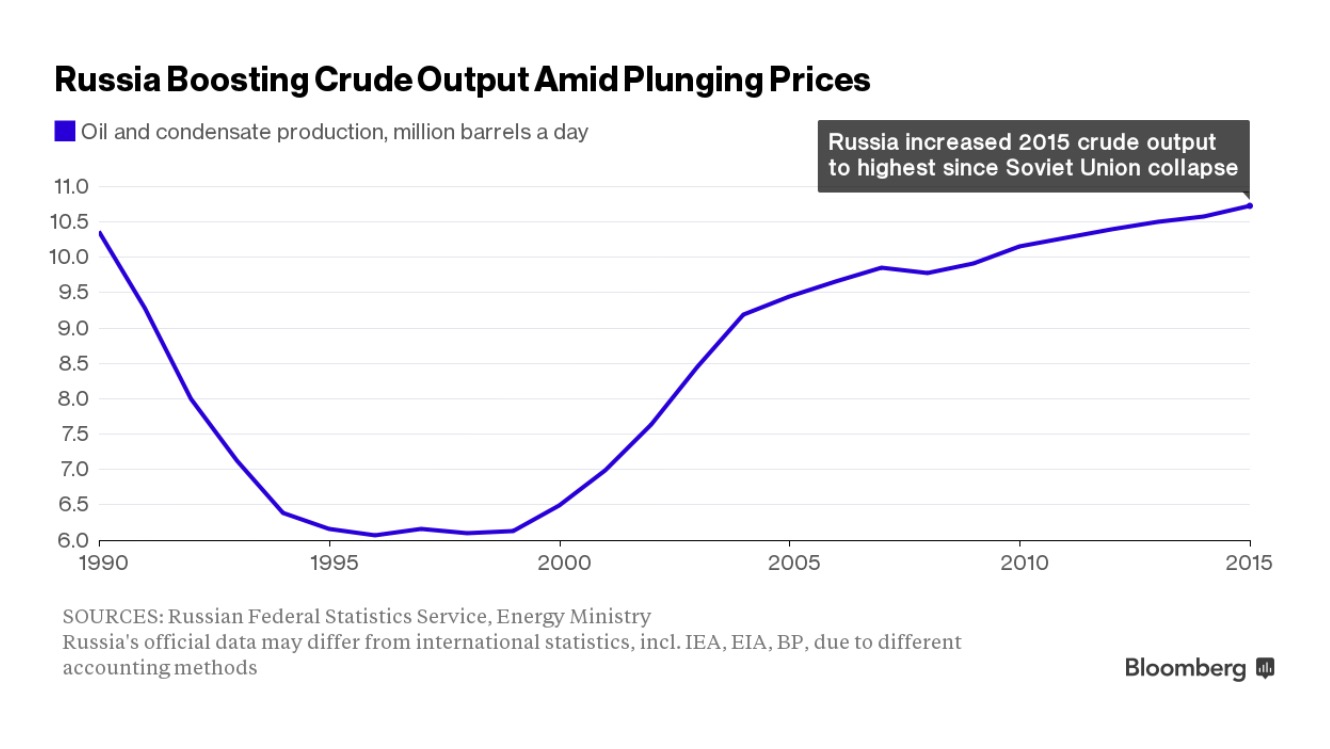

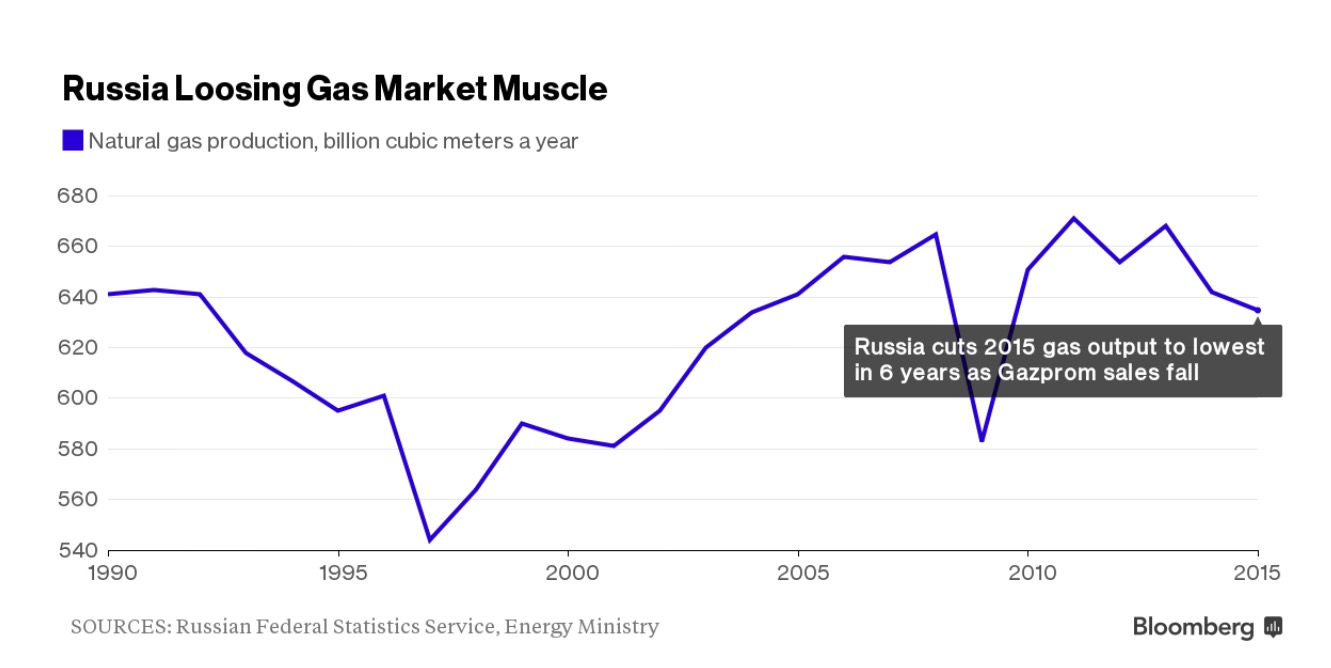

Crude is up a little more than 2%, after Saudi Arabians embassy in Tehran was attacked and burned by “students.” As a result, the devils inside the House of Saud expelled Iranian diplomats, gave Obama the middle finger, and severed relations with Iran.

“The Saudi situation is, geopolitically, not good news,” said Kengo Suzuki, chief currency strategist at Mizuho Securities Co. in Tokyo. “Still, if oil prices stop falling, that may underpin commodity-related currencies and stocks. So we’re watching whether markets will be dominated by a risk-off or risk-on mood.”

More importantly, champagne sales hit a new record in 2015, surpassing the old record set in the go-go days of 2007, when homeless men refinanced the mortgages on their new Mcmansions and used some of the proceeds to buy the very best French bubbly.

Industry estimates gathered by Reuters showed that about 312 million bottles of the prestige sparkling wine will have been dispatched in 2015, a rise of between 2 and 3 percent from 2014.

Revenue has risen 4.4 percent to 4.7 billion euros in 2015.

In 2007, the record year so far, revenues reached 4.56 billion euros, before the global economic and financial crisis began weighing on the market a year later.

There are so many anecdotal warnings out there, it’s crazy.

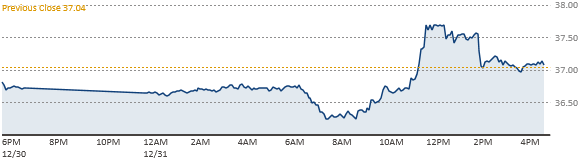

Futures are marginally higher.

Comments »