This shall forever been known as the ‘night of the long knives’ in red, hell, communist china.

Moody’s went buck wild this evening and slashed the credit ratings for dozens of Chinese state owned businesses, 38 in total.

“The negative outlook revision on both the Chinese sovereign and banks is not a huge surprise as the challenges that China is facing are well flagged,” Nicholas Yap, a credit analyst at Mitsubishi UFJ Securities HK Ltd. in Hong Kong, wrote in a report. “We expect the near-term impact on yield spreads to be relatively muted.”

Amongst the prominent companies cut include China Mobile, ICBC, Bank of China, Citic Group, China State Construction, China metallurgical and many others!

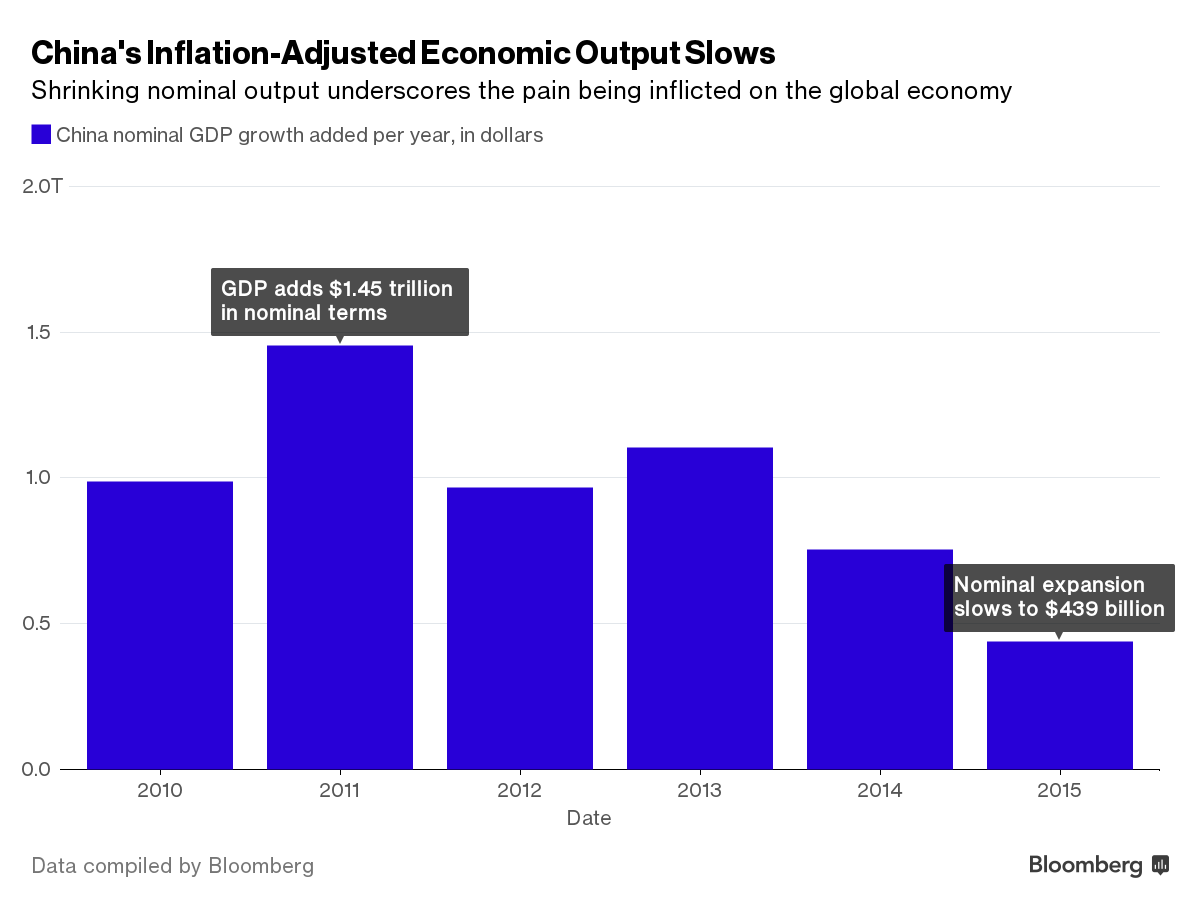

Moody’s cites China’s 247 debt/equity levels, coupled with the capital flight that is pervasively infecting the Chinese economy and forex markets as the main drivers for the downgrades.

Comments »