Towards the end of 2015, I made a well thought out decision to take a break from the depraved world of money management. Having done it all of my life, and made millions along the way, I felt myself getting burned out, cynical at every turn, completely and thoroughly spent from the emotional roller coaster of having to be responsible for the wealth of so many people that I cared about. For me, the market was no longer fun and I didn’t like the forecast for 2016 and beyond.

I didn’t sell my practice or try to gain one last monetary benefit from the fantastic clients that I’ve had since entering the business back in the late 90s. Simply stated, I woke up one day and decided this was something that I had to do. I explained it as best I could to clients and friends, who took me for a lunatic–walking away from an easy paycheck for the grindhouse life of being a fucking blogger. As you can see by the additional work load I’ve been putting into the site, I have some spare time on my hands and there is nothing that I like doing more than talk shit and trying to help others navigate the murky waters of Wall Street.

Truth is, in spite of the fact that I’ve voluntarily axed my annual take home by more than 75%, I haven’t been this happy in centuries (The Fly is immortal).

My current thinking on the market goes like this. We are in a mini-bull market and emotions are running high. Very soon, people will be walking around the streets naked, or thinly robed, with jars of incense chaperoning their every step, eating grapes and enjoying a life of wanton hedonism. Market tops are always marked this way. It’s natural to get sucked in towards the top. That’s why it’s so hard to time tops. The only way to avoid getting suckered into the drudgery is to remove yourself from the system.

Hear me out. If you’re buying and selling high beta stocks, you’re gonna end up blowing up. It might not be today, or tomorrow. But rest assured, it will happen. A vast majority of the people I know believe the market is rigged. They don’t really believe the economy warrants a never-ending bull run; but they play the game nonetheless–because they’re addicts.

My trading philosophy for 2016 is to utilize the system and algorithms that I created in Exodus. With myself dedicated to trading Exodus exclusively, it gives members a birdseye view, or a better understanding, how the system could be utilized. Like all things that are easy, I have a penchant for making them hard.

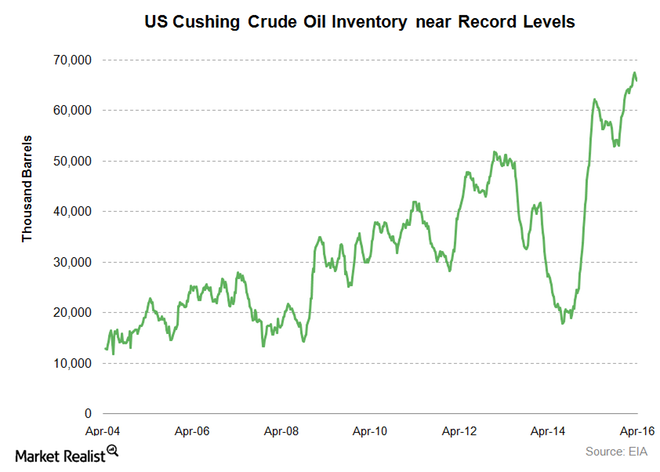

I was only supposed to trade the SPY oversold this year. Instead, at the open of trade tomorrow, I will be concluding my final short sale of XLE–putting me into a ludicrous 175% short position on big oil. My risk is mitigated by the time in which I am permitted to hold the position, which is 10 trading days. Nevertheless, I find it somewhat humorous, in a money losing sort of way, how I fixed myself into a fucking pickle jar without even trying.

My methodology is to stagger 25% positions with each overbought signal. Clearly, we’ve been on some demonic run higher, which is lighting shorts on fire. Nevertheless, my basis is $64.02; and after tomorrow’s final purchase, it will be a tad bit higher.

My opinion on the market is very poor. This house of cards will begin to unravel, in earnest, in approximately one week hence.

Comments »