Okay, I take exception to this fucktarded analysis. This is chicken v egg analysis. In other words, China is saving a boatload of money ($480 bill per annum) because commodity prices have dropped. But, the only reason why they’ve dropped is because the Chinese economy has fallen off a cliff!

So, in other words, the consolation prize to having your arm cut off is that your fingers are in really good shape.

China’s annual savings from the commodities rout amount to $460 billion, according to calculations by Kenneth Courtis, former Asia vice chairman at Goldman Sachs Group Inc. About $320 billion of that is from cheaper oil, with the rest from other energy, metals, coal and agricultural commodities.

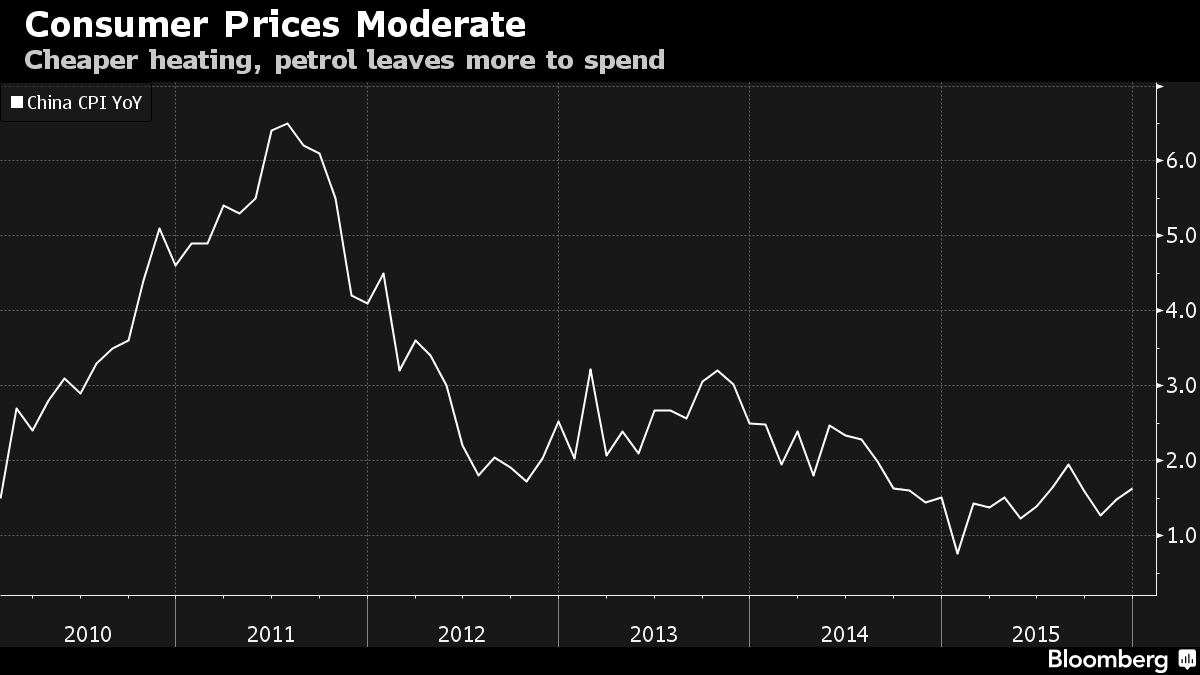

Benefits are rippling through the economy, pushing down or steadying prices of everything from home heating and petrol prices to the cost of raw materials at factories. That’s also boosting China’s efforts to recalibrate its economic growth model away from a reliance on heavy industries and investment toward consumption and services.

“It’s shown up in low consumer-price inflation and more stuff that households have been able to buy,” said Louis Kuijs, the head of Asia economics at Oxford Economics Ltd. in Hong Kong and a former World Bank economist in Beijing. “Manufacturing companies would have had even worse profit developments if it had not been for those low commodity prices.

Naturally, CPI is in the streets.

China is capitalizing on the lower prices, importing a record amount of crude last year as oil’s lowest annual average price in more than a decade spurred stockpiling and boosted demand from independent refiners. The country had record imports of iron ore, soybeans and copper concentrate last year.

How did that work out for all parties involved?

“China is the great winner from the crash of commodity prices,” said Courtis, now chairman of Starfort Holdings. “A significant portion of that windfall gain is being transferred to the domestic population.”

If China is a great winner in all of this, I’d hate to see what the losers look like, considering China has been forced to DRAW DOWN over $500 billion in FX reserves over the past year and has enjoyed the splendor of GDP growth, anchored at 25 yr lows.

To think people actually pay for research like this is unbelievable to me.

If you enjoy the content at iBankCoin, please follow us on Twitter

If China is sandbagging their progress on converting to a consumer driven economy, these analysts are geniuses.

Nothing can fall in price. That is the game. Must have ever higher prices to afford the vig. Not complicated. Loan sharking 101.

How has the Chinese economy supposedly fallen off a cliff?

Dude do you understand the Doc Copper thing?

I like to re-ask simple questions from time to time. Is copper able to be manipulated?

Moosh

Go look at electricity consumption in China and the actions of the PBOC for evidence.

I can’t believe I need to explain this to you after all of my posts.

Word up Dr Fly. Thank you for all of the hard work you put into this.

Exactly electricity is the real economy. The service economy has and will always be the tick on the real dogs ass. Hard to “service” nothing. Next they will claiming the service will service the service and all will be well.

Looked up the US. Damn, we have just been floating at 3800 billion kwh for a straight decade now.

Used to be the stock market guys were all crooked sticks.

Now the data guys are crooked sticks ant the stock market

are trying to make it look straight.

I’m so confused.

theres actually a real unity between our remarks

Gorby, the main thing to remember is that in the stocked market, there is a sucker born every minute– and 10 out to get him.

essentially what daily-health-news segments became. a study …bought…and…paid…for… by someone. with an interest. my take

Same half assed analysis that was applied by CNBC et al here in the U.S.. Significant portion of recovery in the US was due to the resurgence of a domestic oil industry (high paying jobs/ capex). From 2011-2014 shale oil was billed as “the future”. Then oil tanked to $30 and all you hear is that its a great consumer “tax cut” (yes, I understand 70% consumption economy).

How can the Fed be so fucking stupid? For a brief moment in the fall I actually thought Yellen would be wise enough to see that the Fed’s work was already being accomplished through the currency and commodity markets. What possesses them to raise rates and maintain a hawkish tone when deflationary forces so clearly show opposite? Fed funds should be abolished and rates should just float in a trading market. I don’t see how anything else could work better.

I’m not trying to be a nutter but how is this shit not going to lead to a one world currency? Or at the least something akin to a master currency beyond any one nation’s control (not king dollar) which all other currencies are floated against. Everyone is fucking with everyone with these dumbass central bankers trying to coordinate some kind of organized chaos in the Forex markets.

dr fly may i ask for a global search bar on the first page ?