I started a position in XON and ANGI.

And I sold out of KMT.

Comments »I know it’s tempting to dive back into the pool, swim about the water, drink some pina coladas like an upright walking pig. Truth be told, there isn’t any water in the pool and you are diving into a cement bottom. Do not allow the mirage of a one or two day rally lure you back into the shark infested waters.

Yes, I am long and have been long for quite some time. No, I do not believe now is the time to start buying high valuation tech again, despite the fact that they are oversold.

For a moment, put yourself in the shoes of the millions of people who got caught in the tech meltdown maelstrom. Now imagine those holdings lept by 10-20% inside of a month. Knowing the pain you felt at the lows, don’t you think you’d sell after receiving a respite? All of these FEYE, WDAY and SPLK’s are diseased and should be discarded from anyone’s portfolio, before the next guy does. I have nothing against these companies, per se. However, I do know price action and resistance. These names are broken. Broken stocks take time to recover, months and months and months. Now is hardly the time to go venturing off in a bunch of stocks down 65% over the past 3 months, hoping the selling climaxed.

Instead, you can get better returns with stocks that are in uptrends, without having to worry about bear raids. Some of my holdings that are surging ahead, with little overhead resistance include AFOP, FANG, ACE, WCC, even MA looks good. Granted, holding a portfolio of mature stocks won’t permit you to enjoy unchecked hedonistic returns. However, they won’t blow your arms off either. I believe it’s a good time to stop charging Omaha beach. The NAZIs have won. The resistance is too great.

Go chill out in England and collect your dividends. Be content with the small smidgen of land that you still possess.

Comments »You’ve been bearish for too long. You’ve had your chance at assembling enough coin to survive the melt up to come. The over-arching trend of humanity, population, innovation, quality of life, is higher. Betting against this trend is equal to shorting time. You people are stupid enough, you might try that too.

Comments »If you’re looking to blame someone for today’s losses, look towards Charles Plosser. He’s one of these delusional Fed governors and resides in the disgusting city of Philly. He said the Fed might start raising rates, sooner than later, because the economy is rip, roaring, mad.

HAHAHAHAHAHA.

The funny thing about his statement is that he holds zero sway, yet people panic as if Yellen had said it. No one cares about the opinions of the Fed governors. They’re just filler, stand ins to make the whole process appear to be democratic.

Also, can someone please educate me about the current “Fed mess” and how rising bond prices is bad for the Fed? Let’s establish a few points here. The Fed wants to get out of these bonds that they bought, eventually, and have begun tapering. Their balance sheet is now in excess of $4 trillion. With rates heading lower, isn’t that to their benefit, you idle inchworms?

In other words, they’ve managed to keep the SPY at its all-time highs, while directing all of the morons who were long FEYE, SPLK, WDAY and YELP into TLT, thereby providing them with the liquidity that they need to sell–if need be. It’s genius. What would you prefer, a rising rate environment and the Fed losing a few trillion dollars in their bond market forays?

You people complain about everything.

Now I am hearing some guy on CNBC suggest we’re heading into a recession. Naturally, Rickard Santelli agrees and then says the 10 yr bond will hit 2.25%. Why will it hit 2.25%? BECAUSE THE FED IS GOING TO RAISE RATES!!!???

Down is up and up is down. You people are living in fantasy land. Let me simplify things for you.

Rates will NEVER, EVER, EVER, EVER go up. Ever.

As long as The United Steaks of America has $20 trillion in debt to service, the Fed will keep rates artificially low so that Detroit and Chicago can continue funding after-school centers and handing out condoms to vagrant teenagers.

Comments »I see gold is down a little bit this morning– and all of a sudden– the misanthropic booze hounds take to twitter to make fun of gold stocks. Are you people really this stupid or are you simply trying to be a caricature of the modern day neanderthal American? You do realize that gold stocks are up 25% year to date, right?

Part of my problem is that I listen to the bedraggled microbes infecting my sphere, with all of their “keen insight.” No offense, but most of you are obsequious sub mental trend followers, unable to concoct an original thought if your pathetic lives depended on it. Here I am, spending inordinate amounts of my time, which by the way is worth an obscene amount of money in the real world (cue predictable ‘you work out of your mother’s basement’ banter), at the expense of my business. It makes no sense, whatsoever. Then again, I’ve never been one to sacrifice myself at the altar of capitalism, whoring ethics for capital. This isn’t about money; it never was about coin. This is about purpose.

I get these mental midgets approaching me on Twitter or Stocktwits, 3 weeks into this business, trying to offer me advice. The moronic design of the market assures that everyone is considered a genius at one point or another, thereby assuring that these vulgar vagrants will continue to approach me with even more stock market tips and get rich schemes. You do realize this is all nonsense, right? Everyone is running one way, while a select few run the other way–taking all of your money. The market was designed to bankrupt servile cretins, while aggrandizing those with power.

My biggest mistake, ever, was allowing myself to be herded with the sheep. Never again.

I’d like to give you people some early morning predictions, but the S&P futures have been flat for about 90 days straight now. It’s an amazing display of incompetence on behalf of the helots who trade the pre-market futures. Talk about waste of oxygen.

Here’s what you need to know:

Don’t bet on any retailer–because Americans are unpredictable obese monsters. At any given moment, your typical American will stop shopping at TGT in favor for WMT. Just when you thought HD was the place to be, LOW enjoys market share gains. This morning DKS missed earnings, blaming it on rednecks sitting at home, drinking out of budweiser cans, instead of hunting. The nonsense will go on and on and on if you let it.

I am sure there is something worth buying today. Maybe one of those stocks that just dropped by 60%, OVER THE PAST MONTH, will become attractive enough today, and today only, for a select few people to trade successfully. All I know is that I am not overweighting any one sector or stock, subjugating myself to this market that appears to be wired with explosives–until the tone and tenor changes. And that’s all.

Comments »Inside The PPT, I ran two screens to search for stocks down huge, but with large net cash positions. Regardless of their business prospects, profitability etc, the following names are on my radar, inspired by the TITANIC move in VRNS today.

symbol, % down from 52 week high, net cash per share/price ratio

CSLT (10-17 over the past month!) 60%, 0.14

CRCM 61%, 0.33

PTCT 53%, 0.54

ACHN 67%, 0.53

DRNA 65%, 0.46

MGNX 52%, 0.37

INFI, 68%, 0.36

RCPT, 52%, 0.27

ARWR, 55%, 0.26

SSNI, 65%, 0.26

TXTR, 56%, 0.14

FEYE, 69%, 0.14

NMBL, 51%, 0.11

BLOX, 61%, 0.25

FUEL, 67%, 0.23

Now get to work.

Comments »Earnings are becoming a memory. The fodder has been disposed with. All that is left is for cheaper assets to grow more expensively, as the great Wall of Worry ejaculates winship all over the Zerohedge crowd.

NOTE: I was up a titanic 0.4% today.

Comments »We had the washout of the high tech/cool stock sector, topped off with a David Einhorn/Rickard Santelli endorsement of a repeat of the dot com crash of 2000 in the cards. I held onto my high beta positions for as long as any man of human flesh could. Very simply, I was washed out with a filthy tide of degeneracy, swept away and cast aside with the third estate. As I stand here looking at the market, it has the look of legend, the sort of gift horse that presents itself once in a blue moon. My sole problem is the inability to absorb loss; therefore, the inability to take on risk.

If I never lost money, had I been smart instead of dumb, I’d be buying the shit out of YELP, CNQR, ANGI, NOW and CRCM right now, just to name a few.

All of these stocks could collapse tomorrow and you could get smashed to pieces by a real truck tonight, buried within 5 days time. But that’s what life is, isn’t it? The ability to feel fear, take a stand, and go for it. I’ve done it a million times and have come out on the other end successful, more times than not. But I cannot do it now. All I could muster was a few measly thousand shares of CNQR.

I love JAZZ, GILD, even IFON down here. But before I can swing for the fences, for the love of dead dogs and barren corn fields, I need a few singles first.

Comments »Trying my hand at a little risk again. I started a small position in CNQR.

Comments »I am seeing huge risk appetite present itself here, alongside the prospect of short squeezes. We might have ourselves a nice week of trading, if this sticks.

Just to keep you informed of what might bounce here, if only for the sake of dead cat:

IMPV

YELP

FEYE

SPLK

WDAY

POWR

FUEL

NMBL

HIMX

MKTO

CSOD

N

NOW

GOGO

JAZZ

CIEN

Naturally, the futures guys were DEAD WRONG as to the immediate direction of the market. There is some meat on the bones of this rally. Let’s see how it closes.

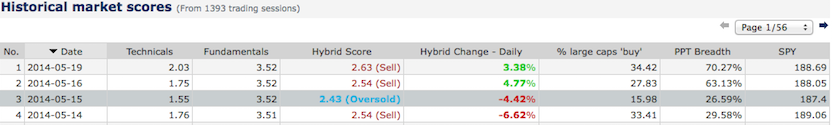

FYI: The PPT flagged OVERSOLD on Thursday, which is the reason why I bought QQQ. I didn’t alert people here of the signal because I am no longer sharing it on the free site.