Bear with me as I scribble a bunch of bullet points on this screen. I’ve been researching XON for some time now and it is ongoing.

What is Intrexon?

Some people call it the google of biotech or “the next Monsanto.”

Here is how the company describes themselves:

The world population is currently seven billion and continuing to grow at an exponential rate. With this growth, food and energy supplies and environmental and health resources are becoming increasingly difficult to access. The current path of the global economy is unsustainable— new solutions are necessary to preserve and globally expand a high quality of life. We believe that synthetic biology is the solution.

Synthetic biology has the capacity to fundamentally change the fields of medicine, agriculture, fine chemicals, manufacturing and energy production. It can reduce our dependence on non-renewable resources like petroleum, increase the productivity of renewable resources such as food crops, and improve or repair environmental damage through bioremediation.

Intrexon is focused on collaborating with companies in Health, Food, Energy and Environment to create biologically based products and processes that improve the quality of life and health of the planet. The science underlying these products is known as synthetic biology – an engineered approach to the field of biology.

Essentially, they are the “DNA guys.” For the love of God, their website is DNA.com. They form collaborations with other biotech, energy or food companies to improve their products, using their proprietary knowledge in cell analysis. I will be the first person to say the semantics of what this company does is above my pay grade. However, I do outsource this stuff to people in the industry to get a better understanding.

Most impressive about the XON story is its CEO: Randal J. Kirk

In 1983, Kirk and his partner founded GIV, which later spun off King Pharma. In 1998, Kirk sold GIV and his partner sold King to Pfizer in 2010. At the time, King was the 39th largest pharmaceutical company in America.

Kirk founded New River Pharma, brought them public in 2004 and then sold it to Shire in 2007 for $2.6 billion. He owned 50% of the company at the time of sale.

After New River, Kirk started Third Security LLC, an investment firm.

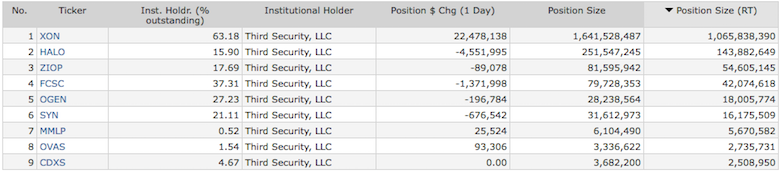

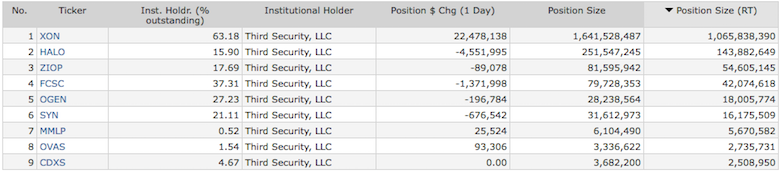

Aside from his private investments, Kirk and his company own a variety of publicly traded biotech firms. Here is the full list.

As you can see, XON is by far his largest holding.

Apparently, owning 63% of XON isn’t enough for Kirk, as he’s been buying large blocks of the stock into this decline.

Aside from Kirk, several other officers at Intrexon have been buying. Zero sellers.

This is a man, who is widely considered one of the most astute investors in the biotech space, buying his companies shares in the open market–following a staggering 33% decline over the past 3 months. The stock is now trading just $1 above its IPO price.

As for other well-noted investors, Dan Loeb’s Third Point owns 3%, and value investor David Einhorn owns 1.4%.

Here’s what Loeb said about Intrexeon:

We initially invested in Intrexon in 2011 in a private round and have continued to accumulate shares since its IPO in August 2013. We believe that Intrexon is an innovation leader in synthetic biology with a unique value proposition and proven leadership team. Most attractive to us is Intrexon’s potential to transform multiple industries, including the health, food, and energy markets.

Synthetic biology is an emerging discipline that applies engineering design principles to biologic systems. Broadly speaking, synthetic biology is about the design, modification, and regulation of gene programs to produce a desired outcome, such as the production of a novel antibody from a cell culture, the optimization of a specific gene trait in crops, or the amplification of wild type natural gas metabolism into an industrially feasible process. Over the past 15 years, Intrexon has developed deep expertise in synthetic biology as well as the adjacent fields of process optimization and data analysis to create a unique technology platform that enables the iterative, directed improvement of experimental design.

To leverage its technology with collaborators, Intrexon has developed a unique business model that centers on Exclusive Channel Collaborations (ECCs) with partners. In exchange for providing access to their technology, Intrexon receives cost reimbursement (thus mitigating the need to raise additional external funds) and significant downstream economics. Because Intrexon’s technology is scalable, its capacity to sign ECCs across multiple industries is limited only by the ambition of its partners. Indeed, to date, Intrexon has already signed over 15 ECCs including, notably, with Johnson & Johnson. Over the course of 2014 and beyond, we anticipate that Intrexon will sign multiple ECCs, creating a broad pipeline of projects and diversifying away from specific product risk.

Intrexon is led by Chairman and CEO Randal J. Kirk, one of the most successful healthcare leaders of all time. Kirk founded and led New River Pharmaceuticals until its acquisition by Shire, and led Clinical Data through the successful development and approval of the anti-depressant Viibryd before selling the company to Forest. While his track record of value creation speaks for itself, we especially like that Kirk has personally invested significantly.

It’s worth noting, Michael Dell’s foundation recently bought about 500,000 shares.

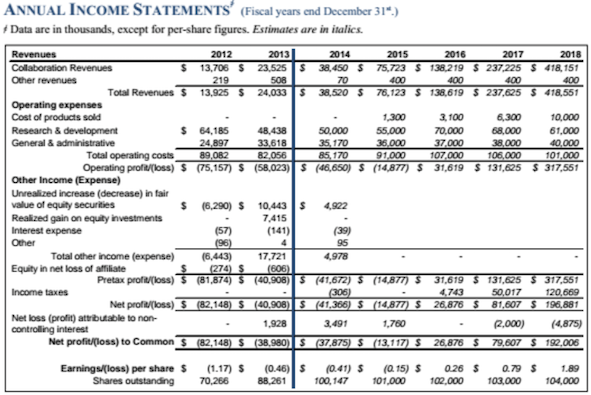

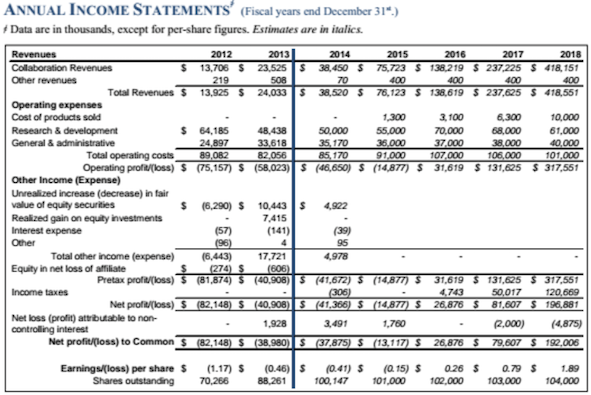

Here’s how the numbers might look, out a few years. They should have over 120ish collaborations by 2018. By the end of this year: 30.

source: Griffin Securities

Bottom line: this is a high beta play. However, with about 75% of the shares locked up in firm hands and another 21% sold short, this stock is poised for a massive short squeeze, should it get going. Kirk isn’t selling. Loeb isn’t selling. Einhorn did reduce his position, which might’ve contributed to the recent weakness. But if you have a strong stomach and penchant for massive upside plays, take a good look at XON.

Comments »