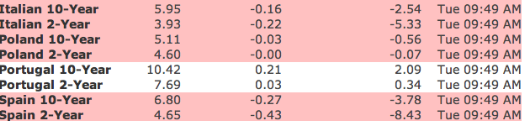

Euro is off by 0.44% and yields are lower, an odd set of circumstances.

Comments »Bankrupt: All City Employees of Scranton, Pa Cut to Minimum Wage

This needs to be resolved,” Scranton firefighter and president of the local firefighters union John Judge told FoxNews.com. “My members are getting a check for $7.25 an hour. These are people that are the head of their households. They have mortgages. They have other living costs. They are now going to have to throw their bills in a hat and randomly pick what gets paid on time.”

Comments »Small Bombs (Hybrid Movers Under $10)

Congrats to @ChessnWine For Becoming a Millionaire!

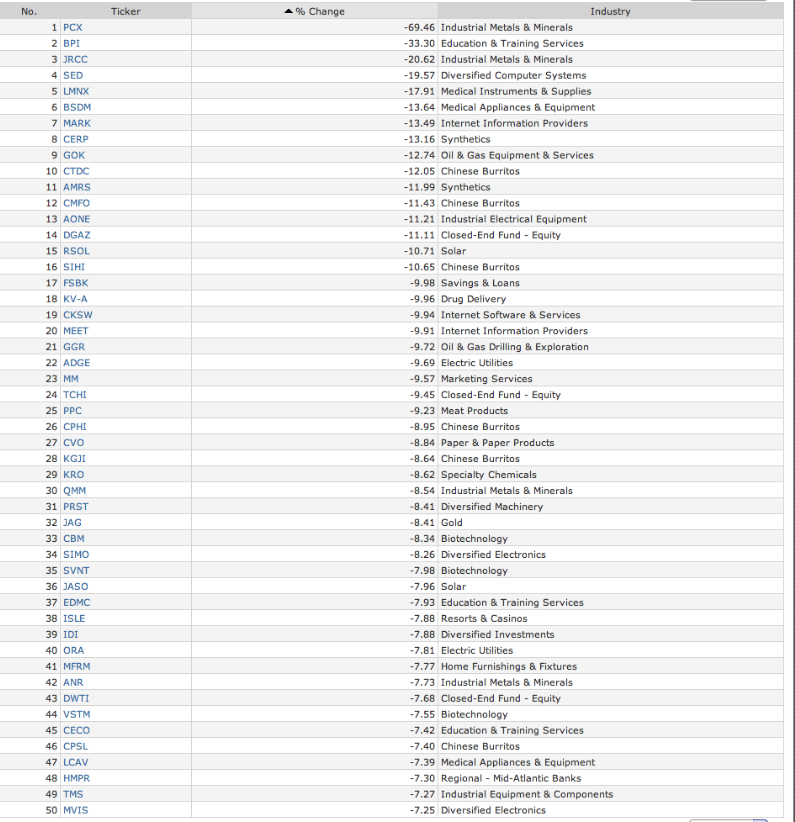

Today’s Biggest Losers

Industry Breadth

Helium as an Investment Opportunity ($APD, $PX)

From one of my favorite writers outside of finance, Zack Parsons:

http://www.somethingawful.com/d/news/helium-investing-pension.php

Comments »Industry Breadth

Nielsen: Digital Music Sales Up 14%

“Nielsen today announced its 2012 mid-year SoundScan numbers for the U.S. and the trends look pretty familiar: digital album sales were up 14% compared to the same time period last year and digital track sales were up 6%. Overall, music sales were up 6%, though overall album sales were down a little bit (-0.6%), as the sales numbers of physical CDs continues to drop. Still, Nielsen says CD album sales still accounted for 61% of all album sales in the last six months. That’s down from 66% last year, but still higher than most of us who live in the digital world would expect.”

Comments »Mysterious Disease Claims 66 Lives of 67 Reported Cases in Cambodia; WHO Investigating

Since April 67 children have contracted a disease and 66 of them have passed. The World Health Organization is currently investigating the matter.

Comments »Today’s Hybrid Movers

CBRC Sees China’s New Banking Rules Curbing Lending

“China plans to retain a cap on loans at 75 percent of deposits and may add further requirements that constrain credit growth under draft rules, a senior official at the banking regulator said.

The liquidity-risk management regulations may be more stringent than the loan-to-deposit ratio set by the nation’s commercial bank laws, the China Banking Regulatory Commission official said, asking not to be named because the discussions aren’t public. The comments refute a report in the Economic Information Daily, which said today that the ratio won’t be included in the new rules and may be scrapped.”

Comments »Asian Stocks, Oil Drop On Signs Europe Slump Is Worsening

Comments »Asian stocks retreated from an eight- week high and crude oil dropped after data indicated a worsening economic slump in Europe. The yen weakened against most major peers as Japansignaled further monetary easing.

The MSCI Asia Pacific Index slid 0.4 percent as of 11:25 a.m. in Tokyo, while futures on theStandard & Poor’s 500 Index declined 0.4 percent. The yen traded weaker than 80 versus the dollar for the first time since June 25. The Philippine peso rose toward a four-year high after a Standard & Poor’s upgrade, while crude oil fell 0.8 percent in New York, where financial markets were closed yesterday for a holiday. Treasuries gained before U.S. jobs reports today and tomorrow.

Gold Climbs As ECB Rate Reduction May Help Fan Inflation

Comments »Gold climbed to near a two-week high on speculation that a decision by the European Central Bank to cut interest rates may help to fan inflation, and after holdings in exchange-traded products expanded to an all-time high.

Immediate-delivery gold gained as much as 0.2 percent to $1,619.13 an ounce and was at $1,619.07 at 10:37 a.m. in Singapore. Holdings in exchange-traded products rose to a record 2,412.42 metric tons on July 3, data tracked by Bloomberg show.

The ECB will probably reduce the benchmark rate 25 basis points to a record low of 0.75 percent today, according to the median forecast in a Bloomberg survey of 62 economists, as policy makers battle the region’s debt crisis. The Bank of England may raise its target for bond purchases today, boosting it by 50 billion pounds ($78 billion), another survey shows.

Fireworks Industry in Biggest Slump Since Vietnam War Era

NEW YORK (Reuters) – As millions of Americans celebrate Independence Day on Wednesday, there are some whose holiday won’t be going off with a bang.

One of America’s top fireworks firms said the industry, still suffering due to the nation’s economic woes, is experiencing its toughest times since the Vietnam War era when the country was divided over such flashy displays of patriotism.

Read the rest here.

Comments »Fourth of July Message from a Leader

Industry Movers (Weekly Change)

Today’s Hybrid Movers

Industry Breadth

Europe, Asia Stocks Gain On Factory Gauges; Euro Weakens

European stocks rose for a second day and Asian equities headed for their longest winning streak since March as manufacturing indicators in Japan and China beat forecasts. The euro fell before factory and jobs data for the currency bloc and oil declined from a one-month high.

The Stoxx Europe 600 (SXXP) Index added 0.2 percent as of 8:01 a.m. in London, while theMSCI Asia Pacific (MXAP) Index gained 0.3 percent in its fourth day of gains. Standard & Poor’s 500 Index futures slipped 0.3 percent. The euro dropped against most of its major peers after gaining 1.8 percent against the dollar on June 29. Oil in New York sank 1.5 percent to $83.72 a barrel after surging the most in three years. Corn rose to the highest since September. The Markit iTraxx indexes tracking credit- default swaps for Asia ex-Japan, Japan and Australia all fell.

Full Article

Comments »