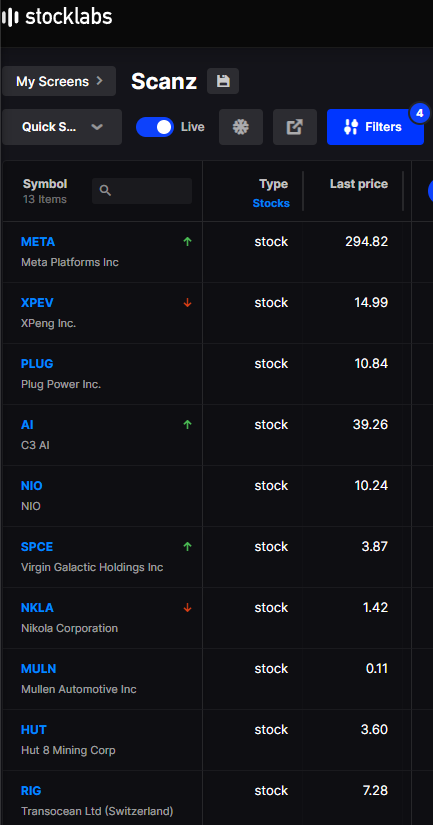

The large caps are on the move this morning thanks to a favorable CPI number. Many of the names we were watching are finally breaking to the upside. META finally gets through $300 and is sprinting, $BABA looks like a slam dunk for the $100 roll trade, NVDA is tearing apart any short seller who bets against it, and $GOOGL looks to be just getting started.

I took some $GOOGL options this morning. Good luck trading all…

__

__