The primary driver in today’s markets are the various Central Banks and their desperate attempts to stimulate inflation of any kind within their economies. I believe we can view the markets through the lens of Central Bank policy and the associated market movements, and gain some insight into potential outcomes. Hopefully this will provide some actionable trading and/or investing setups.

Issue #1: The elephant in the room in the Federal Reserve; they are in a tightening posture and I believe markets are underestimating the number (and possible dates) of future rate hikes. On the other hand you have the rest of the world’s Central Banks, seemingly dead-set on doing whatever it takes to stimulate their economies. This is despite the fact that each action becomes less and less effective.

Issue #2: We have the commodity markets, most of which are showing the characteristics of having potentially bottomed. For example, crude oil is up something like 45% since it’s lows earlier this year. It could simply be a short covering rally, but every bottom starts out that way. I’ve said it before (here), in order for the commodity complex to demonstrate a sustained rally, one that perhaps leads to the next up-cycle, the U.S. Dollar needs to pull back against the rest of the worlds currencies.

Given that the above two issues are definitely related, what should we expect moving forward? Let’s take a look at the currency trigger levels from my previous post:

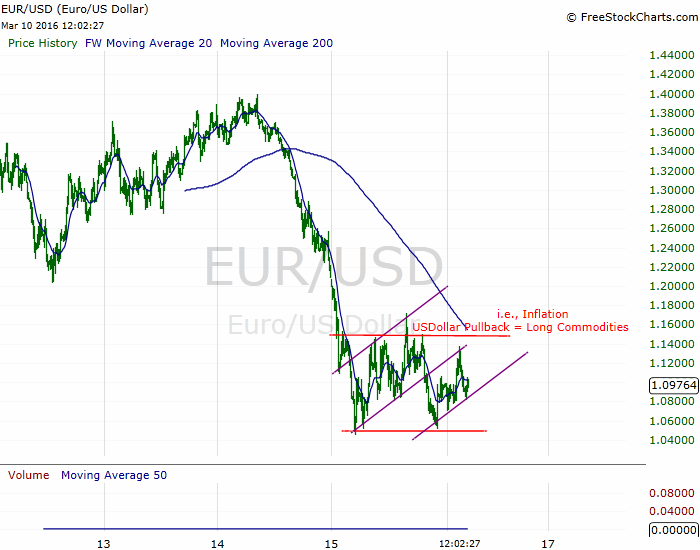

Taken by itself, the USD/JPY cross trigger level of 115.50 was a good signal to buy commodities for a bounce; oil bottomed 2 days later. However, I recommended waiting for the EUR/USD cross to confirm the move, and I suggested using a trigger level of 1.148. See below:

To date, it’s not even close. My recommendation is therefore NOT to play crude oil or any of the other growth (inflation) driven commodity on the long side, at least until both trigger levels are breached.

If the European Central Bank’s bazooka somehow disappoints, this situation could turn on a dime. However, I think it’s more likely that Central Banks will continue with their current postures: the Fed tightening while everyone else eases. Furthermore, I believe the U.S. economy is the proverbial last man standing, meaning we are stronger relative to the rest of world.

This is important, it implies that all of the Central Bank posturing is perhaps “correct” on a global scale (i.e. relative to everyone else). For example, if the U.S. economy is stronger than the rest of the world, perhaps the Fed should be in a tightening posture. Likewise, if the Japanese (or European) economy is struggling, they probably should be easing.

In summary, I expect the U.S. Dollar to outperform other currencies. Why? Because, if the Fed is raising rates and the U.S. economy is outperforming (on a relative basis), the U.S. Dollar will outperform. Growth commodities should therefore either pull back from current levels or languish into a trading range. Either way, they do not represent a good risk/reward long at this point in time.

So Here’s the Trade:

Short the banks – the risk is the Fed will guide to further tightening (or even raise rates in March).

Short the EUR/USD – divergent policies will continue and the performance of each economy will also continue to diverge (U.S. > Eurozone).

Short any of the insolvent Oil & Gas companies that are up over 30% in the past two weeks – research their bonds, find the ones that are due soon – these companies are at risk of default.

Follow me on Twitter @dyer440

If you enjoy the content at iBankCoin, please follow us on Twitter

Solid post as usual man. One thing I wanted to ask though is why would you short the banks if you’re expecting future tightening or possibly a raise? My assumption is that you believe the interest rate increase wouldn’t be enough to overtake the downside moves in commodities, which would have a net negative impact on the banks.

You always ask the hard questions, and this time I think you’ve caught a flaw in my logic: Fed raising rates would be supportive to banks. Thanks.

Short the euro? Suicide. The ECB, despite appearances to the contrary, just threw more fuel on the EUR rally and there will be much grinding of teeth in euroland over their apparent inability to “control” the euro trade value.

Zoom out pb… Euro/USD is in a long term down trend (due to what I’ve described in the article). These wild swings are simply part of a consolidating structure within a large move.

And I think it continues:

US economy > Euroland economy

Fed Hawkish > ECB Dovish

= US Dollar up, Euro down…

Always a pleasure seeing your work.

…. i’m not on my knee’s just showing respect where deserved.

Great post man.

Thanks probucks

FWIW, I perfer Aussie, Kiwi to the Yen for the health of commodities.

I guess it depends on how you define “long term”. Yes, the EUR will eventually hit USD parity or lower. But if you put that trade on NOW, you’ll be carried out on a stretcher long before it becomes money good.