Why do people insist on being right, while everyone else is wrong? I can comfortably say the number 1 reason why people blow up their accounts is due to being a contrarian. Fuckers get wrapped up in the glory of making a once in a lifetime call, motivated by fuckhead movies like Margin Call or The Big Short, or Jim Fucking Chanos, and instead end up blowing themselves up in a feeding frenzy process of self-mutliation.

The number one rule when trying to make money in the market is to follow trends. That’s right, fuckheads — the market is efficient and filled with people like me who know more and have access to information that most people don’t and have dedicated their lives to the art of investment management. Do you really believe that you’re gonna ‘outsmart’ the vast majority of professionals on Wall Street because you’ve got a hunch?

Let’s face it: with the Fed put off the table, the financials are fish in a barrel. Fuck what some of you inflation hatfuckers have to say, we are too tight. The economy is not strong; therefore, rates need to be in the 3-3.5% range.

As you know, the homies, mortgage, mortgage insurers, brokers, regional banks and a variety of money center banks are getting the shit kicked out of them. All of them are intertwined in creating one of the worst banking fuck-ups– in the history of modern banking.

The short sellers have been making a bundle, betting against these fuckers–with the exception of a select few brokerage stocks.

My short list of potential ‘going to zero’ plays are: RDN, BSC, COWN, TWPG, CLMS, ETFC, CNS, MCGC, NFP, SF, AIB, ESGR, IHC, MGI, RAS, ACF, CCRT, CFC, PMI, ABK, MBI, TGIC, FPIC and RWT.

Now, I know that is a fucktardly long list. Pick and choose your spots.

Look, the financials represent the largest part of the S&P 500. With earnings being slashed and burned, the overall PE of the market is going up. Plus, let’s not forget how fucked the consumer is, with their only source of income (house) in the shit box.

This is how I view the 10 principal sectors of the S&P 500:

Financials: Fucked. Their only hope is renewed Federal Reserve cuts and a short squeeze.

Healthcare: Biotech is a major dice roll. I hate those little time bombs. Additionally, with an election around the corner, I’m afraid the healthcare industry will be the whipping pole for many democratic candidates. The only safe haven is established pharma’s, like GILD, MRK or PFE. Also, some of the cost containers, like MHS, may thrive.

Industrials: The only stocks that can work are companies that derive most of their business overseas and benefit from the wheelbarrow dollar, or who offer machinery and/or services to the booming agriculture industry. Stocks like VMI, LNN, AGU, MON, BG, POT, DE, ITT, FLR, JEC, FWLT, PCP, BA and BEAV should continue to do well. Also, it appears the military sector will not suffer, even under the Dems. There, ATK, GD, LMT, NOC and RTN look solid.

Consumer Discretionary: This is where the wild card lays. Either the consumer is dead or she received a new, shiny credit card in the mail. Thus far, looking at restaurant and clothing stocks, the consumer is dead and buried. Let’s see if she can dig her way out of that grave, in order to buy a few more pairs of plastic slippers with holes in them. The only stock I have confidence in, long term, is HANS–due to its low priced product and loyal customer base. However, looking at M, VLCM, BWLD, CROX, SBUX, HD, AEO, PERY, CACH, RL, ARO, GES, COH, CTRN, BEBE and KSS, I’d say the market is screaming recession. If not, all of the above names can quickly recover 20%.

Consumer Staples: Stocks like CL, PG, CLX and UL have survived many recessions– and are durable. Recently, I sold out of my PG, due to valuation. However, I still own CLX and will add to the position, especially if the market gets worse.

Materials: If you believe in the retarded ‘global growth’ story, this is where you buy. Stocks like BHP, FCX, RS, CENX, PCU, amongst many others, should thrive for years, providing ‘Chindia’ keeps growing. However, the sector is subject to extreme volatility– and should never be bought on margin, if you enjoy life with green paper that have ugly faces on them.

Energy: Oil at $90+ and gasoline under $3.00 has fucked the refiners. Stocks like ALJ, VLO, TSO, HOC, WNR and DK will not breakout, until this paradigm alters in their favor. For now, service companies, like NOV, RIG, GHM and DRQ, should continue to receive a lot of hot money. Additionally, the solar stocks have been on fire, as investors hope and wish for energy alternatives. I am not sold on solar. LDK should be a lesson to you solar fools. Watch those yields and silicon quality. Finally, natty may make a move here, with China saying natty is ‘seriously cheap.’ I have some clients in the industry– and they have been shutting in supply for two years. My guess, with a cold winter, natty may hit $10–sending UNG, SWN, GMXR, NGS, NGAS and BEXP higher.

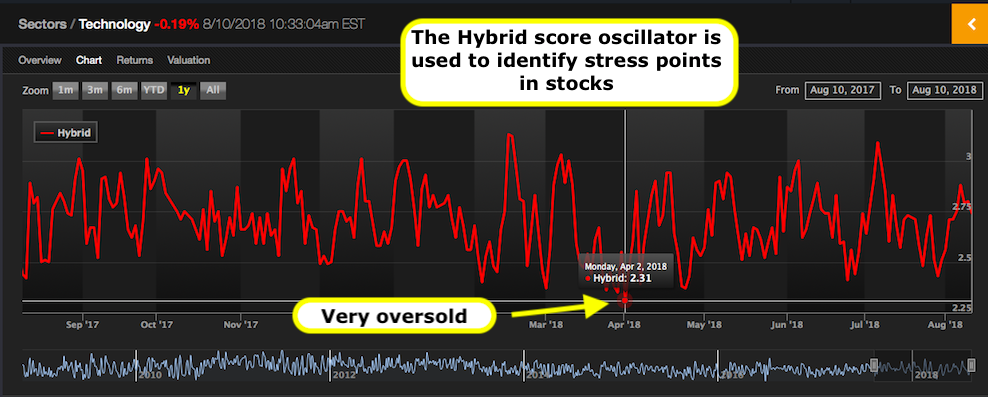

Technology: Tale of two cities. The semi’s are being squeezed, with the exception of the ones who do the squeezing, like INTC. Also, having clients in the field, I understand extreme bullishness in INTC may be a profitable endeavor. However, the rest of the SOX cannot be relied upon. For the most part, good tech revolves around a select group of stocks, like AAPL, CSCO, RIMM, EQIX, CIEN, GRMN (on pause), AMZN, CTRP, PCLN, OSTK, MFE, GOOG, BIDU, SINA, SOHU, NTES, SNDA, ERTS, HPQ, MSFT, NOK, NVT, VMW, EMC, WFR, STX, WDC and a few others.

In short, it’s a stock pickers tech sector.

Utilities: With rates coming down, the utilities may thrive– thanks to rich dividends. Not really giving a fuck about the sector, I can tell you OKE, CPL, EN, D and GXP look decent.

Telecom: Another treacherous sector, if you’re not careful. For a long time, NIHD was as good as gold– not anymore. My favorites are foreign telco’s, where growth still exists. CN, CHL, CHU, VIP, TKC, MBT, ROS are favorites. Domestically, I am lukewarm on VZ and T. Finally, USM seems to be kicking ass and is a takeover target.

In summary, this market, like many others in the past, is riddled with potential pitfalls. However, much of the fucked up stuff is already reflected in the share prices. Forget about where the DOW is trading. Look at the sectors that are in the eye of the storm, like retail, financials and home builders. They’ve been annihilated to the point where mass bankruptcy looks imminent.

Anything that helps the consumer, such as tax or interest rate cuts, will make the short sellers regret living. On the contrary, should our fucktarded politicians go gangster on China, hike taxes and fuck with our cheap labor pools, pack up boys and go home; we’ll be at 9,500 DOW by 2010.

Place your bets.

I wasn’t special for being able to see what was in front of my face. My opinions were guided by price action, not some pre-conceived notion of what stocks should be doing. Before the credit crisis ended in 2009, I had switched my bias a few dozen times, sometimes bullish, other times end of the world bearish. I recall, explicitly, banking immense coin during the depths of 2009, laying down on my couch with a hoodie over my head, depressed because I thought western finance was about to end. All of the money I had been making was meaningless, since said dollars were soon to be worth less than garbage. Anyone who was careful back then, as I was, took tens of thousands out of the bank and into the house safe, bought physical gold, and kept the garage filled with dry goods. That’s how fucked up the credit crisis was — it made the winners feel like losers too.

This post is motivated by the endless parade of people that I know or come across in life who tell me they’ve blown up their accounts — betting on an option trade, or some sort of hare-brained scheme to get rich, whilst everyone else becomes poor.

Please, for the love of everything that is scared on this planet (dogs, coffee, alcohol, meat, beaches) STOP TRYING TO OUTSMART EVERYONE AND GET RICH OVERNIGHT. The odds of you accomplishing this task is infinitesimal. Instead of partaking in bad habits, such as being a know it all fuckhead, here are some things that might help your trading and your lives, making it a more comfortable environ for you and the people around you.

Happy Sunday lads, lassies. Now go cook a grande Sunday meal and prepare for Monday’s trading wins.

Oh and fuck Jim Chanos.