bears alike. I am sure many of you pressed your bearish bets into yesterday’s close, then redoubled them again into this morning’s weakness. You’ve played yourselves into a ‘fag box‘ and now you’re all bankrupted.

There isn’t a rhyme or a reason for today’s late day rally, other than the fact that some people have figured out a way to harmonize mathematics with price action, ergo, finding an exact level to bounce from (SHOMP). Will the market go up from here and will there be a summer rally? Who knows? I am merely moonlighting here, trying to panhandle enough dollars now to survive the real decline later.

This is what I do know. If you’re short going into this fine weekend, you will find yourself to be exceedingly uncomfortable after learning of a Russian-Ukraine peace resolution is in the cards. You might feel a bit uneasy after seeing the NIKKEI romping around, going GODZILLA on its shorts. And, finally, you will soil yourself, after seeing medieval devices rolled into the city square, for the purposes of silencing those who talk too much.

Comments »S I L E N C E

The market is bottoming. Can you hear it?

https://www.youtube.com/watch?v=Iq3v5XNuMis

How Long Can Tech Go?

I hate to do this to you, but I am going to cite some valuation data from the darkest hours of 2008. Why am I partaking in such an adventure?

Because I can.

It’s hard to get an apples to apples comparison between the tech stocks of that era and today; but I will try to scare you nonetheless.

I looked at names like CRM, AKAM and AMZN. Out of the three, I think it’s fair to say CRM best embodies the scams that are traded today.

Back in 2008, CRM traded down to 4x sales, 6x p/b and 17/fcf. In other words, CRM would have to trade down by 50%, from current levels, to repeat the glory days of 2008. Now if we are to apply the same stringent valuations to FB, TWTR and YELP, well, it gets decidedly uglier. All of those stocks are trading above 15x sales. They’d need to drop by 60-70% from current levels to get down to the apocalyptic Santelli levels of 2008.

Now is that a reliable benchmark to shoot for?

Absolutely not.

But at least you now know that if YELP should trade down to $15 again, you should probably back up the truck.

In all seriousness, these tech stocks will bottom for good once mergers and acquisitions in the space smacks short sellers in the face: a YELP buyout, or maybe a LNKD merger. We need to see real companies with real earnings saying “FEYE IS RETARDO CHEAP MORONS. I’LL BUY THE ENTIRE COMPANY NOW, thank you very much.”

As an aside, I bought QQQ on the close yesterday.

Comments »The Oldest of the Old Man Stocks

There are old man stocks and then there are olde man stocks. Some of you, like myself, play games in the stock market, hoping to insulate oneself against the never-ending barrage of sell orders that seem to be hitting the street of Wall–each and every day. Truth be told, our lives would be measurably easier had we just caved in and shorted everything we thought was good. Alas, one cannot live in the past. One must look towards the future.

When planning for my future, I tend to study the past, however. I like to see how sectors behaved during the hardest of times–times when good men turned to alcoholism to stop the pain, and when women did the dishes without gloves.

These are hard times, trying times: ask David Tepper. Born and raised in the disgusting and filthy city of Pittsburgh, PA, David quickly moved up the ranks at Goldman Ballsachs, then segued that success into America’s best run hedge fund. He now manages over $20 billion from the Short Hills shopping mall, where he gets nervous about things, prepares media presentations, and woks diligently on his small home in the Hamptons.

Not to take up the mantle of populism here, appealing to your inner anti-establishment hatred, but what does David Tepper know about “nervous?” Has he ever felt nervous about meeting his mortgage payment or having his car towed away for being delinquent? This is a man, mind you, who makes over $3 billion per annum. If I made $3 billion per annum, trust me when I say, I’d be completely and totally insulated from the world around me– working on spaced aged cannons and buying whole companies just to convert their offices into roaming carnivale trailers.

Do not trust David Tepper. But believe in the numbers, for they do not lie.

Let’s talk turkey. The oldest of the old man sectors is the utilities. Within that sector, EXC is the best performing stock, with a reliable dividend, liquid daily volume and mammoth market cap. For the purposes of this exercise, we will use EXC versus the worst months in the NASDAQ’s wretched history, dating back 14 years.

Jan, 2005: QQQ -6.3%, EXC +0.4%

Jan, 2008: QQQ -11.9%, EXC -6.8%

Feb, 2001: QQQ -26.2%, EXC +8.98%

Feb, 2008: QQQ -4.8%, EXC -1.01%

Feb, 2009: QQQ -5.27%, EXC -12.09%

March, 2001: QQQ -17.49%, EXC +0.35%

April, 2000: QQQ -13.47%, EXC +13.02%

April, 2002: QQQ -12.02%, EXC +2.52%

April, 2005: QQQ -4.36%, EXC +7.88%

May, 2000: QQQ -12.27%, EXC +5.96%

May, 2002: QQQ -5.3%, EXC -0.76%

May, 2006: QQQ -7.2%, EXC +5.6%

May, 2010: QQQ -7.39%, EXC -10.3%

May 2012: QQQ -7.04%, EXC -4.27%

June, 2002: QQQ -13.1%, EXC -2.18%

June, 2008: QQQ -9.61%, EXC +2.24%

June, 2010: QQQ -5.96%, EXC -1.63%

July, 2000: QQQ -4.29%, EXC +5.88%

July, 2001: QQQ -8.63%, EXC -11.9%

July, 2002: QQQ -8.62%, EXC -6.22%

July, 2004: QQQ -7.56%, EXC +4.82%

July, 2006: QQQ -4.3%, EXC +1.87%

August, 2001: QQQ -12.27%, EXC -2.6%

August, 2010: QQQ -5.13%, EXC -1.42%

August, 2011: QQQ -5.06%, EXC -0.86%

September, 2000: QQQ -12.66%, EXC +25.8%

September, 2001: QQQ -20.89%, EXC -18.3%

September, 2002: QQQ -11.82%, EXC +1.47%

September, 2008: QQQ -15.58%, EXC -17.56%

September, 2011: QQQ -4.5%, EXC -1.18%

October, 2000: QQQ -7.94%, EXC -0.49%

October, 2008: QQQ -15.47%, EXC -13.39%

October, 2012: QQQ -5.29%, EXC +0.58%

November, 2000: QQQ -22.9%, EXC +10.2%

November, 2008: QQQ -11.48%, EXC +4.69%

December, 2002: QQQ -12.09%, EXC +5.19%

The Average Worst single monthly drop in the NASDAQ, since 2000: -13.07%

During those respective months, EXC was -0.19%

Conclusion: When credit was an issue, as was the case in 2008, the utilities were horrid places to hide. You’d be much better served hiding in TLT. For those of you who are members of The PPT tribal army, feel free to use our seasonality tools and compare the QQQ to TLT for the years mentioned above. I already did the grunt work for you. The utes certainly possess a defensive quality, outperforming the NASDAQ by 13%, since 2000, in some of the most horrid trading months known to mankind. I’d be interested to see how the utility ETF, XLU, performed over the same time period. Or maybe a REIT ETF.

The bottom line: EXC is for old people who do not like getting blown to smithereens in tragic NASDAQ forays. If you should find yourself in need of non-tragic waters, look towards the utes in these trying times. Everyone else may proceed to juggle pin less hand grenades inside of plutonium factories (actually, it’s not nearly as dangerous as it sounds).

Comments »How Am I Doin’ So Far?

Dear readers of iBankCoin,

A friend of mine at the podiatrist told me that the stock market was having trouble, ever since I became Federal Reserve chairwoman. She said that “Ben wouldn’t have allowed this idle downside speculation take place” under his watch. For some strange reason, the owner of this website seems to paint me as an olde grandmother, who goes out all day on shopping binges, eating “clubbed sandwiches.” That could not be further from the truth.

I am at work from 6am until midnight, each and every day, playing bridge with the other nice ladies at the Federal Reserve. Quite honestly, it’s the hardest work of my life. There isn’t much for me to do, frankly, since the TAPERINGBOT3000 has been initiated. We at the Fed, simply sit around all day, eating corned beefed sandwiches– laughing at Seinfeld re-runs. I don’t have any of my personal money in the stock market, since it’s prohibited by law for a Fed chief to have exposure. Therefore, I never really look at the market. Was it down today? Someone at the beauty salon said that I “sucked” and should “go back to brooklyn to go rob and punch a bunch of people in the face.” That man was very rude. As he left, he said he hoped I’d receive “shares of splunk, on margin, for Christmas.” Whatever that means. I guess he didn’t know that I am jewish.

Anyways, I just wanted to clear up the confusion that has been brewing about the internet, and on the Twitter, about my habits. Frankly, I believe this Fly character to be a reprehensible chauvinistic animal of a man.

Sincerely,

Federal Reserve Chief,

Janet Yellen

Buy on Close

With some of the cash I have left, I will be buying the NASDAQ, in all of its cancerous glory, into the bell. While it’s tempting to buy it here, seeing it bounce, I’ve been around the block a few times and know how the mysterious robot overlord powers work–often choosing to torture market inhabitants with horrendous sell imbalances.

Considering the down 200 headline, I am not fairing too bad, save FANG.

Nothing scares me anymore, not even the specter of unforgiving losses.

Off to drive around my wife. She fancies a thing to two at this very moment.

Comments »