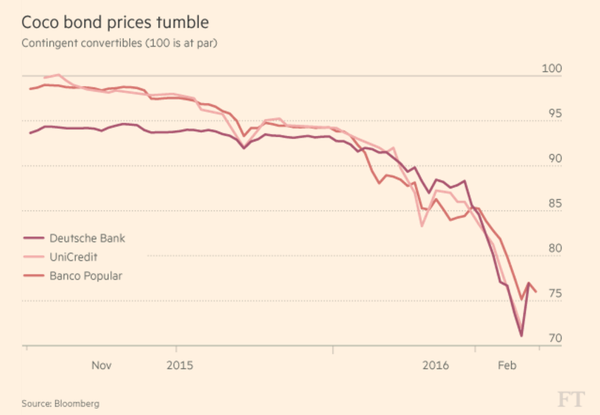

North American investors are likely still perplexed about CoCos, given the negative buzz (deserved) out of Europe in recent weeks.

Note: Not good company to be keeping

Both the US and Canada banks issue preferred shares as their instrument of choice for AT1 (Additional Tier 1). In the case of Canada, rate reset preferred shares are the dominant instrument whereby the bonds carry a fixed rate for the initial 5 year period, then reset at a spread to the yield on the current Government of Canada 5 year bonds. These instruments have a non-viable contingent capital (NVCC) feature where they potentially get converted to equity. In the case of Canada, the bank regulator, the Office of the Superintendent of Financial Institutions (OSFI) is in the drivers seat. There are two triggers; i) a public statement by OSFI that the bank is or soon will be non-viable and ii) the acceptance of provincial or federal government support, without which OSFI would have declared the bank non-viable. This is an important distinction, NVCC securities convert at the point of non-viability (gone concern) whereas CoCos convert via set contractual triggers while the bank is still operating (going concern). At least some of the recent flow we have seen in European bank equity has likely been driven by CoCo hedging by institutional holders (the UK and others ban retail participation in CoCos). Canada’s aggregate bank issuer dominated preferred market is small at $57bln (versus a $1.4tln+ stock market), but dominated by retail, in part due to the preferable tax treatment (eligible Canadian dividends).

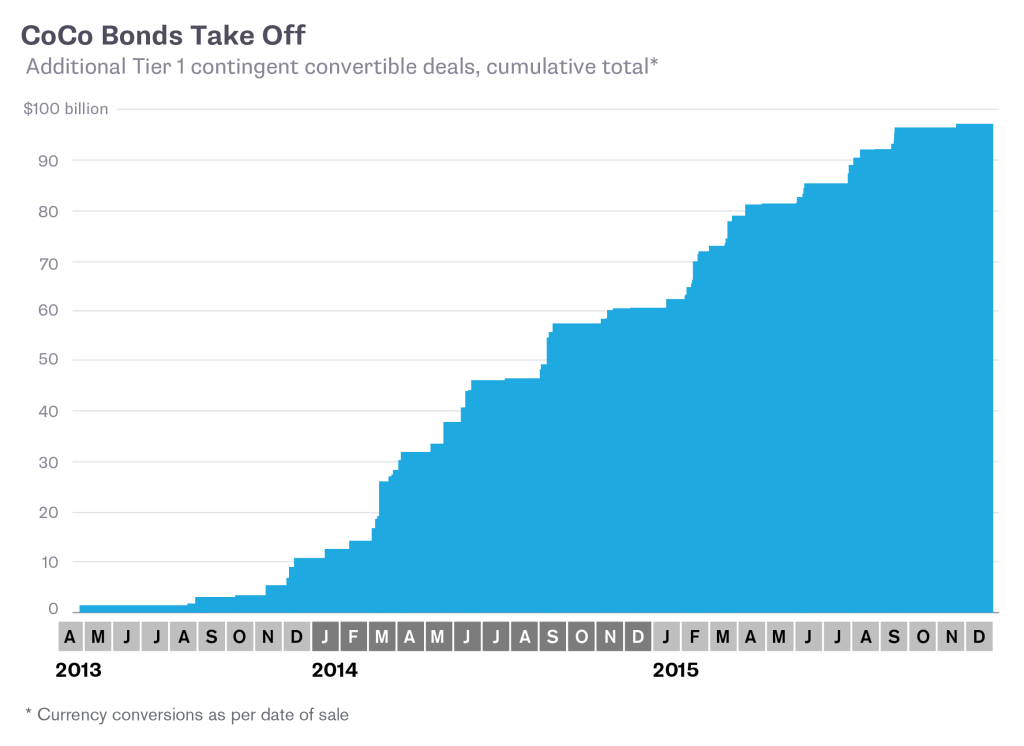

Under Basel 3 (B3), Tier 1 capital is split into 2 components; Common Equity Tier 1 (CET1) and Additional Tier 1 (AT1). Banks must maintain a minimum CET1 capital ratio of 4.5% and a minimum total Tier 1 capital requirement of 6%. The means by which AT1 is raised is not mandated. Banks could simply issue more CET1, but issuing AT1 securities in contingent form (CoCos) has been deemed more efficient from a capital perspective (cheaper than equity, and also counts toward regulatory capital buffers and leverage ratios).

European banks have issued $97bln of CoCos since 04/2013 through the end of 2015. Of the EUR40bln incremental targeted for 2016, zero has been issued thus far in 2016 given the overall funk the markets are in and the particular pain for financials (Europe down 24% versus 19% for US and 36% for Japan).

Contrarians looking to allocate fresh capital to this space should hunker down for some serious analysis. The legacy premium being offered for the “contingent convertible” feature was just too skinny in retrospect. The Canadian market has re-priced where relative value has emerged versus USD peer securities. Structurally there are differences in that US Bank prefs do not have explicit NVCC language. US prefs are issued at the holding company level, versus the operating company level for Canadian prefs, hence it is safe to surmise they are roughly comparable in terms of the potential for equity conversion in a tap out.

From a statistical modelling perspective we have had a negative 100 year event nearly every decade. This does not seem like an environment where you want to “sell the tails” too cheaply. Caveat Emptor. JCG

If you enjoy the content at iBankCoin, please follow us on Twitter

The CDN banks have recently issued new 5 yr fixed rate resets with a 5.25 coupon…. EFN did the same but also added a floor guarantee as well …..

as an ex-pat Cape Bretoner you know the oligopoly Cdn banks enjoy and the thought of one of them going tits up would not be a likely event. in 2009 they issued bonds with a 10 % coupon to shore up the balance sheets… you couldn’t get access to these until the traded in the secondary market by which time they had already jumped to 110……

anjing bau,

Agree on all counts. Recent Cdn bank deals offer more compelling value for certain, with back-end spreads on reset that greatly increase the delta of the call at the 5 year point. Early buyers got big lumps though.

For another perspective on the space Grant’s Interest Rate Observer has a recent article from Feb. 12, 2016 called “Canadian Sunrise”. Worth a read if you can find it. Couched in terms of a play on recovering oil rather than relative value.