This is the funniest shit since Al Gore said he invented the internets.

Elizabeth Holmes, the prodigal child who “invented” a method to test blood using just a pin prick of substance, has come under intense fire these last few months. The gist of the WSJ war against Holmes is that she is full of shit, the actual scientist behind the leading Theranos tech committed suicide, and she’s not being honest with her investors.

Ever since she launched Theranos in 2003 when she was 19 years old and dropped out of Stanford University, Ms. Holmes has been driven by ambition that is big even by Silicon Valley standards. Instead of a smartphone app to hail a car or order food, she wants to revolutionize health care with a vast range of diagnostic tests run with a few drops of finger-pricked blood.

Now 31, Ms. Holmes has emphasized a variety of strategies—a hand-held device, tests for drugmakers, drugstore clinics—while trying to turn her dream into a business. She often has collided with technological problems, according to interviews with more than 20 former Theranos employees, company emails and complaints filed with federal regulators.

For now, though, Theranos has stopped collecting tiny samples of blood from patients’ fingers for all but one of its tests while it waits for the Food and Drug Administration to review the company’s applications for wider use of the small proprietary vials called “nanotainers.” As a result, Theranos is using traditional lab machines for most of its tests.

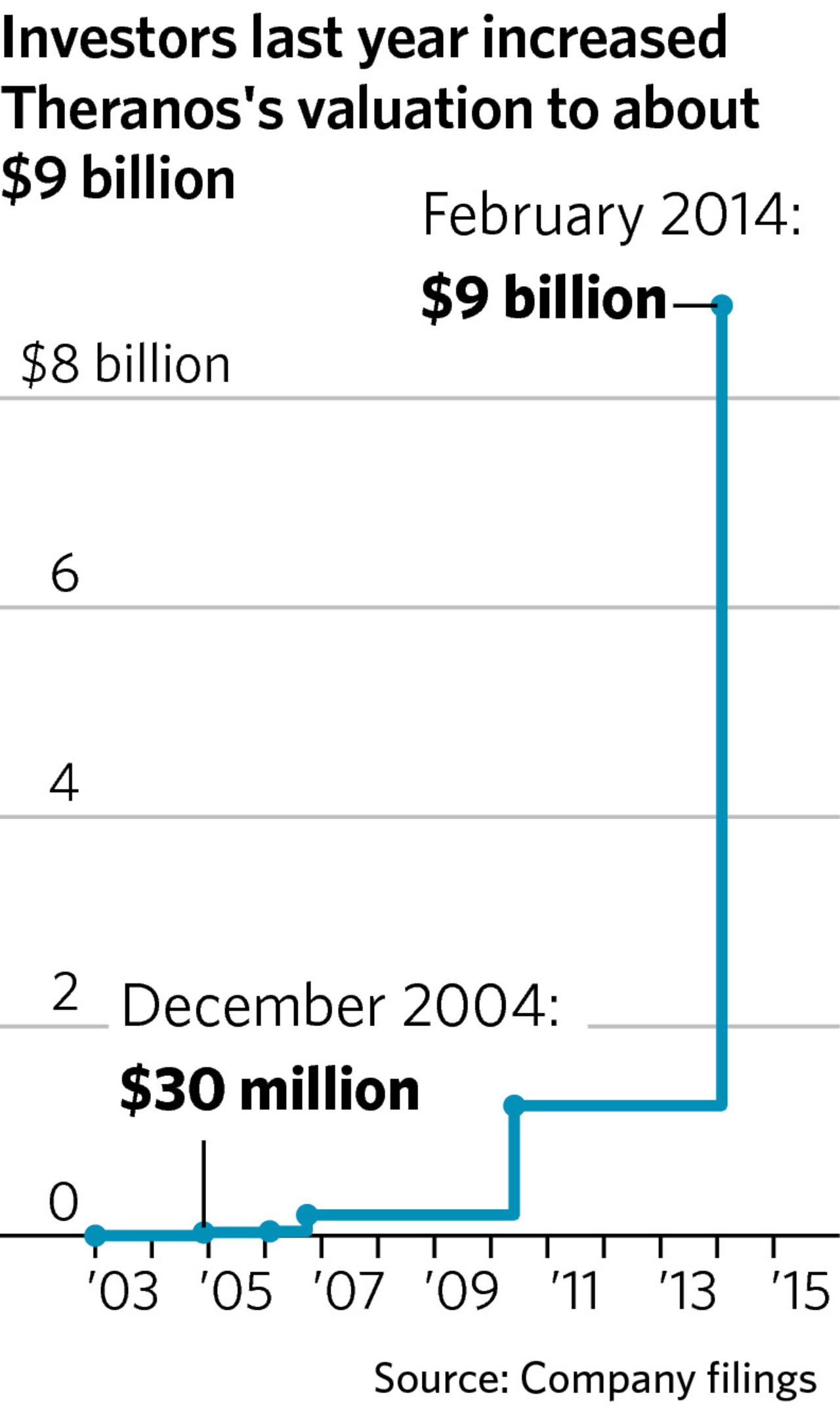

By the end of 2004, Ms. Holmes had raised at least $6.9 million, valuing Theranos at about $30 million, according to corporate filings.

The first $1 million came from Tim Draper, a founder of Draper Fisher Jurvetson, through two of his funds. Ms. Holmes was a childhood friend of his daughter and came to him “with extraordinary energy and brilliance,” he says.

The money enabled Ms. Holmes to hire scientists and engineers. She believed the fastest route to getting revenue was by offering Theranos’s blood tests to drug companies for use in clinical trials, former Theranos employees say.

In April 2005, Ms. Holmes said on the public-radio program “BioTech Nation” that she had created a hand-held device that would help drug companies tell in real time how well their drugs worked on patients using “a little tiny needle that pulls a little tiny drop of blood” from an arm or the hand.

Ms. Holmes called it the RDX Metabolic Profiler and said it was “going into the production phase,” according to a recording of the interview. “We hope to release it, actually, to a pharmaceutical partner around mid to late this year.”

In 2010, another fundraising round boosted Theranos’s valuation above $1 billion. By then, the device was code-named Edison, after the famous inventor.

Safeway Inc. and Walgreens agreed to offer Theranos tests in stores. Mr. Nugent says he was surprised by the September 2013 announcement to “bring access to” Theranos’s “lab testing service through Walgreens pharmacies nationwide” because he still considered the Edison an experimental device.

He recalls seeing the machines labeled “for investigational use only.” Their accuracy “was not to the level you’d want.”

Ms. Buchanan responds: “We are 100% confident of the accuracy of our tests when we rolled them out.” She says Mr. Nugent seems to be confusing devices designed “for a non-clinical purpose…with those that are ultimately used in the clinical lab.”

In November 2013, Theranos’s lab in California got an order from a patient at a Walgreens for a blood test handled by the Edison, according to a former Theranos lab worker assigned to run the test.

Before doing the test, the employee put the device through three trial runs with a quality-control sample containing a known amount of the substance the test was supposed to measure.

When the Theranos employee alerted superiors, someone from research and development came to the lab and deleted quality-control data to make the Edison’s test runs look better, the former lab employee alleged in the complaint to the Centers for Medicare and Medicaid Services, or CMS.

The R&D employee then tested the patient’s blood on the Edison and sent the results to the patient, according to a copy of the complaint. An agency spokeswoman declines to comment. CMS auditors inspected Theranos last month as part of a regularly scheduled audit the company says is continuing.

Ms. Buchanan says Theranos doesn’t believe the incident happened. “If there ever were a circumstance like that, we would do a quality-control check on that device and not give out a patient result,” she says.

Last year, investors pumped another $633 million into Theranos, increasing its valuation to about $9 billion and Ms. Holmes’s majority stake to more than half that.

In April 2014, she got a long email from another employee. The employee alleged that Theranos had cherry-picked data when comparing Edison machines to traditional lab machines to make the Edison look more accurate, according to a copy of the email.

For one test, the device’s accuracy rate increased sharply after some information was deleted and manipulated, the employee wrote. Edison machines also allegedly failed daily quality-control checks often.

“I am sorry if this email sounds attacking in any way, I do not intend it to be,” the employee told Ms. Holmes. “I just feel a responsibility to you to tell you what I see so we can work towards solutions.”

Ms. Holmes forwarded the email to Mr. Balwani. He replied to the employee, who no longer works at Theranos, denied all the claims and questioned the employee’s understanding of statistics and lab science.

Quality-control failures were due to the “newness of some of our processes, which we are improving every day,” Mr. Balwani wrote.

He added: “This is product development, this is how startups are built.” The reply ended with an edict that the “only email on this topic I want to see from you going forward is an apology that I’ll pass on to other people.”

Ms. Buchanan says the employee was too inexperienced to “make these types of comments” and “struggled” to grasp Theranos’s scientific processes. The company has disclosed its test methods to regulators, she adds.

Theranos’ valuation, as of last raise, rivals that of Quest Diagnostics, who does $7.5 bill in revenues with profits of over $600 mill per annum.

As for Theranos’ valuation: fucking unicorn.