Back in 2008, I gave Bill a lot of flack for being retarded. I even co-produced an Asshat of the Year Award video in an attempt to ruin his life.

But Bill is back on top again, hot shit, running money like a god damned gladiator.

His picks, while somewhat simple and retarded, ended up being pure gold.

The money manager gained 49 percent in the past year following a disastrous stretch. That’s made the Miller Opportunity Trust No. 1 for the year ended June 30 among diversified funds with at least $1 billion in assets, according to data compiled by Bloomberg. In the year-earlier period he lost 27 percent.

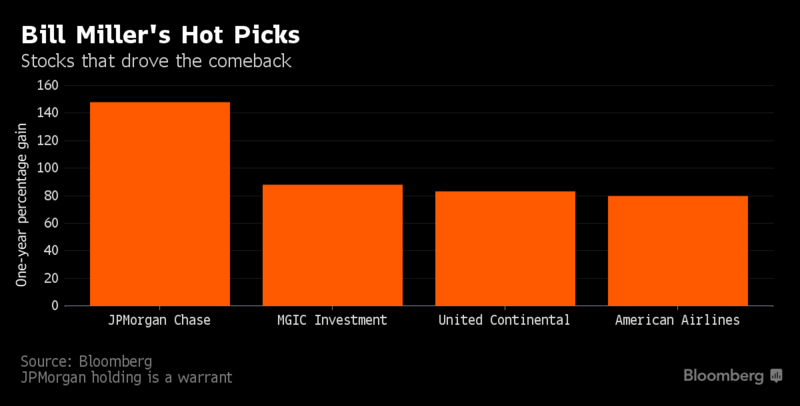

Best known for beating the S&P 500 for 15 straight years, Miller prospered by picking beaten down securities in industries including retailing, financials and airlines. The $1.5 billion fund’s biggest holding, retailer RH, owner of Restoration Hardware, has more than doubled in 2017. A JPMorganChase & Co. warrant is up more than 100 percent over the past year. MGIC Investment Corp., which provides mortgage insurance, gained 88 percent over 12 months while United Continental Holdings Inc. climbed 83 percent.

“A year ago people were worried about a slowdown or even a recession,” Samantha McLemore, Miller’s long-time co-portfolio manager, said in an interview. “We looked at a lot of our holdings at the time and thought they represented great values.”

Miller, 67, became one of America’s most prominent money managers during his streak at Legg Mason Value Trust, which was snapped in 2006. He stumbled badly during the financial crisis, losing 55 percent in 2008, triggering major redemptions. The forerunner of his current fund, Legg Mason Opportunity Trust, lost 65 percent in 2008 and 35 percent in 2011.

Miller, who ended his longtime affiliation with Legg Mason in February, said his troubles in the down years were the result of investor fears about the global economy. “When it is all macro, we do poorly,” he said in an interview last July.

McLemore said she and Miller don’t share the widely held view that stocks are overvalued. “The overall direction of the market is up until we reach a point of extreme euphoria,” said McLemore. “We are a ways from that point.”

Ask yourselves this question: are you better than Bill?

The answer is ‘no’, fucked faces

“Miller, who ended his longtime affiliation with Legg Mason in February, said his troubles in the down years were the result of investor fears about the global economy. “When it is all macro, we do poorly,” he said in an interview last July.”….he also didn’t mention that his stock picks sucked. Now luck has smiled at him with some monkey/dart throwing picks and now he’s a hot shit? Yeah, mebbe.

Great, now I’m contemplating hitting the convert everything to phyz, crypto and cash button for the summer. Where are you when I need you, gartman?

Pedos do not look like pedos. And never have yachts. That float around in “international” waters. Never happens. Ever ever.

Throw in Marty Armstrong and you’ve got a hat trick.

Classic vintage!