Carvana, the “disruptive” used car dealer, aka the “Amazon of used cars”, has had a tumultuous 2020 and it is only May. Entering the Year of the Rat at $88.00/share, the well-baited trap of mid-March saw a 65% swoon to sub $30.00 before a miraculous resurrection to the current $98.00 print (hundy roll intra-day 8th May 2020), now sporting a market capitalization of an eye-watering US$16bln (within 15% of ATH). Nausea inducing moves are not new for the “Glengarry Glen Ross” of the on-line car business. $CVNA IPO’d a mere 3 years ago in May 2017 at $15.00 (15mm shares, raising $225mm for early backers and still Chairman, Ernie Garcia III). Day 1, $CVNA trade went over like cotton candy at a diabetes convention, -26% to close at $11.10. Most IPO’s are “priced to perfection” to allow for a 20% bounce out of the gates, as Cloudera $CLDR did on the same day, co-incidentally at the same offering price base of $15. Cloudera may have had a heavenly “cloud” story, but the stock has swooned 44% since, and it currently trades $8.50/sh., much in contrast to the near 9 banger Carvana has delivered since that inaugural trading day in 2017.

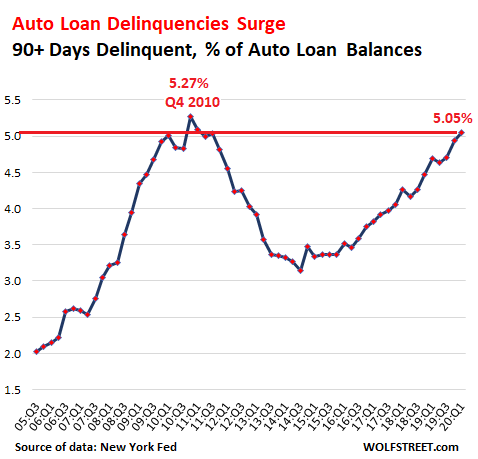

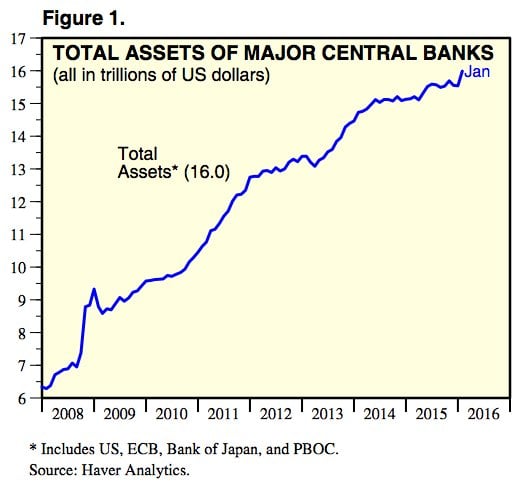

The cloudy macroeconomic forecast need not be outlined here, COVID-19 has the USA in a near cryogenic state. Hertz may file Ch. 11 in May as 500,000 rental cars sit idle across the country. Even the daft can connect the dots with respect to the knock on effects. Used car values will fall as the ranks of the unemployed swell and many still “working for the man” do so from a distance. 30% of the gasoline usage in the US ̶i̶s̶ used to be attributed to commuting, for work. Things will come back gradually as shelter-in-place orders are lifted, clearly. Delinquency numbers in the auto space were not looking good in Q1 2020, before COVID-19 hit. Delinquency rates will certainly take out the previous highs of 5.27% and may well crest in the low double digits, depending on what Mnuchen and his merry men have in reserve (Cash for clunkers II, et al). Carvana does not bear the full brunt of this, they are after all in the moving business, not the storage business. Conforming loans are securitized, largely through Ally Financial (GMAC beginning with a couple of “bolt on’s”). The CRVNA ART (Auto Receivables Trust) has been used liberally, netting >$2bln in aggregate funding. A well timed follow on equity offering (13.3mm shares at $45) also raised $600 million. Survival through 2021 is not in questions, but valuation is another matter all together.

There is no “e” as in earnings with Carvana yet, this is a disruptor/unicorn after all. Price to book is 157x. Profitability was slated for as soon as 2023, on the pre C-19 glide path.

The flashy, impressive Carvana car vending machines may not have their buttons pressed for some time. Great marketing for certain and might even make the Idiocracy II sequel for visual effect. Adam Neuman will not be picking up his Softbank financed Cerulean 2021 McLaren at a Carvana fulfillment “vending machine”. This is exclusively a “used” car business, despite the median 71 month loan term and interest rates from 13.47-13.84% for their “prime” (FICO 635, sub-prime is < 620) rated borrowing customers. Sub-prime APR, as per their latest securitization (1st in the sub-prime category) is 19.2% (should your credit card already be maxed). There are 24 bespoke car vending machines in operation presently and their most recent regulatory filing notes new vending machines are “on hold”. The difficult to re-purpose structures are 8 stories high and can inventory 32 cars each for a paltry 768 automotive treasures ($18,400 avg. price in 2019). LTV 101.85% (assume fees blended in). $CVNA’s average customer is not the typical prime FICO score customer preferred by the money center banks. 700 FICO scores can finance a new car in the low 5% range and used in the mid 5’s for reference. An $18,500 used car financed at 100% LTV for 71 months has a monthly payment of $380 for a Carvana “prime” loan, sub-prime is $440 ….. for almost 6 years. Even with extended and enhanced unemployment benefits, there is a high probability that many car payments do not get made (more than was modeled in any event) and the now discounted car comes back for eventual resale. The arms-length owners of the Auto ABS will also be affected of course, but funding avenues will narrow for Carvana and those still open will be more expensive. Financing via the bond markets unsecured would be difficult given Carvana’s CCC rating.

Of the listed car rental companies, Avis has proven more savvy to date, building a war chest through new 1st lien debt ($400mm 5 year, 10.5% coupon priced at $97.00). Avis is rated B+, Tesla B3/Caa1 in comp. Hertz ($HTZ $3.00 $434mm mkt cap) has one foot in the grave and the other on a banana peel. Lenders have given Hertz 2 weeks to figure out a viable option(s). Carl Icahn is in the mix in a big way and I think a solution will be found, one that is good for Carl, if nothing else. When GM was bailed out after the GFC it was largely to salvage the 250,000 pensioners. Hertz in comparison has 38,000 employees (few defined benefit, presumably) and Carvana has 3,900 car sales concierges, as a point of reference.

I last looked at establishing a short in the used auto space in mid 2018 via $CACC (Credit Acceptance Corp) which currently sits at $314.80 with a mkt cap of $5.7bln with a 9 p/e (sub 3 price/book to boot). https://ibankcoin.com/firehorsecaper/2018/06/17/sub-prime-auto-loans-get-off-the-gas-short-via-cacc/#sthash.1Cc2E7LK.dpbs I was talked off the ledge at the time (short never established) by sage fellow Exodus members (Pelicans Room members), it should be noted.

Much of the story the Carvana “believers” lean into is the tremendous growth Carvana offers. They have doubled revenue every year for the last 6 years. Carvana is eventually hoping to sell > 2 million cars per year, heady aspirations indeed. The 2020 estimate was 255-265k prior to COVID-19, up from the 177.5k sold in 2019. Cash flow was negative 990 million in 2019 (-280mm in 2017, the year of the IPO for reference). The other revenue drivers for Carvana, beyond 100% gross margin advances revenue are vehicle service contracts (VSC’s) and GAP (Guaranteed Asset Protection) waiver coverage (topping up insurance payout to amount owed). Management is also a questions mark for me as the Garcia clan have a checkered past (go figure, used cars to “dented” credits, Forbes Magazine seems to have the most in-depth coverage on the inter-web). Base salaries of key execs; Ernie Garcia III $885,000, Mark Jenkins, CFO $735,000, Ben Huston, COO $735,000.

Ernie Garcia II, billionaire used car salesman, on the day of his son’s $CVNA IPO in 2017. Ernie Garcia III, CEO & Co-Founder was 34 at the time of the IPO (not pictured, he was feeding).

Used cars in the USA have an aggregate valuation of $1.5 trillion with $1.3 trillion of debt against it and with the likely impairment going forward, at best, they now match at $1.3 trillion (on paper), negative after Carvana facilitation. JD Power reported wholesale auction value for the week ended April 12th at -83% yoy.

Key competitors: #1 CarMax Inc. ($KMX), Group 1 Automotive ($GPI), Cars.com Inc. ($CARS).

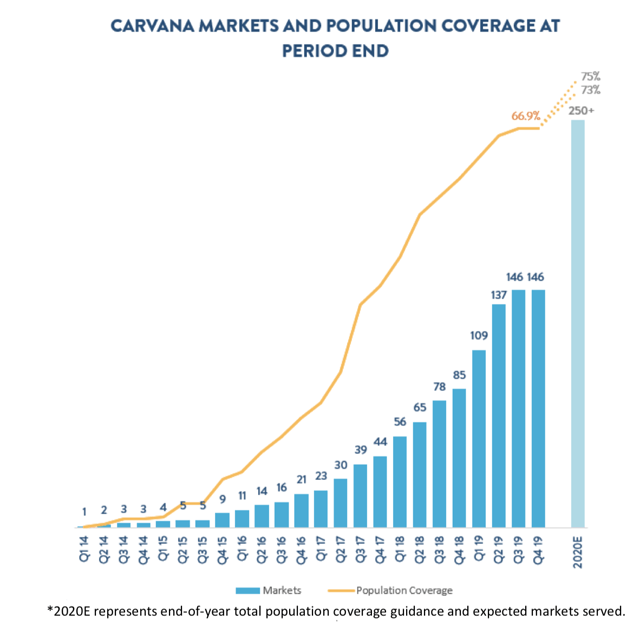

Much of Carvana’s growth has been through expansion of their coverage markets;

Note: NOT a COVID-19 chart, Carvana corporate slide; markets/penetration.

I think the curve flattens for Carvana quicker than it does for COVID-19, and would not be surprised to see their coverage platform turtle back to Q1 2019 levels and < (i.e. sub 100 from 150). Carvana has a very high short interest and many potential shorts run for the hills when the short interest exceeds 1/3 of the float, let alone 50%. Availability of borrow and the cost of same are critical factors when juggling sticks of dynamite. This appears to be priced for near perfection in the midst of a horror film, for all facets of the automotive sector. One for the watch list in any event. Uber (pun intended) bulls think that Bezos might tuck Carvana into the fold for a run at yet another critical “artery of the American consumer”, but I think Jeff would dry heave at the valuation and deem the Carvana moat puddle-like in terms of both breadth and depth. 100 key automotive hires along with some online mojo wave-ins like www.bringatrailer.com and/or Vroom and Amazon would be off to the races in the space without a Softbank/Visionfund like check being written.

No position at the time of writing in Carvana $CVNA. Vetting a 2% “starter” short. Target price $25.00 (-75% from spot $98.00). Having a measured downside is important with some of these high flyers, just ask anyone short $BYND, $W, $SHOP, or $PTON this week. Option based strategies to be given prime consideration. I’ll post eventual trade entry via Twitter with an update to this blog post as well.

Trade safe. Get under the hood. Analyze, reflect, size, act, & hedge.

Follow me on twitter @firehorsecaper

Regards,

Caleb Gibbons, CFA, FRM

Comments »