I don’t know how best to communicate this to you, other than to strongly advise that you look at nothing else but SAAS stocks. For a while, I was a skeptic too, unfamiliar with the business process and how these companies continued to grow, seemingly unabated, without even a semblance of free cash flow generation. But, after maybe 100+ hours of intense research, listening to countless lectures and podcasts and reading reports and articles, I can comfortably say that SAAS is the single best industry to invest in since the invention of the internet (marks top in SAAS now).

Stop thinking about SAAS as tech and instead view them as the best sales teams in America armed with NSA grade spying data that is used to hack the human mind and grow sales. They know what you’re doing at all times and they’re watching you, ever so creepily.

They understand what colors appeal to you best, how to write an email to a prospect, and what verbiage to use to get you to take a free trial (BTW: Exodus is doing free trials). Once you’re in the free trial and have expanded their sales funnel, they know how to onboard you to convince you to subscribe. Once you’ve subscribed, using advanced software, which is also SAAS, they’re monitoring you closely to make sure you’re getting maximum value out of the product. If your behavior changes, one of their customer success reps will immediately contact you, in an effort to prevent churn. After you’ve been a happy customer for a period of time, they up-sell and cross-sell you into various services, in order to increase their MRR (monthly recurring revenues), and to help you grow your business using their software.

This subscription model is used by all of the best companies in the world, from Amazon to Netflix, down to companies you’ve never heard of. But they’re growing very fast, hiring a ton of people, and have been backed by the very best VCs in America.

Right now a good SAAS company, growing at 10% per month, with churn less than 3% per annum, fetches 30x sales. In order to become a unicorn, all you need is ~$30 in sales. Is that nuts? Maybe, maybe not.

The sales process and revenue projections at the top SAAS companies are, by definition, predictable because they are repeatable. They know how much revenues each sales rep will generate and they know how long it takes to train each rep to become successful. They understand that by investing ~$1m in the business can product $10m in sales, inside 18 months.

I can go on for another thousand words discussing how well positioned these companies are in today’s enterprise migration cycle. However fantastic their prospects are, there will be downticks and panics, so be mindful of that. These companies are premium valuations because smart money owns them in size and expectations are very high. Should they falter, the subsequent drops will be heinous.

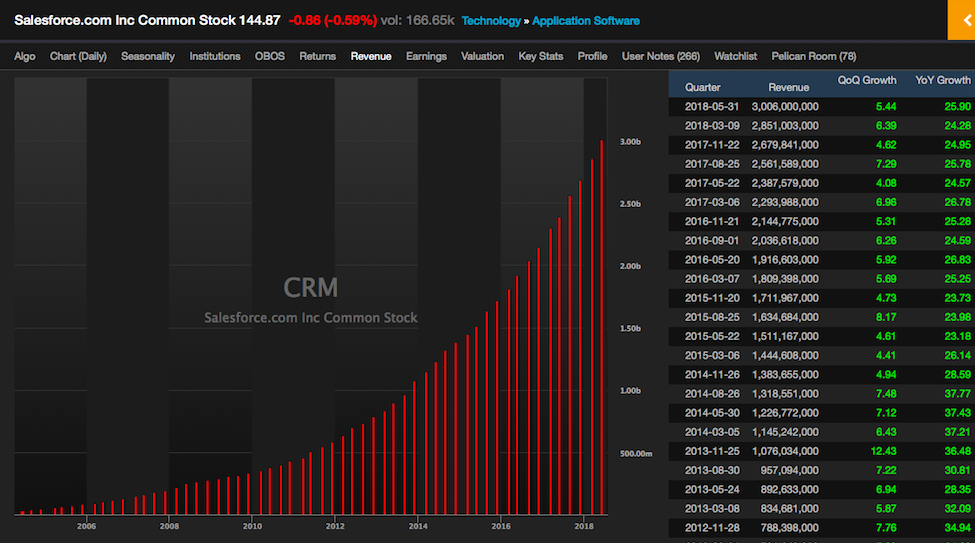

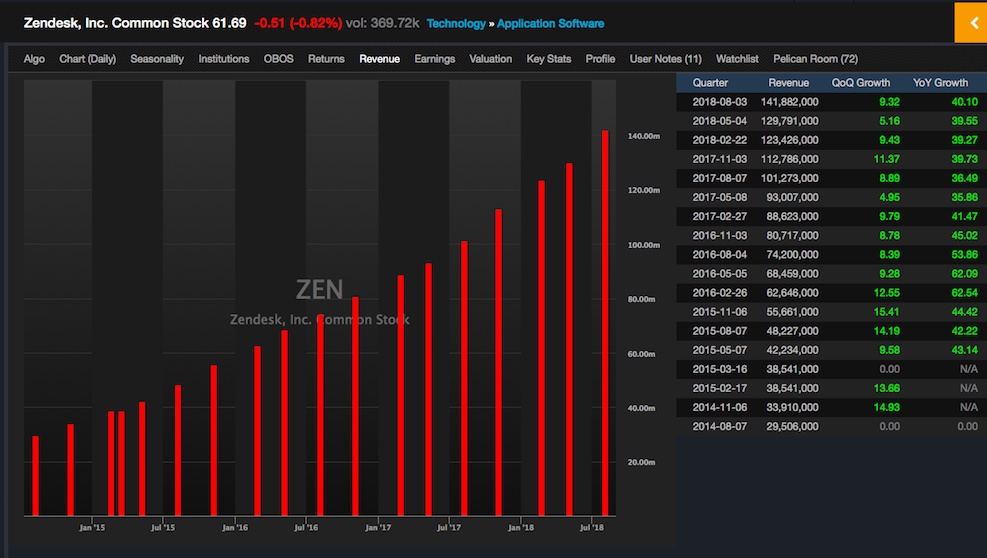

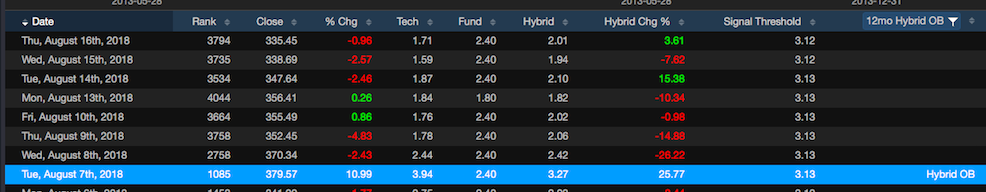

This is what we’re looking for in a SAAS company, in terms of repeatable and consistent revenue growth.

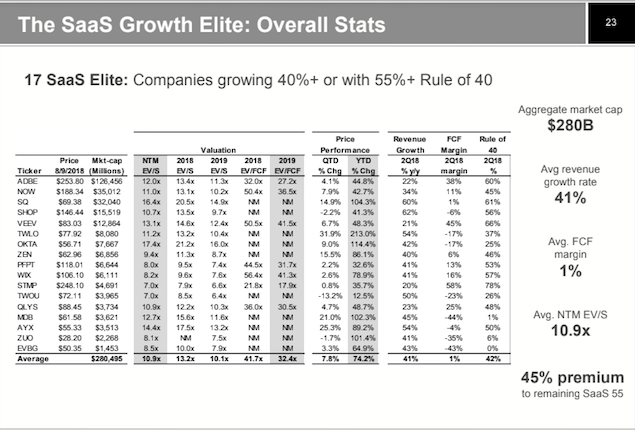

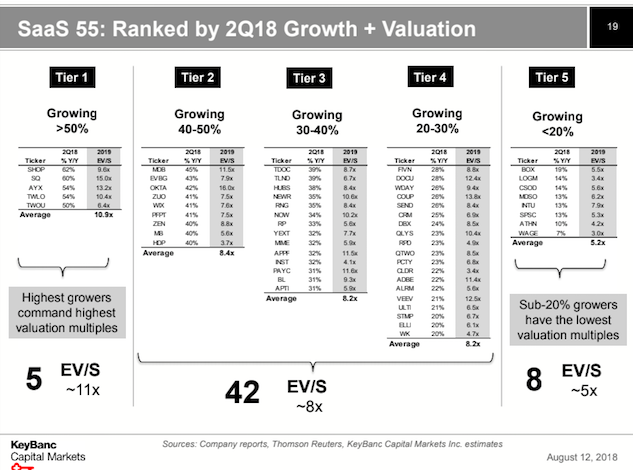

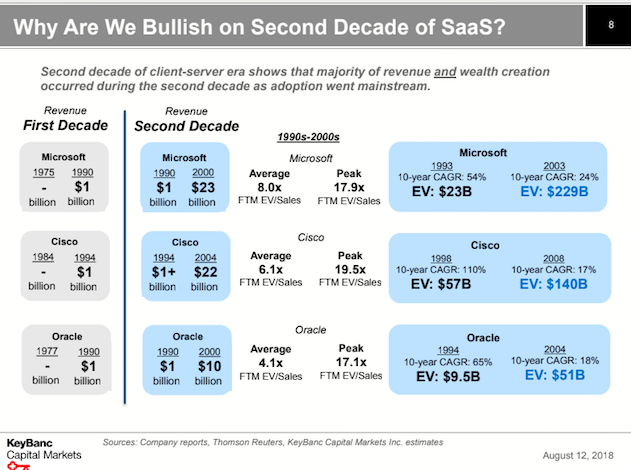

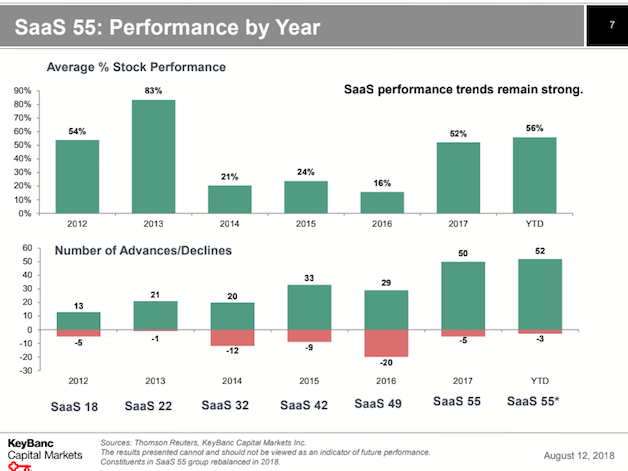

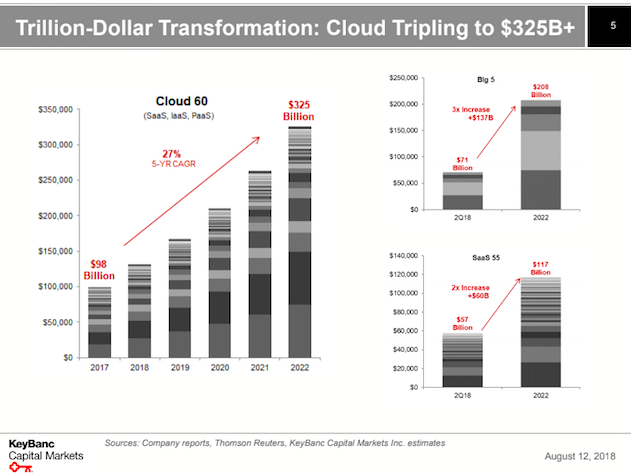

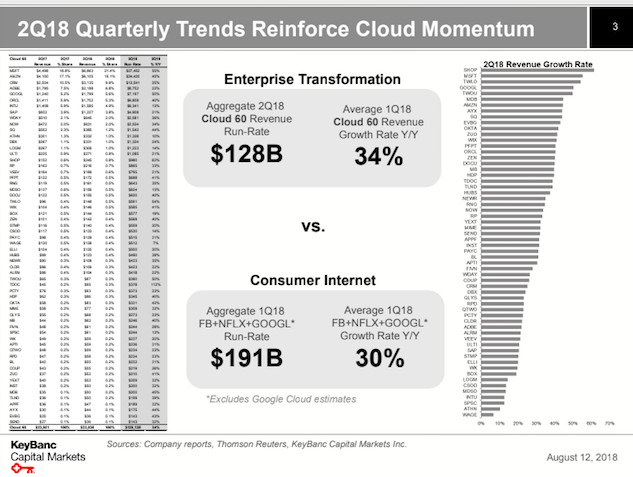

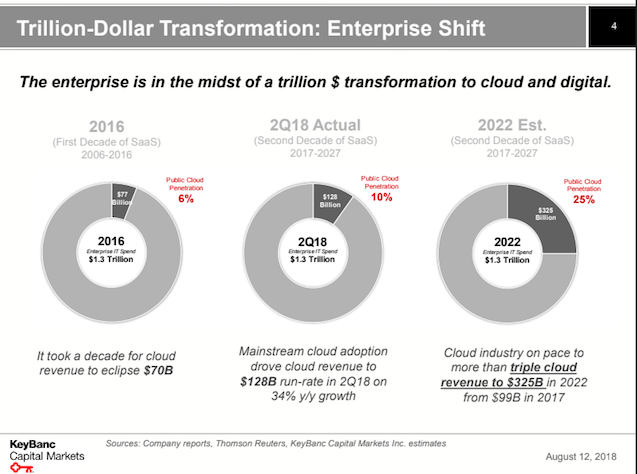

And here is a fantastic data dump by Keybanc, explaining why this sector is to be owned — briefly glossing over the fact that enterprise (big business) is in the process of a great cloud migration and how the second decade in SAAS should create vast amounts of wealth, as the industry goes mainstream. Remember, big business wants to help their sales people be more successful and they want to streamline their IT projects, and reduce costs if possible, by outsourcing by subscription to software that costs a fraction of what it might cost for them to create internally.

My advice to young kids coming out of college who are unsure what to do with themselves: become a software salesman.

Want to know more about SAAS? Listen to the CMO of MongoDB describe their process.

David Skok

Jason Lemkin

Enjoy your Saturday.

Comments »