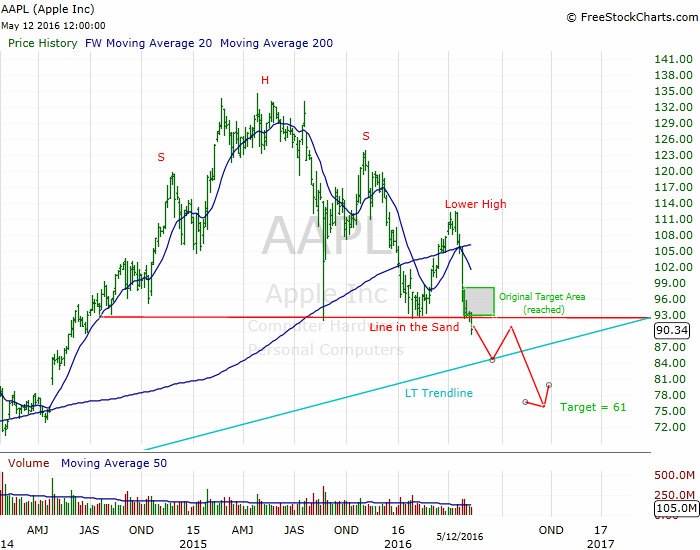

Apple Inc. is once again trading at it’s proverbial line in the sand, refer to my previous article here: $AAPL Line in the Sand. The large top forming on this company is intriguing from a short perspective.

If the Brexit fears produce a global slowdown, $AAPL could be a primary instrument in which to get short. It’s one of the most liquid trading securities, options included, and it provides exposure to a tech earnings downturn. Here’s my updated long term chart:

My initial pattern did not play out as buyers came in and provided a stick save at the last moment. However, the way $AAPL is trading lately is indicative of sellers supplying the market with shares. Even today, during this nice bounce in equities, $AAPL is a serious under performer.

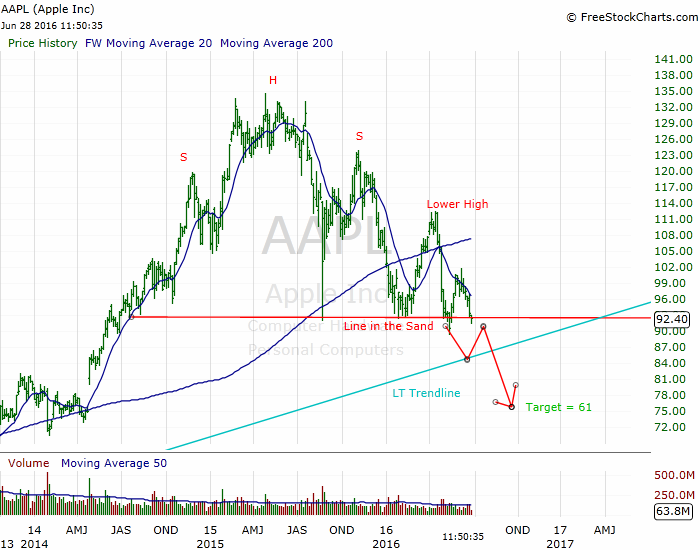

Here’s a short term chart:

As you can see I’ve been playing it pretty well; but the big move will come once it breaks down through the Line in the Sand at around 92.50ish.

Bottom Line: if you’re looking for short exposure, AAPL is an ideal candidate.

Follow me on Twitter at @dyer440.

Comments »