Let’s be honest about a couple things right from the start:

- Coal is a dirty word in the investment community, and frankly it’s a dirty fuel.

- Environmentalists are winning the war against coal, whether you “believe” in global warming or not, rational people would prefer to not live in cities that look like this:

The fact is however, those reasons are not why the coal industry has had the shit kicked out of it. Coal has been bludgeoned by another so-called environmental evil, namely hydraulic fracturing – which has led to epically low natural gas prices. Without the low natural gas prices a significantly higher number of utilities operating coal-fired power plants would have simply upgraded their emissions scrubbing to meet the new EPA mercury standards. Instead, the cost-benefit analysis suggested that switching fuels from coal to natural gas was (and still is) a better option. This outcome has led to lower coal demand, lower coal prices, and lower earnings for coal producers.

In addition to fracking, the ineptitude of management and the lack of foresight led to some poorly timed decisions by a few major coal producers in the US – specifically, the purchase of metallurgical coal properties at the top of the Chinese led, so-called commodity super cycle. I’m referring to Alpha’s acquisition of Massey, and Arch’s acquisition of International Coal Group, which both occurred in June 2011. Alpha Natural Resources (ACI) has already filed for bankruptcy, and I’d currently give Arch Coal only a 20% chance of avoiding the same fate (their bond prices imply worse odds than that).

So from now on let’s put aside the environmental aspect from the coal theme, all it does is create a smog of negativity which prevents us from useful analysis of the sector. The bottom line is that the companies that survive this downturn will see huge returns simply due to the extreme negative valuations currently being applied. Eventually, the bankruptcies will result in closures of enough marginal and/or risky coal mines that the production will reach demand equilibrium. The result will be more efficient operations, less exposure to environmental liabilities, and (eventually) improved balance sheets.

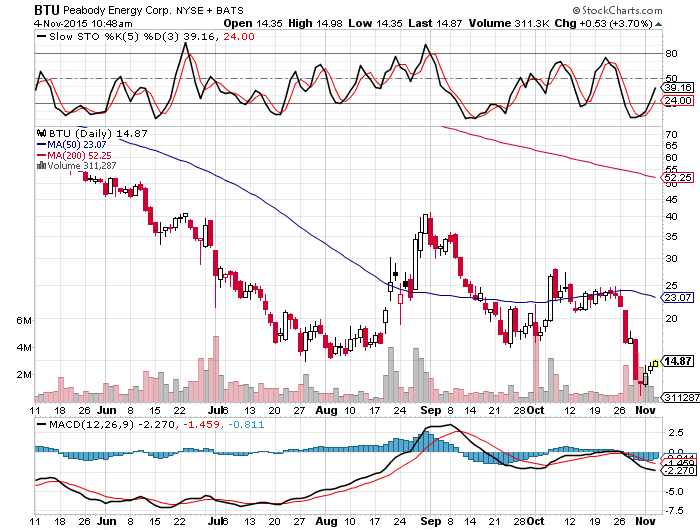

For example, Peabody Energy (BTU) has a balance sheet that appears highly levered however, 85% of FY16 production is locked-in at relatively good long term price contracts and they have access to a committed credit facility that doesn’t expire until August 2018. Comparing Peabody’s operations to their bankrupt (or near-bankrupt) cohort leads me to believe they have superior assets due to less exposure to the Appalachian and metallurgical coal markets, as well as a globally diverse presence. If you believe global coal use is not going to die, then Peabody is arguably the best of breed pure play on coal to use as an investment vehicle.

Here’s the Trade:

It’s all about Arch Coal earnings and probable bankruptcy. Arch is the number two US coal producer behind Peabody and I believe the Arch bankruptcy will mark a bottom in the coal sector. Arch is set to release earnings the morning of Monday, November 9. The release and subsequent conference call will likely yield a deep drop in Arch share prices. The key here is the reaction to Peabody shares; if Peabody shares also drop and hold their recent lows of $11.75 I will be deploying approximately half a position long (I’ll probably do it through options). Use the $11.75 level as a stop loss and add the second half on a closing basis above $16.35 (I always add to strength as opposed to averaging down). Alternatively, if Peabody’s stock is up on the Arch news I will deploy a full position immediately and use a 5% stop loss channel, calculated daily, until a close above $16.35 (then use that level). I’ll assume you can manage your own profits from there as the sector rebounds.

Keep in mind, this is pure speculation – not value investing. Peabody is down over 90% in the past 52 weeks; this is simply a structured and opportunistic bet on a bounce with the added benefit that it has the potential to be long lasting and provide many multiples of returns on capital. If you prefer a less risky route, simply watch the reaction to Peabody shares whenever it becomes blatantly clear that Arch will file for bankruptcy protection (that could be Nov. 9, or it could be sometime later this year). Then, simply go long whenever you feel comfortable that a bottom is playing out; you may miss the first 25%, but there is much more upside that awaits.

There are a lot of sub-plots which I could add to the bullish coal narrative: George Soros, a potential republican POTUS, natural gas producers running out of money (another possible bottom), macroeconomic headwinds turning into tailwinds, etc. But I would prefer some feedback before I go further down the rabbit hole.

If you enjoy the content at iBankCoin, please follow us on Twitter

welcome

Remember to upload picture for the front page

Thanks. I’ve updated the picture – unless I’m doing it wrong.

dyer – great post. You’ve covered so many things that I’ve been pondering. The Soros purchase is still something that gnaws at me… and his putting any money at all towards ACI.

I truly appreciate the post. Solid first post.

I appreciate that. Regarding Soros, beyond the cynicism of funding environmental groups espousing death to coal, then purchasing shares once they’ve been beaten to a pulp, I think he is losing his ass on the ACI purchase. I think he was caught off guard by the New York state judge blocking the debt-swap deal that was “suppose” to keep them out of bankruptcy.

But Soros is also losing on the BTU purchase – unless he quickly sold his shares once they popped on the news he was in it. Everyone knows there is value in the sector – it’s just all about getting the timing right.

If (when) ACI files, you will have over 25% of coal production in the US under bankruptcy protection!!

Nice piece, BTU is they type of stock that would keep me up at night…what a dog this year.

I’m thinking about starting up a no-kill animal shelter at some point…

Update: ACI cancelled the conference call “in light of the Company’s ongoing discussions with various creditors”.

It doesn’t look like we’ll see any sign of impending bankruptcy today – unless some big bond holders make waves. I’m going to watch closely the reaction to BTU shares. Stay tuned…