When it comes to the stock market, I am inherently bullish. Over a long enough time line, the stock market goes up (no zerohedge). However, these letters affixed to numbers have their own little idiosyncrasies in the short term, ebbing and flowing with the emotions of the time. For me, the trade for 2016 is a very simple one: fade rallies, position longer term accounts into counter cyclical names. For growth, focus on companies generating high gross margin free cash flow.

I’ll get into the details of my plan this week, when I unveil my predictions for 2016.

The one thing that I can’t seem to shake is the level of underperformance from our preeminent hedge fund industry, with grotesque performance data out of ValueAct, Greenlight and Pershing Square. I know there will be a handful of you that will smugly dismiss those three funds because of their eccentric leaders. Nevertheless, they’ve demonstrated a rich history of outperformance for many years, just like Le Fly.

Why, if I were you and I saw Le Fly down big for the year, I’d be awfully reticent about fading him the following year. The laws of averages do not permit extended lengths of underperformance for people like me. Therefore, the same rules should apply to others, who’ve demonstrated a certain know-how in this market, uncommon to most.

I guess what I’m saying is, I am bearish, but open to the idea that somehow, someway, stocks will grind higher.

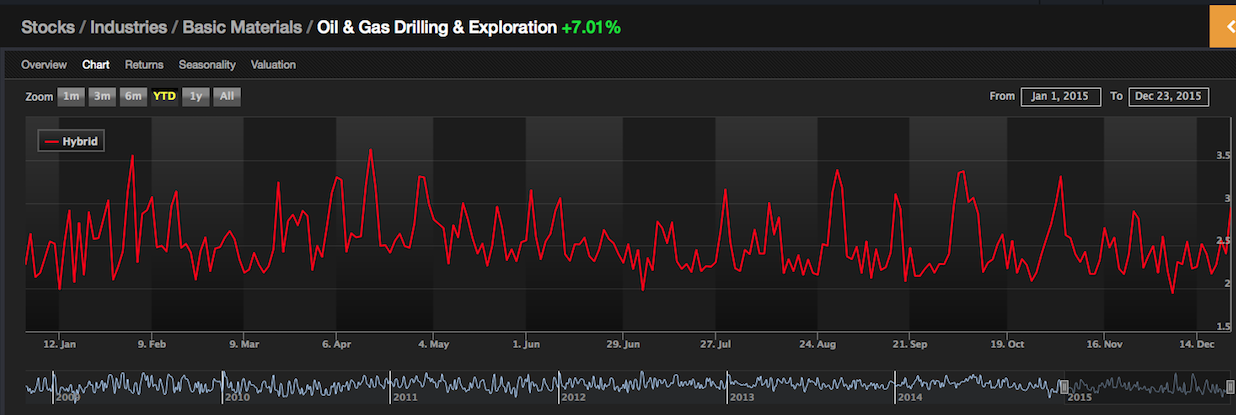

Everything hinges on oil.

Without the support of higher commodity prices, there is zero chance for a rally. The way I’m positioned now, I’m expecting a rip your face to the skeleton bones rally in commodities, just like last year, perhaps lasting until March. I am betwixt between an overly conservative longer term time horizon and a short term bullishness, not seen since January of last year. Couple that with the fact that I am in the midst of a transitional phase in my investment management career, I am wholly consumed with reshuffling the decks this final week of trade.

Heading into the final week, my top holdings, in random order, are JAZZ (don’t sleep on me), PAH, FCX, SHAK, COST, VRX, PANW, GILD and APPL.

Comments »