Should the insurance sector be left for dead, or is there any semblance of value beneath the multi-layered COVID-19 ruble?

No sectors were immune from the March 2020 left-tail quickening that brought global equities to their knees in a snap reaction to the “Chinese virus” (POTUS’s term), COVID-19’s seemingly inevitable global roll-out, still underway.

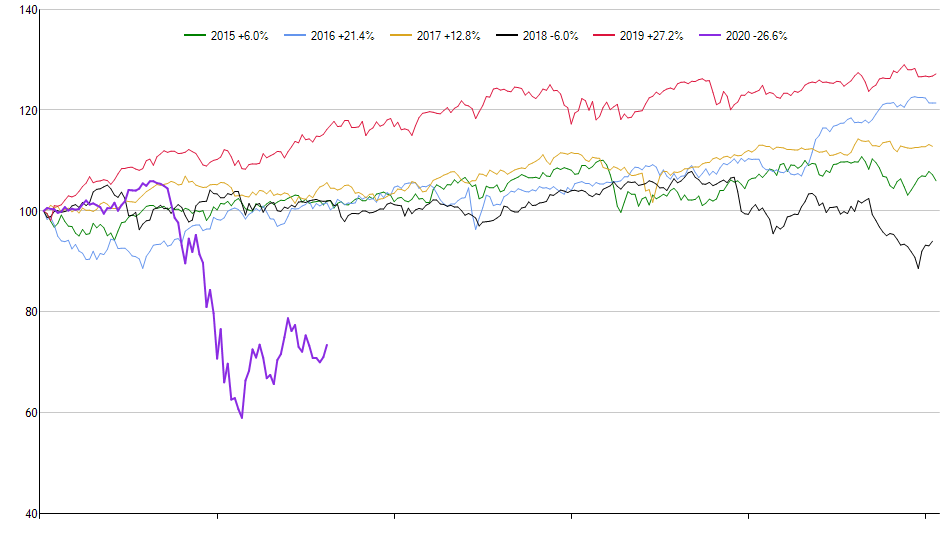

Chart: total return, by year: $KIE, the SPDR Insurance ETF, while smartly off recent lows, sits -26% ytd in 2020 (updated through 29 April 2020). $XLF, the much larger and broader Financial Services SPDR ETF $XLF is down 23.4% ytd in comparison (largest weighting in $BRK.B at 15% with 12% in $JPM).

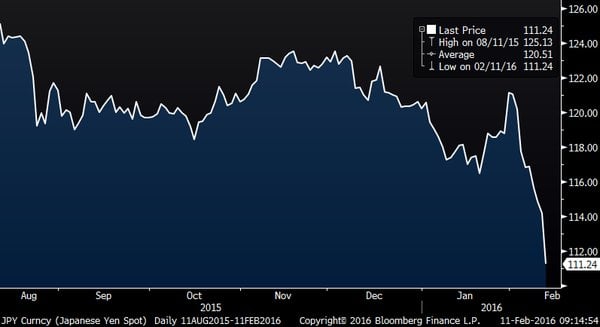

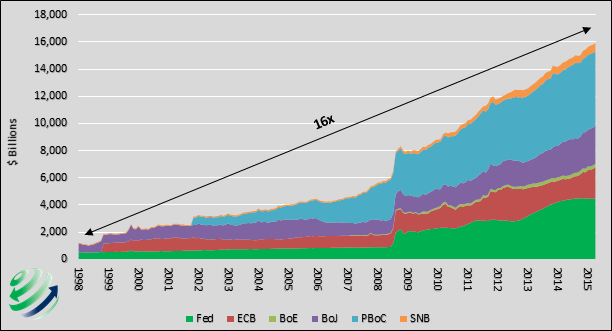

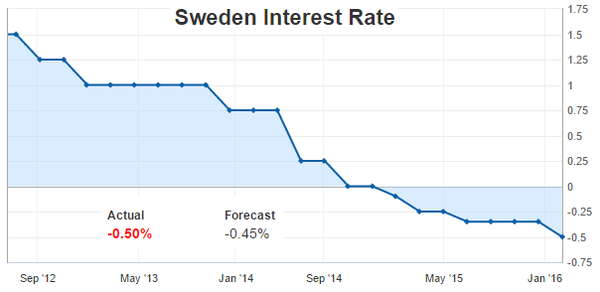

Early estimates for COVID-19 insured losses for the global insurance industry come from UBS which estimates a wide range of US$30-$60 billion. Included in this estimate is $7-$22bln in non-US business interruption losses and $8-$16bln in credit insurance losses, primarily re-insurance. The lock-down has hit the service led US economy particularly hard. Paycheck-to-paycheck has taken on new meaning for throngs of employees caught in the maelstrom. Not enough time has passed to see the full repercussions. Decisive action has been taken for certain, with the USA leading the charge. Monetary policy has spent its wad at this juncture, save negative rates which perhaps can not be ruled out in the “upside-down” MMT world. The fiscal stimulus measures announced have been awe inspiring with respect to both size and breadth, the tally in terms of cost now within a stone’s throw of 30% of GDP. As Canada’s Poloz (BoC Governor, this week) noted at their last meeting, “A fireman never gets accused of using too much water.”

Chubb Insurance ($CB), headquartered in Zurich, Switzerland, CEO Evan Greenberg cautioned last week that the industry is at risk of insolvency if open-ended business interruption claims (even those policies where losses from the peril were explicitly excluded from coverage) are enforced.

Source Bloomberg, “Lawmakers in states including New Jersey have considered legislation forcing insurers to pay out certain interruption losses for small businesses, with some bills requiring insurers to pay out even if policies explicitly excluded losses from viruses. The American Property Casualty Insurance Association has estimated that companies with 100 employees or fewer could see business continuity losses of as much as $431 billion a month, compared with the $800 billion in total surplus for all U.S. home, auto and business insurers.” Mr. Greenberg expects eventual COVID-19 claims to be the biggest ever recorded for the industry, which would tighten the UBS estimate band considerably to US$45.1-$60bln.

Greenberg, clearly sensing the legal landmine that lies ahead, urged Congress to grant some broad legal immunity for the insurance industry. Insurance regulation is a combination of State and Federal responsibility in the USA, roughly weighted 70%+ State. Court decisions are extremely important and historically when it comes to policy language interpretation, the courts often rule in favor of the insured. Evan further noted that the loss potential from a pandemic are infinite and that insurance company balance sheets are finite. His father Hank Greenberg ran AIG, the name should be somewhat familiar. Chubb has a mkt cap of $51bln and is 32% of its 52-week highs versus the more opaque AIG, sporting a market cap of $23bln and an oil like 50% off its early 2020 pinnacle.

Chubb CEO Greenberg is correct in noting that the insurance industry is a critical part of the plumbing of the economy. Global insurers manage over US$25 trillion in assets, the majority allocated to bonds (credit risk).

Chart credit Twitter; @the _chart_life

GFC; AIG Financial Products

AIG was the biggest seller of credit default swaps on the street in 2007. Their comments as we rolled through the summer of 2007 were like a fortuneteller. “It is hard for us, without being flippant, to see a scenario within any realm of reason that would see us losing 1 dollar in any CDS position.” A short 5 months later AIG wrote down their CDS book by > $5bln. AIG’s $20bln Muni GIC (aka Investment Agreement) book soon took write downs as well as they guaranteed “make-whole” on a loss of AAA/Aaa. The initial Troubled Asset Relief Program (TARP) was sized at US$700bln. It was a source of a great deal of consternation as the time, the gob-smacking size of it. Those were the days. Instead of taking equity stakes in the targeted firms, a full 1/3 ($235bln)was clawed back via various and sundry fines for all forms of malfeasance. There were no perp walks and Martha Stewart served more time solely that the lot of them collectively.

To get back on point, 9-11 was the largest single insured loss in history, to date. $45bln in insured loss were paid. 2/3 of the eventual losses were paid my re-insurers (the mechanism by which insurers lay-off/hedge their risk). In a parallel to COVID-19, legal matters became paramount. Most policies at the time were “All-Risk Policies” (covering all possible risks, save those explicitly excluded in the policy text) versus what has now become more common, namely “Named Perils” policies. A long standing exclusion on insurance policies is war, but there can be others, such as flood, earthquakes (if covered, often at a lower absolute level here in Japan, given the prevalence, “Ring of Fire” and all).

Those of us working/living in lower Manhattan on 9-11 thought it our last loss, as in the “final loss”. I was working that morning at One Liberty Plaza across the street from the WTC towers, already in the thick of it and gazing on a brilliant blue sky in lower Manhattan between morning market updates calls. I was on the phone selling the days wares when the 1st plane hit the North Tower , changing our lives henceforth. More screens than a sports bar were reporting perhaps an errant Cessna struck the formidable 1 WTC tower. From our close proximity the sounds, the evidence of it all (i.e. flames, debris falling) told another story all together, a more sinister version of events. Our trading floor was gracefully on the 2nd floor and a small grouping of us escaped One Liberty Plaza (OLP), pulling the fire alarm as we exited, well before 9am. I had just moved into a flat on Park Row and was concerned my fiancée might be in harm’s way, walking our dog in the vicinity. Most colleagues were held inside OLP to reduce the risk of injury from falling debris. From my bedroom window I saw the 2nd plane strike the South Tower ….. this is a terrorist attack honey, let’s get to street level. We watched the ferocious fire burning 4/5th up the North Tower and mused how it could possibly be extinguished. It took less than 2 hours for One WTC (WTC 1) to succumb to the litany of hell like temperatures. Fire & rescue loudspeakers warned a few minutes prior and we backed our way towards Brooklyn Bridge which Park Row filtered directly into. I was filming the tower at the time of the critical “break”, when the substructure could no longer support itself. The building fell straight down, like a demented Wile E. Coyote cartoon. I spun on my heel and tucked the Frenchie (Yukon) under my arm as we jetted for escape across into Brooklyn. News of the concurrent strikes blared from car radios with doors ajar and early estimates were that as many as 50,000 American may have perished in the co-ordinated attacks. The dust cloud unleashed by the collapse of the North Tower was tremendous and given the sinister, other worldly funk we found ourselves in my thoughts as the cloud enveloped us were “Did these terrorists fill these planes with Sarin gas to boot?” (As Aum Shinrikyo had perpetrated in Tokyo subway 6 years prior, killing 13). The air was gritty, but breathable. We made it eventually to our disaster recovery site in Long Island City and found organized chaos. Our chairman was at the disaster recovery site are noted he had one of the few hotel rooms in the area booked, flipping me the card key with directions. French bulldogs and paring risk in dollops of a few million $ per basis point of risk exposure did not mix well, apparently. We never did make it to the “fancy” hotel and caught a few hours sleep at a flea-bag motel in one the worst of neighborhoods, undetermined miles north. Kick-out early morning because of the mutt, we eventually made to a friend’s place in Hoboken the morning of the 12th. The first flight to Japan was Sept. 19th and my fiancée was on the flight. The dog was in cargo and I’m sure the wedding would have been cancelled if the dog had not made it. Japan waived their quarantine (30 days) with the ability to inspect the animal at regular intervals. The final certificate we needed to get the dog in was issued exclusively by an office in the former 1 WFC. The wedding took place the first week of October. While under a high degree of stress, dressed in a kimono (borrowed from Gojoro, a sumo wrestler with links to the family), reciting Shinto vows it was a miraculous win, esp. for me. My team was temporarily moved North to Toronto, Canada which was certainly difficult for key staff, being away from family in a time of uncertainty. Less fortunate firms had their “back up” data centers and even disaster recovery centers in the adjacent WTC tower. Margins reflected the turmoil and management gave thought to keeping up permanently in “T zero”, as Toronto was affectionately known. The Royal York, while close by, was not home and the lads were getting restless to return to the “Big Apple”. Mike Bloomberg saved the day and granted us some space in a trading room fashioned out of a converted warehouse in Tribeca (Bloomberg terminal at every station) in early 2012 and we re-entered OLP on Valentine’s Day 2012. Almost 800 windows had to be replaced and all soft materials down to the carpets were re-fitted, but we were back. Despite being across the street from the outlined direct hit, we suffered no fatalities. 9-11 was the worst ever event with respect to loss of life for firefighters, 343 having perished, along with 72 law enforcement officers and 55 military personnel. On-going ailments from first responders and clean-up crews are on-going, with extended benefits just granted in 2019 for some.

The eventual 9-11 loss of life was a horrendous 2,977, tallied many weeks/months after. The 13 acre WTC site was a smoldering, caustic mess and over 1 million square ft. of office space was zeroed out in one go. Insurance losses were quite evenly split between commercial liability, group life and business interruption. The courts were involved in the settlement of the WTC tower coverage as the insurer sought to cap their payout at US$3.55bln with the key clause being whether it was 1 event or 2. Silverstein eventually settled in 2007 for $4.55bln. The lawyers always make out OK, it seems. A full 2/3 of the loss fell to re-insurers.

The property & casualty insurance industry was in shambles, not because of the insured losses per se (a war exclusion does not cover idealogical differences), but losses from terrorist acts became effectively un-insurable with private insurers from that day onward. The white horse arrived in the knick of time in the form of the Government sponsored TRIP (Terrorism Risk Insurance Program) program, not to be confused with Stephen King’s Captain Trips from “The Stand”. The Federal loss sharing program was well crafted and was tweaked on a couple of iterations as the plan life was extended. In a nod to law enforcement and Homeland Security there has never been a terrorist claim in the USA since 9-11. Quite remarkable, historians will attest. We perhaps have a template for global pandemic coverage to boot (Acronym to follow).

Post GFC a complex web of regulations were put in force globally. Of the current top 100 financial companies in the world, 40 are insurers. The list of G-SII’s (Globally Systemically Important Insurers) issued by the FSB (Financial Stability Board) existed from 2013 through the beginning of 2020 (no longer required, impeccable timing). The exit list included 8 global insurers (market cap US$):

Allianz (German), parent of PIMCO, mkt cap $73bln

AIG (US), mkt cap $24bln

Aegon, (Netherlands) mkt cap $6bln

Aviva (UK), mkt cap, mkt cap $13bln

AXA (France), mkt cap $43bln

Metlife (US), mkt cap $34bln

Ping An (China), mkt cap $227bln

Prudential (UK), mkt cap $38bln

Aggregate mkt cap $458bln. Ping An 50%. USA (2) 13%.

Supreme Court

The courts do not always rule against the insurers. Just this week, a long standing case came down on the side of the health insurance industry (aka Obamacare Insurers) where it was decided the $12 billion promised them by the Obama administration to aid in the 3 year implementation period of the Affordable Care Act (ACA) in 2014 must be paid. The vote was not close 8-1 in favor of the insurers, the government must make the payments to effected insurers.

In a famous event cancellation policy case, a Lloyd’s of London underwriter refused to pay the US$17.5 million Michael Jackson’s concert promoter AEG took out on the “This Is It” tour in 2009. At the time of the purchase of the policy key details were withheld with respect to the “King of Pop”, his poor health, drug use and prescription. The court case was not settled until 2014. Insurance companies must protect themselves from adverse selection, a higher than average risk seeking coverage at the average risk. The only real protection in this regard comes from prudent underwriting practices. Lloyd’s of London is not actually an insurance company, rather it is a syndicate of underwriter. A study unto itself, individual underwriters used to carry unlimited liability until a few individual members (family offices effectively) were forced into bankruptcy by 1999 asbestos claims. Yet another example of an open-ended liability, asbestos isa generic term for a fibre that has a length 3x its width. When working in environments where asbestos is prevalent workers can easily breath in the fibers which can lodge in the lining of the lungs, over time (20+ years in some cases) forming a pearl, which is often cancerous. To ensure their longevity as a company. Lloyd’s capped the liability of individual underwriters thereafter.

In 2020, Wimbeldon collected £125 million (US$145mm) on a pandemic insurance cancellation policy they put in place 17 years ago after the SARS outbreak in 2003. Their annual premium for the policy was £1.5 million and they have paid out £25.5mm in policy premiums to date.

Moral hazard is another key concern with insurance fraud costing as estimate $80bln per annum.

Total annual insurance premiums in 2018 were $5.2 trillion (6% of global GDP) with 54% life insurance and 46% property & casualty. The US is the biggest insurance market in the world, accounting for 29% of the total with a penetration rate of 7.1% (premium as a % of GDP). China is the 2nd largest insurance market ($575mm in 2018 premiums), followed by Japan ($441mm) and the UK ($337mm).

Director and Officers Insurance (D&O). Elon Musk has increased his shareholder loans to over 50% to “self-insure” Tesla’s D&O insurance, which Musk this week deemed too expensive. The Tesla board (10 strong) includes Elon’s brother Kimbal Musk. Considerable risk exist from the ongoing class action lawsuit relating to the 2016 acquisition of sister form Solar City to the on-going self driving experiment involving live crash test dummies. Firms like Toyota and Nissan, that have spent considerably more on self driving technology than Tesla caution that the current tech is not ready for “prime time” beyond closed loop applications. It is a good thing that Elon has deep pocket to backstop and/all lawsuits that might be brought against the Tesla board. They have a degree of “wrong way risk” with the war chest of fiat US$ margined against his holding of $TSLA stock (he owns 27%), but I’m sure it will be fine.

Globalization of the insurance industry over the last few decade have seen waves of consolidation as mutual insurers largely de-mutualized to become stock corporations. Many jurisdictions have seen the lion’s share of market fall to half a dozen players. In the USA almost 4 million people (3.8mm) work in some facet of the insurance industry (>5,000 insurance companies). There are over 750 life insurance companies in the US (down from >2k in the 90’s) and > 2,500 property & casualty insurers and 860 health insurance companies. There are still 85 fraternal insurers (8% of in-force life insurance policies) in the US with Thrivent being the largest (founded by the Lutherans).

A basic tenent of insurance is the concept of indemnification, i.e. putting the insured in a similar position as they were prior to experiencing a loss. Some categories of insurance are not suited to the public insurance markets, unemployment insurance being one such category. It has been reported that in some states >50% of workers on unemployment insurance are making more on a take-home basis than they were when working. Such largess can only be found by the folks running the printing presses and obviously must have a terminus once shelter-at-home orders are lifted. “At risk” populations must clearly be protected as restrictions are lifted across the globe, but clearly the medicine (extreme behavioral modification/ lock-down as a vaccine is developed and the Ro is brought to a manageable level) is not supposed to be worse than the disease. Fail we may, sail we must.

COVID-19:

COVID-19 global prevention measures affect the various business lines of global insurers in distinctly different ways. Commercial, Speciality & Personal lines:

Auto insurance. Caught in the grips of shelter-in-place orders, few are driving. Claims have plummeted, leading leading insurers to rebate customers auto insurance premiums. Allstate has pledged to return $600 million in premiums to policy holders. State Farm, who insure 10% an Americans will be rebating as well, a total of $2bln. Berkshire’s GEICO appears to be less enthusiastic, offering 15% off of renewals.

Business interruption insurance will be the big category for COVID-19, very open ended and a potential tail risk for P&C insurers. The early data from the UK allows for some extrapolation with £1.5bln in BI claims paid thus far in 2020. With a UK GDP of 2.9tln this scales to $13.125bln for the USA ($20.5 tln GDP). The UK has also paid out $275mm in trip cancellation insurance. Heavy pressure is being applied to insurance companies pay claims promptly and to take an “insured friendly” interpretation of contract terms (from the UK Treasury Committee). It seem to have fallen on deaf ears thus far, with 71% of business interruption claims declined upon submission.

Credit & surety markets will see higher claims as the construction industry globally has been heavily delayed. All specialty lines; aviation, marine, construction and energy have been negatively affected.

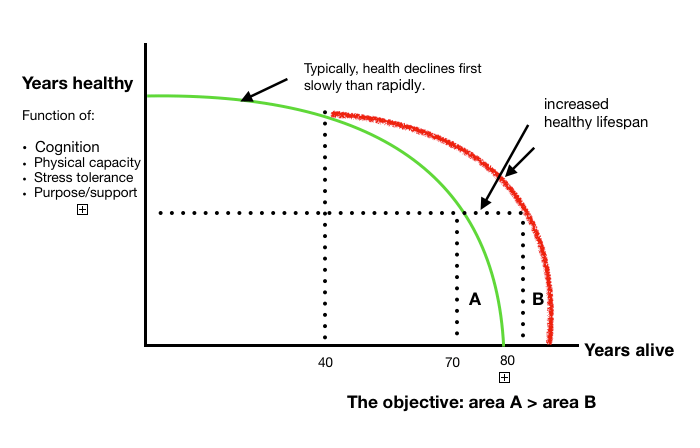

Life insurance. Even with global deaths from C-19 approaching 229,000 and US at 61,680, overall death rates are at a 6 year low. The double digit COVID-19 case fatality rates have been evident in those >65 and esp. in those with comorbidity (obesity, diabetes, heart disease, renal disease). 78% of the aggregate reported COVID-19 deaths are from those aged > 65. The UK has seen a life policy surrender rate spike of 4% since the onset of COVID-19. Whole life currently has a surrender rate approaching 50% by the 10 year anniversary. For many, term life (2x base for each dependent) is often the way to go to cover that critical age 25-65 year period. Underwriting standards are changing rapidly, with John Hancock now only selling new life policies on those that agree to wear a Fitbit (or equiv.). 40% of all the life insurance in force is group life which is all term life underlying.

Dr. Peter Attia, podcast “the drive”.

Early numbers out of China are dire from an earnings perspective with China Life reporting -34% for Q1 2020 and Ping An -43%.

Hard markets lie ahead in the insurance industry. Tighter underwriting standards and higher prices. In the P&C sector the major risk categories include tornadoes, thunderstorms, hurricanes, draught & wildfires. Economic losses in the USA exceeded $650bln over the 2017 – 2018 period. Insured losses were the highest ever over the same period $136bln in 2017 followed by $50bln in 2018 (and $41bln in 2019).

Across some business lines insurers will be dealing with an existential crisis. A deemed lack of value-add is a real risk. A threat of relevance is also a risk if policy exclusions are broadened going forward. While there are less global fixed income securities trading at negative yields, more in aggregate trade closer to the zero bound as well, threatening to make long-tail lines uneconomical at current rates.

Expense ratios for insurers will go up as they outsource help to assist with claims adjustment in an environment of lock-down.

Summary;

Insurance is a key global sector. It is both complex sector and a difficult one to assist via direct programs given its international nature (footprint, ownership, & multi-line nature).

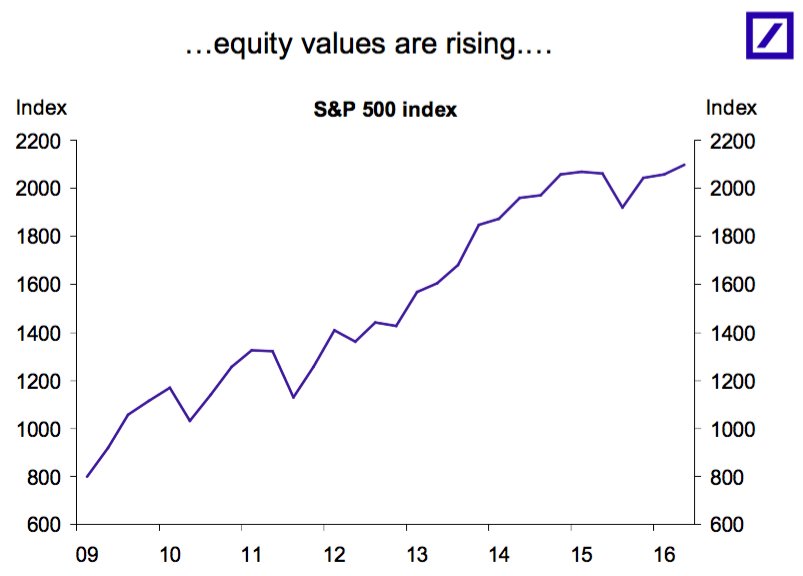

The average equity drawdown in a recession is 33% and the recent BRRR … inspired bounce has us inside of 10% down from the February 2020 highs (almost flat in the tech heavy NASDAQ). When the risk guys are modeling the fallout of an Illinois or Italy default it is probably not the time to daydream about multiple expansion or S&P earning flat to 2019.

Dry powder, in the form of a larger allocation to cash are prudent in the current environment. Gun to my head to allocate new $ in the insurance space, I’d buy Berkshire Hathaway ($BRK-B), $818bln balance sheet with $130 of it liquid, with direct premiums received of $38.4bln and a 6% auto insurance market share (#2 to State Farm at 10%). Life Insurers that get too beat up will be worth a look, but I’d give P&C focussed insurers a wide berth until the COVID-19 dust settles.

Safe trading, as always.

JCG

Follow me on Twitter; @firehorsecaper

Comments »