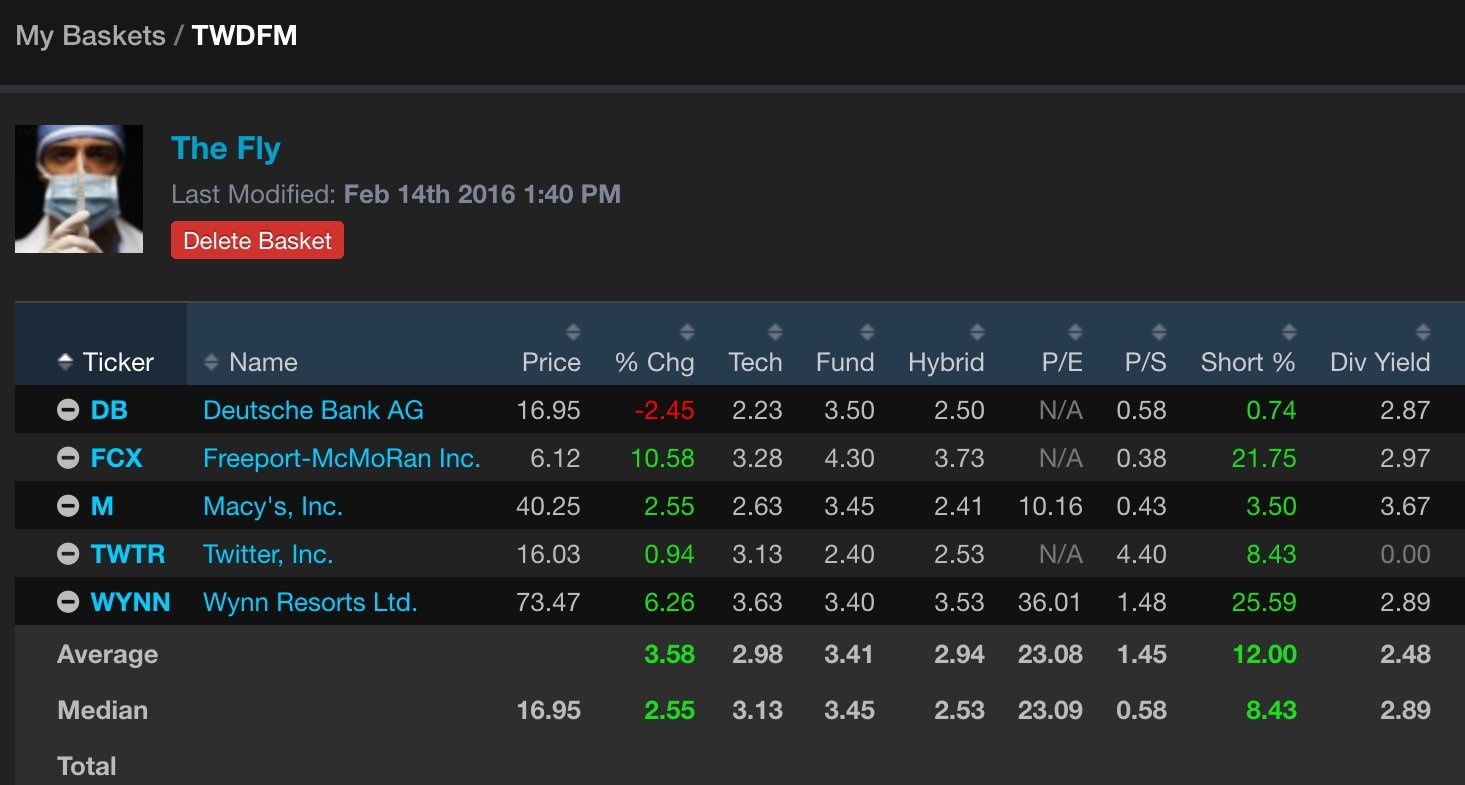

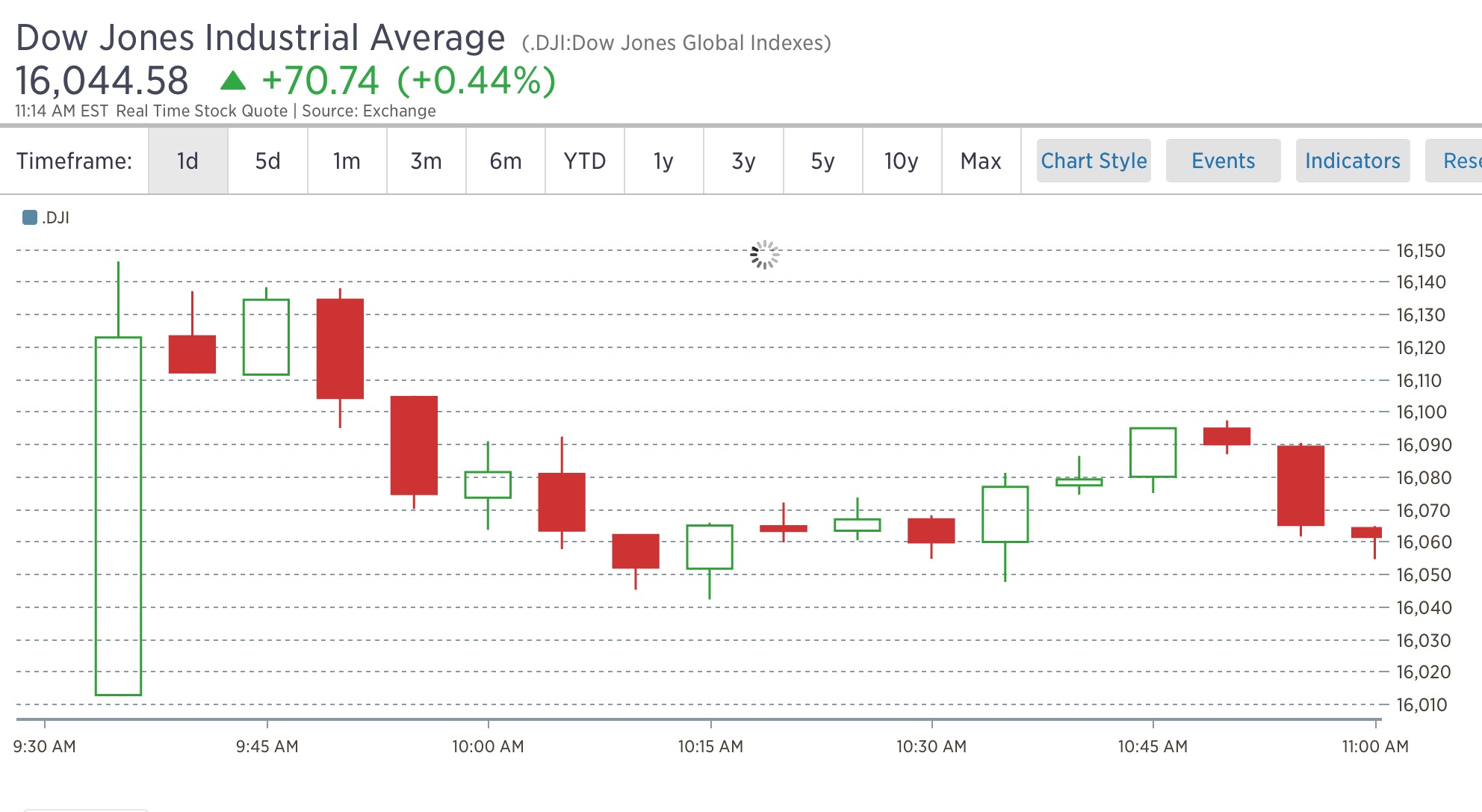

Add Deutsche Bank and UBS to the list of investment banks out with research notes today, attempting to create a panic amongst short sellers. I find it interesting that these notes are coinciding with a much more effervescent market, if you will.

The Deutsche Bank notes is, essentially, suggesting the bear case for systemic risk due to oil collapse is completely without merit and that the US labor market is very robust, hardly a harbinger of recession of significant broad economic slowdown.

“The bears have a problem,” asserts Torsten Sløk, chief international economist at Deutsche Bank. “The problem is that the challenges in the energy sector are not spilling over to the broader economy and the macro data is not deteriorating.”

Growth in consumer spending may not be as robust as hoped, but it’s also nowhere close to recessionary levels. And the labor market hasn’t rolled over, either.

“Since 1960, the median increase in the unemployment rate in the year before a recession is 0.4 percentage points,” wrote UBS Deputy U.S. Chief Economist Drew Matus. “The past year has seen a drop of 0.8 percentage points.”

“The Federal Reserve Bank of Atlanta is tracking 2.7 percent for Q1 GDP on the back of strong consumer spending,” added Neil Dutta, head of U.S. economics at Renaissance Macro Research. “Ex-trade and inventories, the two most volatile sectors of the GDP accounts, real GDP is tracking 2.8 percent. Yep, call in the IMF.”

Meanwhile, the epicenter of the bear case for the U.S. economy—a general, across-the-board decrease in credit provided to businesses and consumers—has shown no signs of materializing.

On the contrary, UBS’s Matus tracked core bank loan growth (a composite of commercial and industrial, mortgage, and consumer credit flows) and found that rather than decelerating amid the crumbling commodity complex and swelling credit spreads, loan growth has been picking up steam:

“Core bank lending also does not suggest we are close to recession,” he explained. “Typically core bank loan growth decelerates heading into a recession on both a 3- and 12-month basis.”

“In plain English, the reason why we are seeing no signs of a slowdown in bank lending or consumer borrowing is likely that the losses in the energy sector are not located inside the banks but instead among investors globally, which have essentially no leverage and are well diversified, and hence much better able to shoulder energy sector losses,” he wrote.

Naturally, these analysts aren’t taking into account the fact that a vast amount of unprofitable oil producers are still alive, only because of access to cheap capital and that those spigots, once turned off, will yield an indelible decline in economic activity and a spate of joblessness in oil rich regions. Moreover, we haven’t seen a large amount of oil centric debt mature yet, which is scheduled to occur after 2016.

In short, these notes, while not entirely false, are merely trying to evoke panic in shorts to perpetuate a squeeze. There’s a lot of bad blood between Deutsche Bank and short sellers, especially since the bank has been singled out as “the Lehman of this era”, broadly derided for its China and energy exposure, amongst other things.

I imagine if Janet Yellen were to write a research note, it’d sound almost exactly like this.

Comments »