Shares of Facebook are sharply higher after demolishing earnings expectations. They did, however, hedge the fantastic numbers with a little sandbagging, pointing to FX headwinds and hard year over year comps.

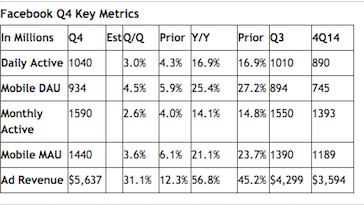

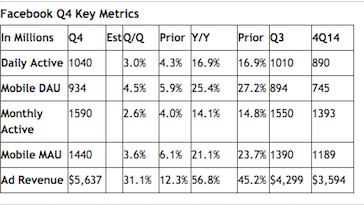

Facebook prelim Q4 $0.79 vs $0.68 Capital IQ Consensus Estimate; revs $5.84 bln vs $5.37 bln Capital IQ Consensus Estimate

Despite the stock trading above 30x 2016 earnings and 15-17x sales, depending on estimates, it is the only game in town, if you’re interested in having exposure to the seemingly endless horde of zombies–stuck to their phones like fucking imbeciles–crashing their cars into walls of stone, just so that they could heart an instagram picture or like someone’s inane Facebook status.

Notes from call (via Briefing.com)

Top 100 advertisers who advertised on Facebook also advertised on Instagram.

In Q4, the average price per ad increased 21% while total ad impressions increased 29% y/y; first quarter since Q3 2013 that total ad impressions increased on a y/y basis; driven by an increase in mobile ad impressions and was partially offset by decline in ad impressions delivered on personal computers consistent with the ongoing declines in PC usage.

In Q4 we also benefited to a lesser extent from increases in ad inventory from Instagram and the Audience Network.

Expect to continue to see FX headwinds, especially in 1H due to tougher comps.

Faces tougher comps given strong 2015 performance.

2016 is another significant investment year for FB

Expect y/y expense growth rate to be GAAP 30-40%; Non-GAAP 45-55% y/y

CapEx to be in the range of $4.0-4.5 bln;

Building a new data center in Ireland

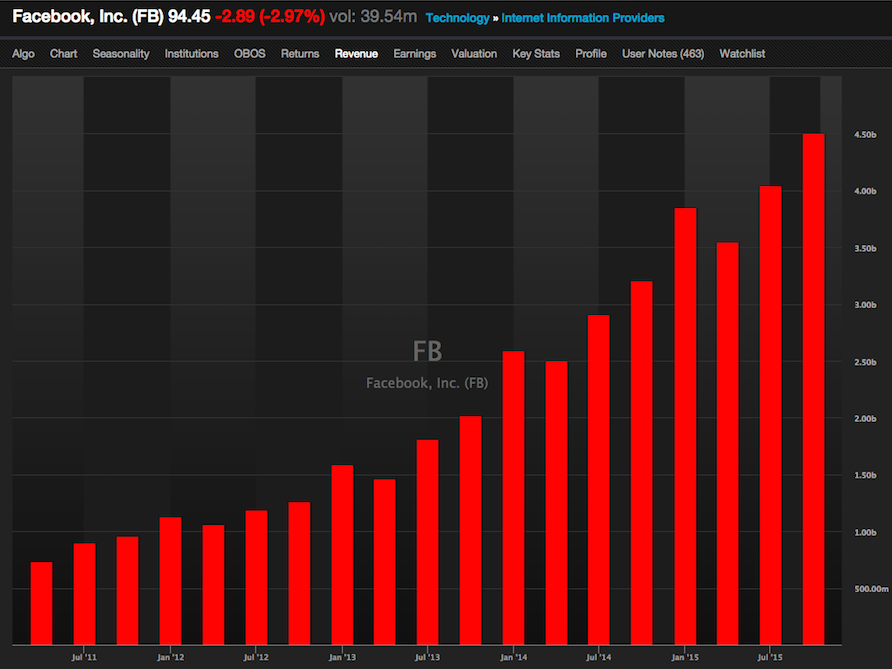

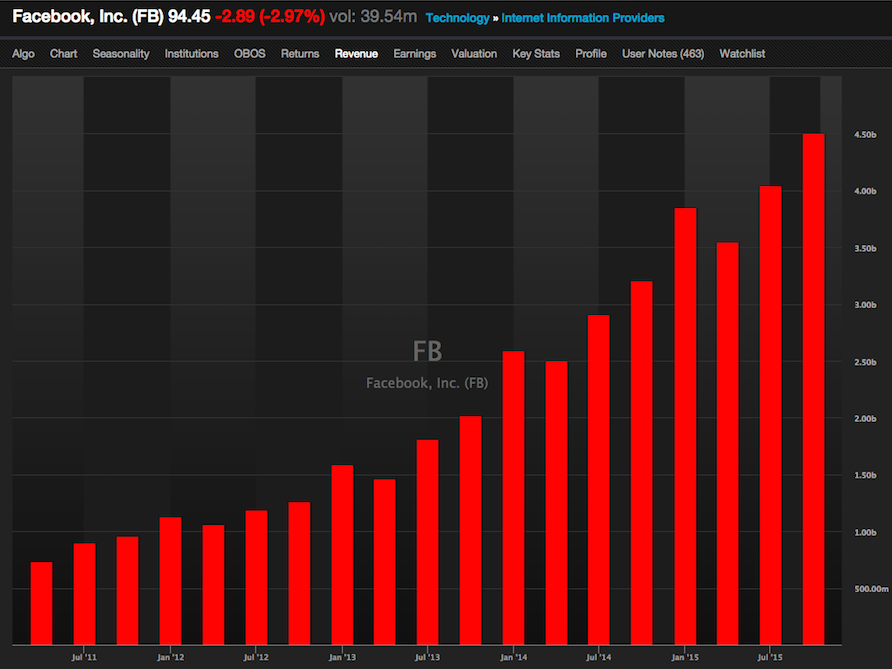

Sales and earnings have gone parabolic.

With a market cap well over $200 billion, Zuckerberg has proven, once again, that the Winklevoss twins were right to have entrusted him with such a revolutionary idea, many years ago. The social network is alive and well, providing law enforcement authorities with the intel they need to toss careless criminals into raping prison cells for boasting about their heinous crimes on the platform, as well as entertaining a wide swath of people–whose dreary lives are made infinitely worse by seemingly perfect people posting pictures of their wonderful lives, happy and joyful, for the explicit purposes of attaining a faux popularity through arbitrary expressions of passive approval.

Long live Tsar Zuckerberg.

Comments »