Equity investors in HCG have been heartened by the 70% rally seen thus far the week of May 8, 2017. To put this dead cat bounce in context, the stock, after rallying 70% this week, remains down 72% year to date. Home Capital Group trades on the TSX in Canadian dollars, last traded C$8.76 (US$6.40 with USD/CAD at 1.37) and started 2017 at just under C$32 (high print was a 55 handle in 08/2014 when USD/CAD was at 1.08!). There is an otc listing in US$, HMCBF as well but I’d use it for tracking only, given the lack of liquidity evident.

I would argue there is too much Home Capital equity glee evident.

The costly (>20% all-in with full fee stack) HOOP (Healthcare Ontario Pension Plan) liquidity facility for C$2bln was the bullfighters spear in this drain spiral. In addition to onerous monetary terms, the degree of overcollateralization HCG had to agree to (2x, i.e. a 50% haircut on Home Capital’s uninsured mortgage collateral) means that access to funding will have a terminus when HCG has no additional collateral deemed finaceable. Short of the HOOP facility terms being re-cast (near zero chance), it appears the days of HCG holding mortgages on their own balance sheet are long past. The company has admitted such in their latest press releases, and have entered into an arrangement with their competitor MCAP (as reported in the press, not by HCG) to on-sell mortgage commitments and renewals, initially for C$1.5bln with the potential to expand the program. Quebec pension plan (you can’t make this stuff up) CDPQ part owner of MCAP has responded that MCAP is the not the end buyer rather is a facilitator for the sale of the mortgages (MCAP will manage and service the loans for the buyer). MCAP have > C$61bln in AUM with a speciality in Canadian mortgage assets.

HCG currently has C$18bln in mortgages on balance sheet, currently largely funded by C$12.7bln in GIC deposits (including brokered GICs) which are eligible for Canada Deposit Insurance Corp (CDIC) coverage. Home Trust’s May 24th deposit notes traded in a range of $89.75-$94.875 on May 5, 2017, as reported in the popular press. Taking a mid off this wide trading range get us to a price of $92.3125. Assuming the CDIC insured 100% of the GICs in question, this would represent a liability of C$976.3mm of the aggregate insured deposit note program (C$12.7 * (100-92.3125)). This implies the Canadian government (via CDIC) is a bigger stakeholder than HCG equity holders, given the mkt cap of C$562.4. Based on the rally in HCG equity since May 5, 2017, secondary GIC levels have likely improved, but this example is more to show that this is a more of a razor’s edge scenario than most “hold my beer” financial journalists are acknowledging. HCG has a market cap of C$562mm and a mortgage portfolio of C$18bln, meaning just over $3 in price for the book wipes the equity out (C$18bln * 0.03 = C$540mm). Fraud naturally tends to widen bid/offer spreads as potential buyer naturally require a safely buffer for the unknown.

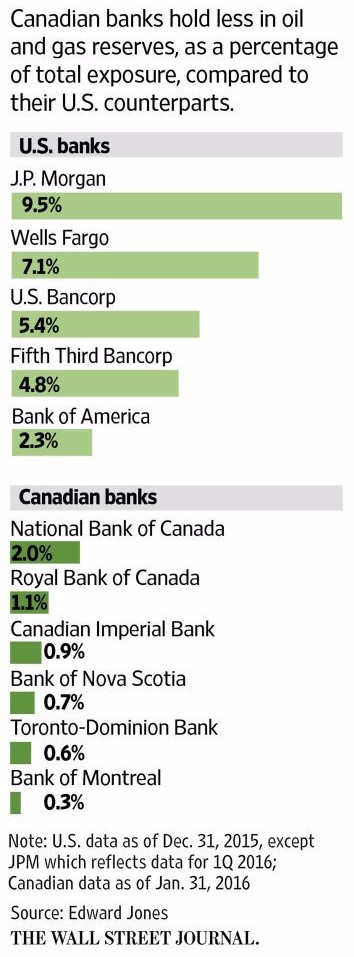

HISA funding has largely rolled off, and will not likely be a source of funding going forward. HCG also have the noted HOOP C$2bln liquidity back-stop (more than 70% drawn 2 weeks from establishment) which effectively served to replace the hole in their bucket from HISA redemptions. Home Capital’s bigger problem may be they are NOT too big to fail. In my view, there would be little public support within Canada for a bail-out of HCG, either directly or through backing white knights (domestic or foreign). Why did the Canadian cross the road? To get to the middle. Not going to happen, especially in light of the blanket Moody’s downgrade just announced for all the Canadian banks, although still very highly rated versus global peers (RY to A1 from Aa3). Moody’s pointed to the banks collective exposure to over-indebted consumers and high home prices, and all remain on negative outlook. Distressed situations call for IRR’s in the low 20’s (HOOP’s facility is estimated at 22.5%, GS and FIG participated in the syndicated deal, and rarely accept less).

Home Capital is a regulated mortgage lender, and is the largest non-bank mortgage lender in Canada. This distinction is as critical as it was during the global financial crisis. Non-banks lack critical access to wholesale funding and access to the central bank funding window (The Fed in the US and the Bank of Canada in Canada).

Liquidity: Bear Stearns was sold to JP Morgan in March 2008 via arranged marriage for $2 a share ($236mm). The deal was announced over the weekend to quell global market nerves ahead of the Asia open. Bear closed at $30 a share (0.38x of $80 book value) on the Friday before the deal was announced at $2 (note: later revised to $10 as further due diligence could be conducted, the NYC headquarters of 85 year old Bear Stearns alone was worth $1bln). The Fed provided a $30bln back-stop to JP Morgan to better digest the thorny prey. Bear Stearns traded as high as $172 a share in 2007 and as an aside bought back $1.6bln in stock in 2007 alone.

Leverage: Fannie Mae was levered at 20:1 coming into the GFC. An increase in their loan loss experience from 4 basis points to 52 prompted both Fannie and Freddie to be placed into conservatorship where they remain. Leverage accentuates the negative by more than most can envision.

It remains to be seen if the poison laiden HOOP spear is lethal for HCG, but I’m confident that the stock is worth less than it is trading for now, and near fully certain it is not a 2.5 bagger from here (CIBC Asset Mgmt have tripled down on their initial long position and own 15% of the common). The only institutional investor that owns more of HFC stock is Turtle Creek Asset Mgmt which holds a concentrated bet (25 positions in total) for 19% of the embattled lender. Turtle Creek’s flagship funds is at approximately C$2bln (closed to new investors) and it should be noted their track record to date has been stellar, boasting a 23.7% CAGR (1998-2016). I’ll be sure to check if they are open to new investors in 2018.

This blog post in being penned in Tokyo which is 13 hours ahead of North America, but a big day lies ahead for all involved in the HCG story. Delayed quarterly earning for Q1 are due and more importantly management is expected to shed more sunlight on recently announced transactions, including the price terms and cpty on the C$1bln mortgage sale. The other disclosure investors are keen to hear is on HCG’s announcement that they will be “tightening our lending criteria and replacing some of our broker incentive programs and expect that will result in a decline in our originations and renewals.” There have been daily tweaks to the rule book this week, but local mortgage brokers report Home Trust is still in business. New business is being written, with a few caveats; Best pricing has been eliminated (called Ace pricing), the max mortgage amount is C$600,000 which it was noted is not that useful in Toronto, their lowest rate is 4.69% with a 1% fee and their non conforming rate is 6.5% (noted as off market). Other B lenders have raised rates as well resulting in a widening gap between the A and B rates. Smaller competitor Equitable (who scored a liquidity facility on much better terms than HCG) is going flat out and not taking refinancings right now due to volumes. As of Wednesday May 10th Home Trust was also just doing purchases (no refinances). Broker finder fees were reduced this week as well (as HCG noted they intended to do).

The press is Canada, to my mind, has been too sanguine about the risk to the HCG story playing out well for retail HCG equity investors. Most analysts have given the situation a wide berth of late. TD presented an analysis this week showing their thoughts on HCG equity valuation for different valuation levels for the C$18bln mortgage portfolio; at $91.00 (a $9 discount) they saw equity as worth $0. At $95.00 (a $5 discount) they saw C$9.70 (close to where we are now at C$8.76) and a sale at par, $100 resulting in an equity valuation of $21.68. Put another way, to make 2.5x your money you need all the stars to come into alignment and see Home Capital get 100 cents on the dollar for their mortgage book. Hope is not an investment strategy.

Those long intent on riding this out should get up the curve on CCAA (Companies’ Creditors Arrangement Act), Canada’s equivalent of Ch. 11.

Follow me on twitter @firehorsecaper. JCG

Disclosure; Currently flat, as borrow for a short position has been unavailable from my current broker (IB).

Comments »