Zoonotic pandemics were not on the list of tail-risks for investors coming into 2020. In hindsight, the timing of Chinese New Year, the world’s largest annual migration (US Thanksgiving x26, 1.3bln Chinese travel for CNY vs. 50mm Americans for Thanksgiving), could not have been worse. Closing borders, once a pandemic has started, has more limited utility.

In mid-February the global equity market was blissfully ignorant of the potential negative effects of the public health emergency, spawned by the infectious disease COVID-19, caused by the SARS-CoV-2 virus.

The Dr. Tedros led World Health Organization (WHO) has not made the global “pandemic” call yet, but this certainly could be the week. The range on unreported cases, due to the lack of testing outside of S. Korea (165k tested, 18k per day pace) is 10x (Johns Hopkins) to 38x (Lancet).

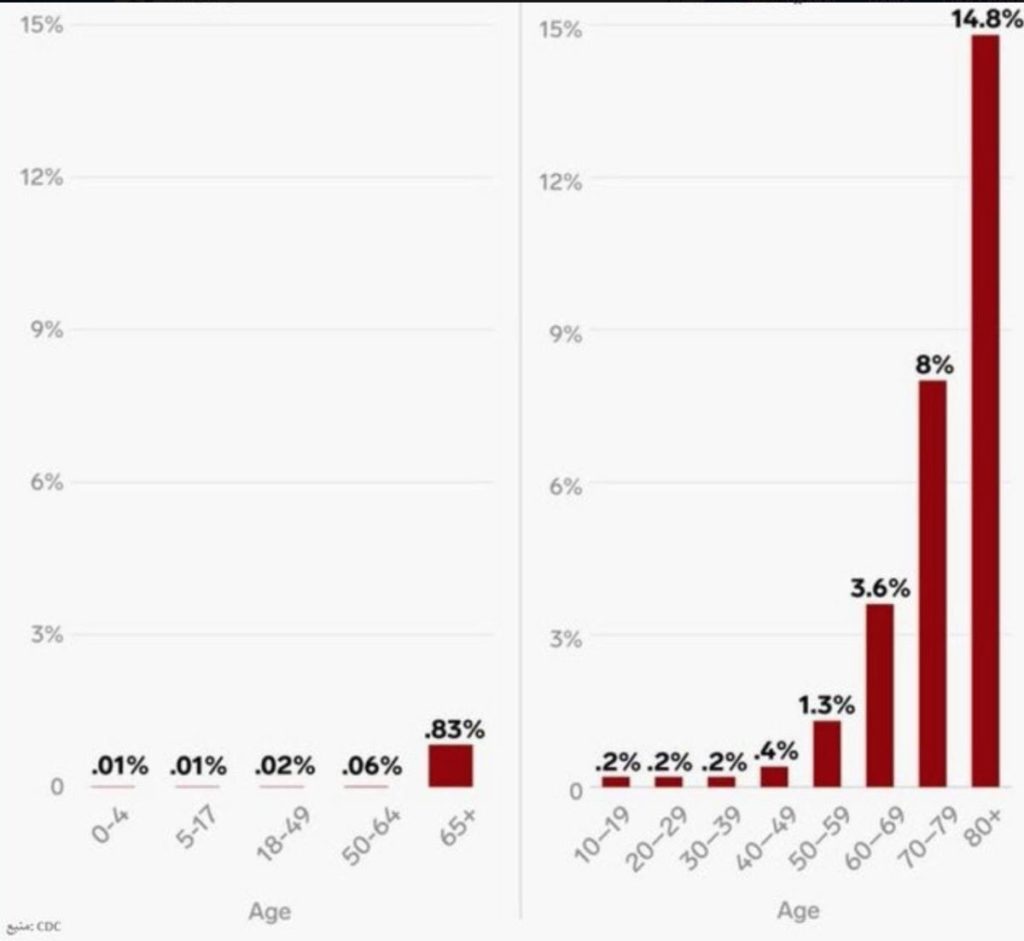

COVID-19 cases in China have crested, thankfully. Outside of China the cases have doubled >3 times in 12 days. Japan cases stand at 461 (>1,000 incl. Diamond Princess), USA is at 439, S. Korea 7134, Italy 5883 and Iran at 5823. Global cases stand at 106,200 with 3,600 dead. The epidemiological assumptions of the COVID-19 outbreak are, let’s just say, fluid. The case fatality rate (CFR) quoted most recently by the WHO is 3.4%, the range is a wide 0.68%-3.4% with S. Korea yielding the lowest CFR’s globally. Unreported cases are assumed to be less serious cases, hence it stands to reason that mortality rates will be lower for the broader group of infected sapiens (a terribly wide 7-34x more deadly than the flu, hopefully closer to 7). Spread rate, aka “r nought” est. 1.1-2.6 = 62% of contacts (approx. 2x virulent as flu). Morbidity, 20% will undoubtedly put a strain on global healthcare capacity. Many governments have been reluctant to invest sufficiently in their healthcare systems. Public health systems in less developed countries is of great concern. The cavalry is coming. The IMF has pledged $50bln in aid to assist countries dealing with COVID-19. The WHO has allocated $12bln ($8 new, $4bln re-allocated) and the USA just got approval for $8.3bln, just signed by DJT (not to mention an emergency intra-meeting 50bp rate cut by the Fed, other mopes falling in line on the follow with their short-end monetary spigots primed).

Trump signing $8.3bln COVID-19 spending bill

The potential COVID-19 effect on planet Earth is still being surmised. Listen to those with both skin in the game and involvement in the market (Andrew Brenner “The UST 30 year rate could break 1% by U.S. Sunday night) vs. the talking heads (Rick Santelli of CNBC; “Give COVID-19 to everyone, so we can get past this.”). The IMF released their estimates for China’s forward GDP estimates -0.4% to +5.6% for 2020 (not a chance, more cow-bell), and -0.1 for global GDP. More plausible estimates see the global impact to GDP at -$2.5 tln outright, just shy of 3% of global GDP, which would certainly trigger a global recession of unknown tenor. Price effects; The effect will overall likely be deflationary due to the shock to global consumption demand. There will be inflationary effects clearly with respect to the shock to the cost of production in many key sectors. The negative shock to global equity risk premia is what we have seen thus far (>$5tln), a long overdue re-tracement of multi-year multiple expansion driven by buybacks financed by a +100bln debt orgy post-GFC. The shock to labor supply will likely show itself quickly, especially in the critical global health-care sector. Child-care is another evident global bottleneck in places like Japan where 13 million public school kids (joined by a couple million more from private school and universities) are homebound (aka self-quarantine, for a month) due to the closing of public school at the behest of PM Abe last week. Even the beleaguered cruise line industry has felt the effects, feeling the need to employ staff from the Yokohama docked Diamond Princess on the sister vessel, the Grand Princess now anchored off the California coast near San Fran (to be confirmed, but Pence, “Mr. COVID-19” has suggested this is factual/likely). The Port of Oakland has agreed to accept the vessel, it has been reported. Best wishes to all aboard for speedy resolution with next years’ resolution to never board another cruise. Folly of the highest degree.

Financial market reaction:

Re-enforcing the repeated shortcomings of risk metrics like VaR (Value at Risk), the move we have seen in this “stress episode”, a 13% equity risk asset sell-off in 7 trading days is in many ways without precedent. As a “tail event” it would happen 0.1% of the time, running data back to 1896. Setting a confidence interval for VaR at 99% would not capture this event. 99.9% would just touch it. As Nassim Taleb would agree, it is not so much the breach as the magnitude “given breach” VaR falls down on.

The list of stress events of this magnitude is short. I have weathered them all, hence the grey hair!:

1.) Asian Contagion (1997). SE Asia currency crisis, laid at Thailand’s feet, but the MIST currencies, i.e. Malaysia, Indonesia, Singapore and Thailand all played a role.

2.) WTC attack (2001). Across the street at One Liberty Plaza for 9-11. 800 windows out, but no fatalities gracefully.

3.) The Big One (2008-2009). GFC (Global Financial Crisis). Epicenter in NYC, $5bln of credit (long). Indoor fireworks.

4.) Flash Crash (2010). Quite a day. Bonds had a good day, as you might imagine (re-allocation from equities, fear trade).

5.) Eurozone Crisis (2011). Sovereign debt crisis. Forced to sell 2 year Ireland paper at a yield of 14.5% (it eventually traded sub 1% before maturity).

6.) VIX event (2018). Structured, levered VIX ETF to zero. Caveat Emptor. Read the prospectus.

Last week 10 year US Treasury yields stood at 0.96% (0.70% intra-day Friday, 1st time since 1871). Long bonds (30 year UST) yield stands at sub 1.50%. Tough environment for pension fund managers, insurance companies and individuals looking to “build” a retirement income, that is for certain. The tumble in US treasury yields, by 1/2 in the case of the 10 year in less than 10 days (1.6% to sub 0.80%), has greatly increased the fragility of the rates complex (25%+ increase in duration translating to great price risk going forward).

Spread assets, like corporate bonds have experienced a massive sell-off. The US$5.3bn withdrawals from IG corp bonds this week was the heaviest on record. With the number of oil & gas credits in the HY (high-yield) market, this is the area likely to crack first with 7.9bln in outflows. CDX (spec grade credit) moved out (widened, i.e. more risky) by 42 basis points on Friday to +451 (365 recent LT avg.).

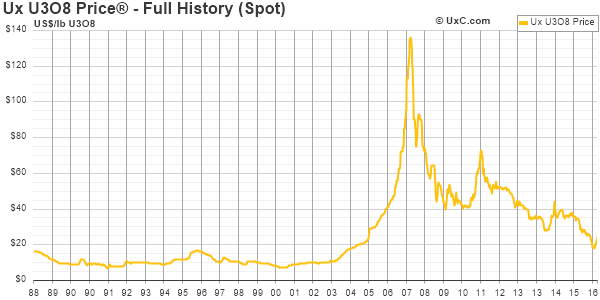

If you thought that central banks looked flat-footed in recent days, cast your eyes on OPEC. The break down in R-OPEC talks last week precipitated a 10% swoon in global oil prices, on the day (Friday). The demand destruction in the petrochemical complex is real, China alone will likely account for a 2-3 MMBRD (million barrel per day) demand shortfall versus prior run rate, and there is another 2 MMBPD in lower demand from elsewhere globally. Saudi Arabia plans to boost production is an all-out price war versus the prior expectation of a 1 MMBPD cut back in production. These are heady numbers and might bring back memories of oil with a 2 handle per barrel, as in sub $30 (well above the cost basis for most global conventional oil production). Peak Saudi production is 12 MMBPD, as a point of reference. As Stephen Innes puts it, “There Will Be Blood”. China’s “force majeure” declaration on LNG deliveries is wreaking havoc in the natural gas market with prices in the US now negative through the end of summer (-5 cents per mmbtu). Warren Buffet has reportedly pulled his funding commitment for the $9bln LNG project in Saguenay, Quebec, due to “challenges” in Canada. This, from a man who has been seen running into burning buildings, most recently with an incremental United Airlines stock purchase. Ill timed, rear view mirror, as airlines will have a $113bln revenue shortfall (projected) vs. 2019.

The only things up on the year include;

i.)VIX, largely to be observed, related tradeable instruments can be widow-makers (see VIX event above), if involved, with stops of course, trading sardines, not inventory sardines for certain. The vix stubbornly holding > 30 telegraphs 2-3% daily swings until further notice. Typical size reduction, stop widening strategies will be employed for certain. A Gatlin gun of global liquidity has been assembled, most yet to be deployed.

ii.) 30 year UST, iii.) 10 year UST, iv.) 5 year UST, v.) 2 year UST, vi.) Gold, and vii.) Palladium (20% +).

Analytics / like minds / support:

Within ibankcoin’s “Exodus” (multi-year subscriber, non-compensated post) platform there is a constantly transforming list of existing and emerging CODID-19 equity plays and the Pelican room spends a goodly portion of daily discourse on the topic of coronavirus. Few rooms are positive month-over-month through the lunacy that COVID-19 has triggered. A sampling of names currently on what I’ll call the “spec” basket include; $SPEX (Spherix, up 130% Friday past), $TOCA (Tacagen +57%), $INO (Inovia +44%), $NNVC (NanoViricides +39%) scalped short as what I view as a “suspect” name/play, akin to cannon fodder $XAIR, Beyond Air, -20% Fri.), $CBLI (Cleveland Biolabs, +25%), $ALT (Altimmune +13%), $OPK (OPKO Health, +13%), $TRIB (Trinity, +9%), $AEMD (Aethlon, +8%), $NOVN (Novan, +10%), $BCRX (BioCryst, +7%), $VXRT (Vaxart, +7%), $CTSO (Cytosorbents, +8%), $COCP (Cocrystal, +4%), $VIR (Vir, +4%), $HAPP (Happiness Biotech, +6%), $CERS (Cerus, +4%), $VCNX (Vaccinex, flat), $APT (Alpha Pro, -13%), $LAKE (Lakeland Industries, -2% Fri.)., $CODX (CoDiagnostics, -10%), $NVAX (Novavax, -3%), and $ONEM (1Life Healthcare, -1%). All of these % moves are 1-day moves. The inter-web can provide historical and ytd numbers, but needless to say there are endless contenders afoot, many well over their skis. The real contenders will show themselves soon enough. Most will not be successful in terms of their COVID-19 aspirations, but those with a broader platform will avoid being taken out by failure with respect to CODID-19 efficacy. Best to diversify a bit as well, hygiene, masks, test kits, vaccines, anti-viral, etc. These are all common sense considerations. With the outsized support both provided and promised for global risk markets, skew will favor the assumption of risk versus the shedding of it going forward. It is the timing of when best to ford the river that remains very much in question.

Large-caps:

$MRNA. Moderna sports a $11bln mkt cap. A novel (pardon the pun) approach. My only other current long after taking profit on $GILD calls Friday past. Moderna intends to develop a messenger RNA (mRNA) vaccine for the virus. The company will use the CEPI* funding to manufacture the vaccine. Promising, as others are, especially given the high tech nature of their approach (akin to $SGMO, Sangamo one of my long term plays).

*Coalition for Epidemic Preparedness Innovation (CEPI) was est. 2017 with an initial grant of $460 million by Germany, Japan, Norway and the Bill & Melinda Gates Foundation. While I was not negative, I think Bill Gates is “moving on up” as an aside.

$AZN. AstraZenica. $124bln.

Clinical trials:

The big boys (maga big cap) are clearly safer investment vehicles and is where I have focussed my recent due diligence efforts.

1.) $GILD. Gilead’s Remdesivir is currently conducting 2 trials (one mild/moderate, one for severe), 297 patients total. First results April. A failed ebola drug that never got FDA approval. Some promise in treatment of SARS & MERS (good anti-viral activity). Worked on 1 patient in the USA, sample size as small as possible, i.e. N=1. $GILD stock has gone up 17% inside of a month, much higher than pv of an approved drug, but with a $100bln mkt cap and a suite of other drugs, seen as a lower risk play.

Varied success, but just closed out a profitable call option trade on $GILD (Gilead +5% Friday to $80) June $70 strike called sold at $13.00 (basis $3 mid Feb.). Yield 3.7% p/e 19, even after recent run-up. Will re-establish long outright or via calls on a retrace to mid 70’s on underlying.

2.) $ABBV. AbbVie Inc. is a $130bln diversified global pharmaceutical company. ABBV’s HIV drug Ritonavir (Kalentra marketing name) has just completed a 199 person trial and results are expected soon. Another untested drug in their arsenal is Erbevo. HT James Bourne on several items in this blog post.

Other:

3.) $RHHBY. Roche is a behemoth, $287bln mkt cap . Oseltamivir (Tamiflu, marketing name) is a tried and true flu drug and esp. if the L and S strains of COVID-19 stay with us on a seasonal on-going annual basis, we will require the full menu of treatments at our avail. At peak valuation (prior) during the SARS breakout a lifetime supply of Tamiflu cost $100k. Rights to Tamiflu now owned by Sanofi, $SNY ($120bln mkt cap).

4.) $JNJ, Johnson & Johnson. Near all time highs, strength to strength, $374bln mkt cap. Steady as she goes.

5.) IBB, iShares Nasdaq Biotechnology ETF. $7bln. Less idiosyncratic risk, buy them all. One way to go. Screen holdings well.

The knife catchers stand at the ready, but never bring a knife to a gun fight. Patience is warranted. Catching the meat of the move is much more important than catching the bottom tick. Central banks must of course show a “chin up” demeanor, but they of course know their runway configuration has issues. Too much accommodation was held for too long a period and they find themselves without stores of ammunition for the battles ahead. Calls for an expansion of Fed mandate, first whispered on Friday last, sparked the valiant final hour recovery. Weekend bookies see much of that final Friday gasp getting retraced before futures open Sunday evening. Rest up, the days ahead will test us all. There will be 5% up days, there will be 5% down days.

Regards,

Professor Gibbons, CFA, FRM

Follow me @firehorsecaper

PS: Some numbers could be stale due to source and/or passage of time. In most cases meant to signal magnitude, not false precision.

https://twitter.com/firehorsecaper/status/1228444727676030977?s=20

Jan. 27, 2020: (Discord chat history). Do we need a #coronovirus tab for both longs ($ZNO $NNVC $APT $LAKE $NVAC $BCRX $ATHX $AZN, $MRNA $LLIT, etc. ) as well as shorts? (airlines $TCOM).?

Comments »