Now that Donald J. Trump is scheduled to drop out of the race, paving the way for our first lesbian President, everything that was once doom and gloom is great again, ironically. The stock market is gearing up for splendour. All of the bearshitter across the universe, dispatched. Everything you knew about markets, lost.

Earlier this morning, Macy’s announced their strategy to sell clothing to people was a bad idea. Instead, they’ll be closing 100 stores and focus on real estate and stock buybacks. Shares soared.

After the close, Nordstrom announced phenomenal numbers, which were 11 cents better than expectations. Although revenues declined 0.2% from last year, the shares are soaring in the after hours.

- Reports Q2 (Jul) earnings of $0.67 per share, excluding non-recurring items, $0.11 better than the Capital IQ Consensus of $0.56; revenues fell 0.2% year/year to $3.59 bln vs the $3.62 bln Capital IQ Consensus.

- Return on Assets 5.1%, Q1 was 5.9%

- RoIC 9.1%, Q1 was 10.0%

- The Company’s Anniversary Sale, historically its largest event of the year, performed better than recent trends. This event started one week later in July relative to last year, shifting one week of the event into the third quarter.

- Total Company net sales decreased 0.2 percent and comparable sales decreased 1.2 percent, compared with the same period last year. The Anniversary Sale event shift had an unfavorable comparison to comparable sales of approximately 250 basis points in the second quarter.

- Gross profit, as a percentage of net sales, of 34.3 percent decreased 101 basis points compared with the same period in fiscal 2015, due to increased markdowns to align inventory to current trends and higher occupancy expenses related to new store growth. Through the Company’s actions to realign inventory and combined with the strength of its Anniversary Sale, inventory growth of 1.4 percent was in-line with a net sales decrease of 0.2 percent.

- Co issues guidance for FY17, sees EPS of $2.60-2.75 (Prior $2.50-2.70), excluding non-recurring items, vs. $2.68 Capital IQ Consensus Estimate; sees FY17 revs of +2.5-4.5% (Approx $14.45-14.73 bln) vs. $14.59 bln Capital IQ Consensus Estimate;

- Reaffirms FY17 Comp Store Sales expected to be in the range of -1% to +1%.

- Retail EBIT expected to decrease 10-15% (Prior 10-20%).

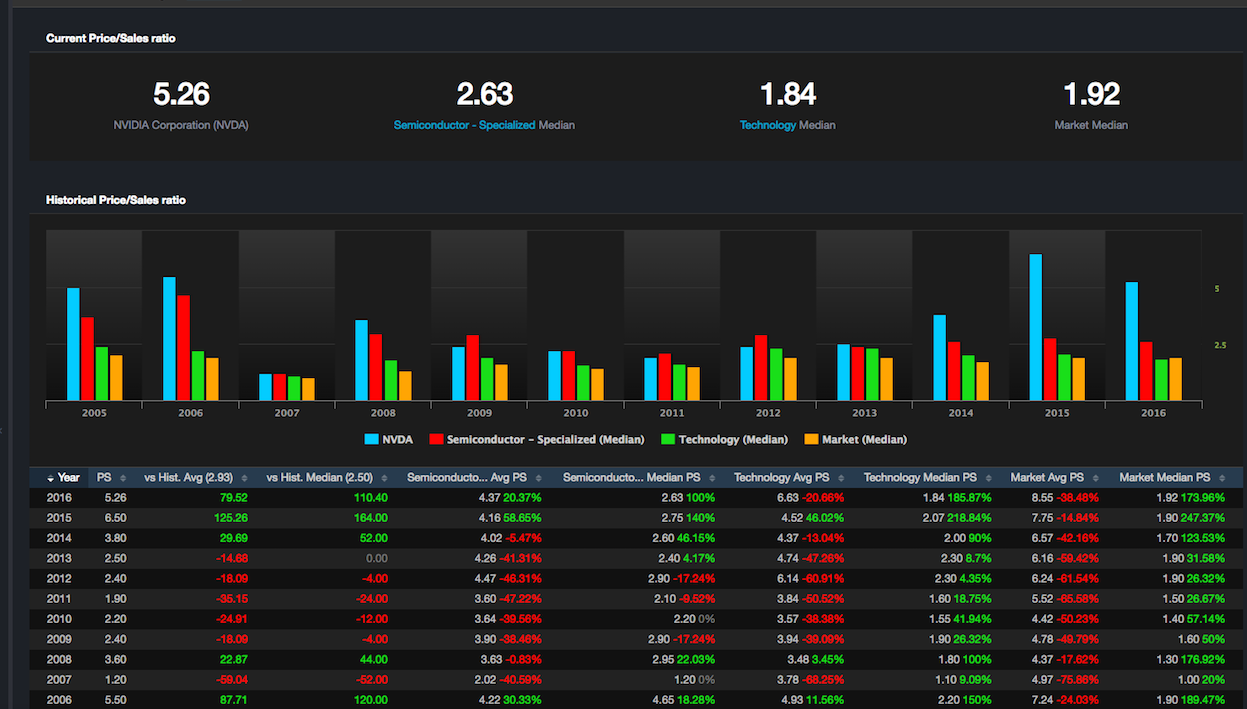

Additionally, olde school semiconductor company, NVDA, crushed estimates–continuing its onward streak. The stock is higher by 90% for the year. Not a bad showing, all things considered. According to Exodus, the valuation metric haven’t been this high for over a decade. The price/sales, PE and price/book metrics have all blown out, currently 110% over the historical median.

- Reports Q2 (Jul) non-GAAP earnings of $0.53 per share, $0.05 better than the Capital IQ Consensus of $0.48 (GAAP EPS $0.40 vs. 0.38 consensus); revenues rose 23.9% year/year to $1.43 bln vs the $1.35 bln Capital IQ Consensus.

- Non-GAAP gross margin 58.1%vs. 57.5-58.5% guidance.

- Co issues upside guidance for Q3, sees Q3 revs of ~$1.65-1.71 bln vs. $1.45 bln Capital IQ Consensus; non-GAAP gross margin 57.5-58.5%.

- “Strong demand for our new Pascal-generation GPUs and surging interest in deep learning drove record results,” said Jen-Hsun Huang, co-founder and chief executive officer, NVIDIA. “Our strategy to focus on creating the future where graphics, computer vision and artificial intelligence converge is fueling growth across our specialized platforms — Gaming, Pro Visualization, Datacenter and Automotive.” “We are more excited than ever about the impact of deep learning and AI, which will touch every industry and market. We have made significant investments over the past five years to evolve our entire GPU computing stack for deep learning. Now, we are well positioned to partner with researchers and developers all over the world to democratize this powerful technology and invent its future.”

Glorious, glory.

If you enjoy the content at iBankCoin, please follow us on Twitter

Un fuckin’ believable! The Obama Bull Market makes ALL TIME HIGHS

in the THREE major averages, and the Lying Republican Shills at Fox News

and Fox Business News barely mention it! They spend 99% of the time

bashing Hillary! Especially coke-addled Bariromo.

Roger Ailes has taught his hired lying propagandists well!

Barack Obama: One of our two BEST PRESIDENTS EVER!

The other being Bill Clinton.

The other being Bill Clinton!

HERE HERE.

Can’t wait for Hillary! Yeah

2 bushs

2 clintons

As you wish

Sorry to burst your utopian bubble, but….Obama sucks sacks of soccer balls….W J Clinton is somewhat married to a lesbian….Shall I continue?

Hey Rig, time to lay the crack pipe down and go outside for some global warmed fresh air!

I saw dow futs +47 last night before europe open guessed a staged tripledigit session. Sat down at 3 bingo. I look forward to every 10 s&p, this is fun, as what I felt and said 3 years ago, so clear, 100% programmed stock indexes. And headed for blowup point. I don’t think we get the 2300 Faber says. My losses are backstopped.