Bringing back the momentum and the charts this Saturday morning as I sip this cold energy drink from my sunroom. I normally sip coffee in my sunroom, but the temperature is over 100 degrees and its now July, I needed something cold.

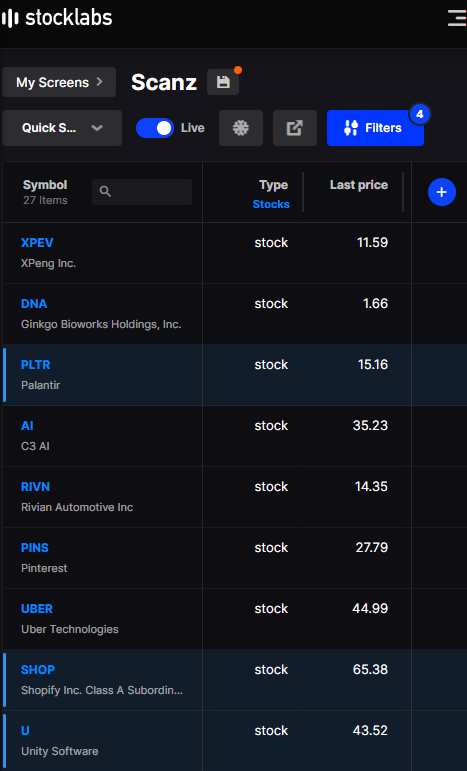

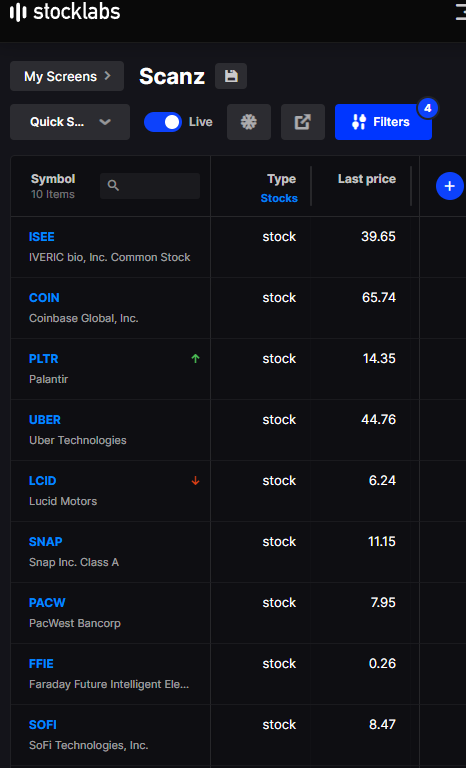

Taking a quick glance at the Momentum Delta scan in Stocklabs, here are a few charts that I will be watching this upcoming week:

CLICK HERE FOR FULL SCAN, courtesy of Stocklabs

Comments »

__

__

__

__

__

__

__

__